Mortgage Rates Weekly Update for May 8 2017

Mortgage Rates Weekly Update for May 8, 2017

Mortgage Rates Weekly Update for May 8, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

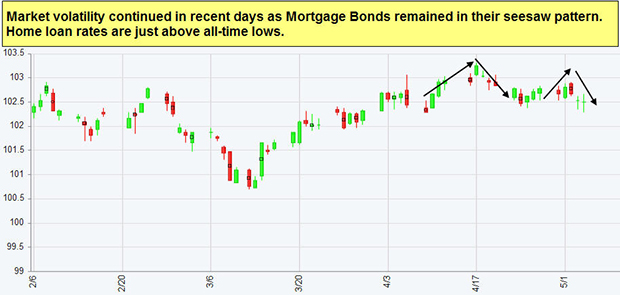

Mortgage Rates ended the week lower as mortgage bonds sold off to end the week. If you look at the mortgage bond chart below you can see mortgage bonds have been trading in a seesaw pattern as bonds bounce off support and are pushed lower by resistance. Mortgage bonds ended this week at the bottom on the trading pattern stopping right at support. We are recommending LOCKING your mortgage rate as mortgage bonds have a tough ceiling of resistance overhead and if break below support have a good way to go lower and move mortgage interest rates higher.

In Economic News

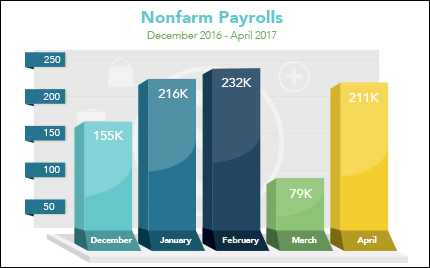

The US Bureau of Labor Statistics released the Jobs Report for April 2017 on Friday which showed 211,000 jobs created which was a big rebound from March’s very low jobs report of only 79,000 jobs created. The Unemployment Rate dropped to 4.4% which is the lowest reading in 10 years. The U-6 Unemployment Rate dropped from 8.9% to 8.6%. The U-6 measures not only unemployed people that are currently looking work but also includes discourage workers who have stopped looking for work and people employed part time who want to work full time.

The Federal Reserve had there meeting this week and announced that they would be leaving the Fed Funds Rate the same and would not be changing the Fed Balance Sheet. This means they will continue to reinvest in mortgage bonds with the money they get from mortgage loans paying off that our currently on the Fed Balance Sheet. This means they will maintain their $20-$40 Billion dollar reinvesting a month in mortgage bonds which will help keep mortgage rates low.

Fed Predictions – We predict the Feds will raise their short term interest rate the Fed Funds Rate at their meeting in June and again at the September meeting which will leave them open to start reducing the balance sheet at December meeting.

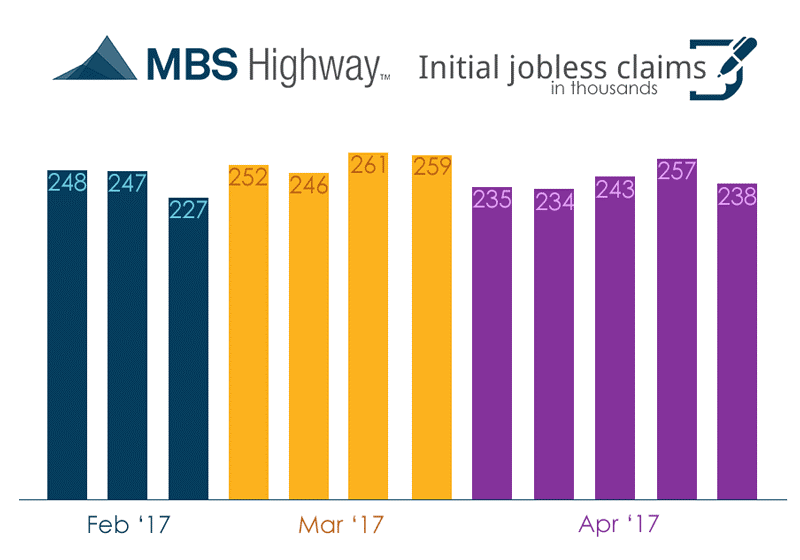

Weekly Initial Jobless Claims were released on Thursday and showed claims dropped 19,000 to 238,000 claims for the week. This is a good report which coupled with the jobs report shows a strong labor market and a rebound from March’s poor Jobs Report.

In Housing News

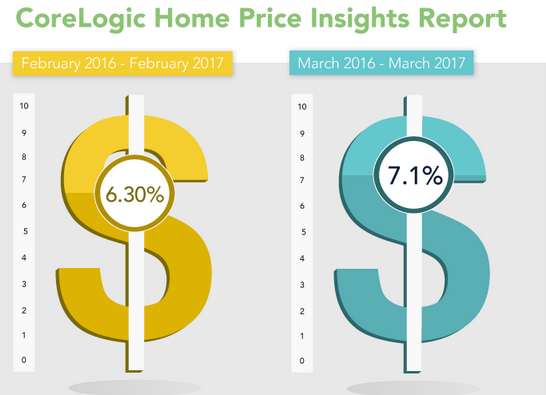

CoreLogic reported that home prices rose 1.6% from February to March 2017 and home prices are up 7.1% from March 2016 to March 2017. This shows that home prices continue to accelerate and CoreLogic is predicting a 4.9% rise in home prices in 2017.

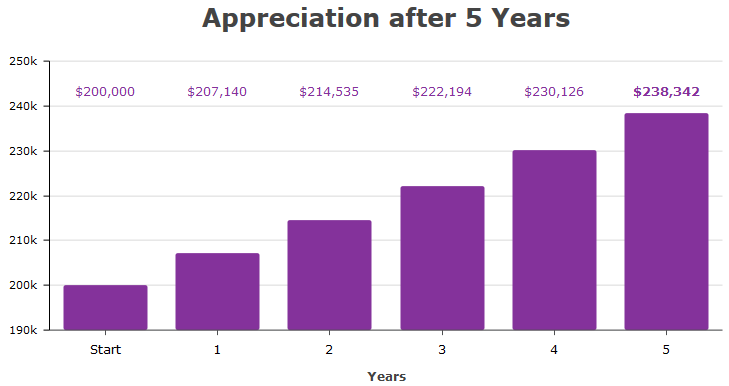

Home Price Appreciation Example – Wilmington, Delaware

If you were to purchase a home today for $200,000 in Wilmington, Delaware and we projected the home value of over the next five years using the historical average for the are of 3.57%, the home would be worth $238,342. The is $38,342 in home price appreciation. If you put 5% ($10,000) down and your closing costs you paid are $9,000, the return on your investment (ROI) would be 293%!

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday May 13, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate