Mortgage Rates Weekly Update [September 11 2017]

Mortgage Rates Update for September 11, 2017

Mortgage Rates Update for September 11, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved to the lows of the year as the bond market rallied in part because of continued low inflation. If you look at the mortgage bond chart below you can see mortgage bonds have been on an upward trend since the middle of July 2017. Mortgage Bonds hit a tough ceiling of resistance on Thursday and were turned lower and Friday closed down from the highs not seen since last November. Low inflation, meager wage growth, inept Congress and under performing GDP remain primary tailwinds for mortgage Bonds and lower rates. With mortgage rates at record lows, we are recommending LOCKING your mortgage rate to start the week to take advantage of these low rates.

In Economic News

Equifax discovered that on July 29th they had been hacked. They were able to obtain consumers’ names, Social Security numbers, birth dates, addresses and in some cases their driver’s license numbers from 143 Million people. Equifax has set up a special website so that you are able to check and see if your personal information was one of the many stolen.

You can go to www.equifaxsecurity2017.com. Once on the website click on Check Potential Impact. If they find that you may have been impacted, they will inform of an enrollment date for their TrustedID Premier. Enrollment is optional.

President Trump and Congressional leaders agreed to increase the Federal Debt Limit as well as extend federal funding until December 15th and provide aid to the states affected by Hurricane Harvey.

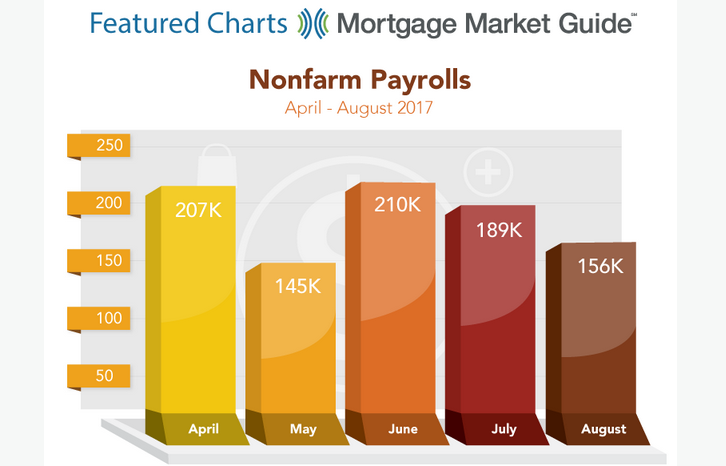

The Bureau of Labor Statistics released the August 2017 Jobs Report on Friday September 1st and it was very disappointing with only 156,000 jobs created well below expectations of 183,000 jobs. The Unemployment Rate ticked up from 4.3% to 4.4% and Wage Growth was very anemic at only 0.1%.

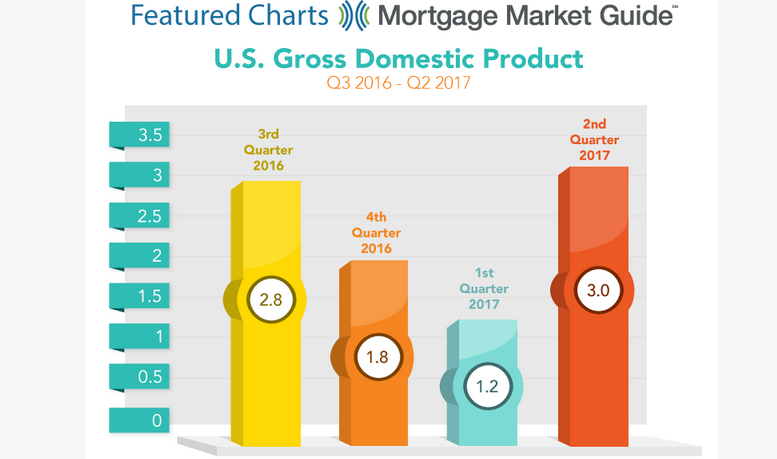

The second reading of Gross Domestic Product (GDP) for second quarter of 2017 came in at 3% which was up from the first reading of only 2.6%. This was the best reading of GDP since first quarter of 2015. This was also the President’s target for GDP at the beginning of the year.

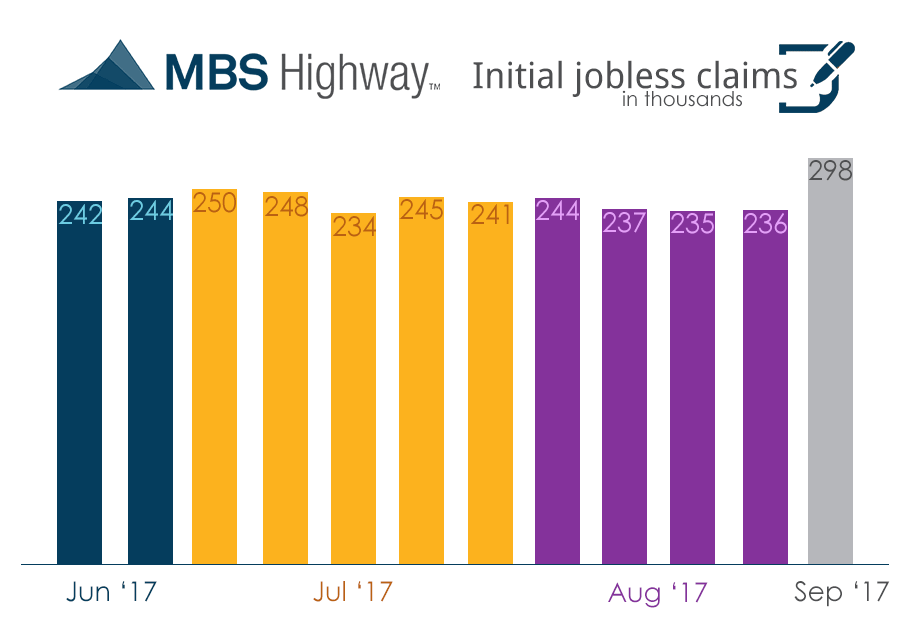

Weekly Initial Jobless Claims jumped 62,000 to 298,000 claims for the week and the previous week’s claim were revised higher from 232,000 to 241,000 claims. This was much worse than expectations but we must take the report with a grain of salt because 52,000 of the claims was from people affected by Hurricane Harvey.

In Housing News

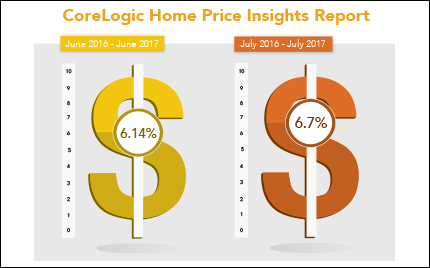

CoreLogic Home Price Index for July 2017 showed home prices were up 6.7% from July 2016. Home Prices were up 0.9% from June 2017 to July 2017. CoreLogic Stated that the continuation of a shortage of inventory of homes for sale will keep the upward price pressure so we should continue to see home prices rise into the end of the year.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday September 23, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday September 16 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage