Mortgage Rates Weekly Update [May 7 2018]

Mortgage Rates Weekly Update for May 7, 2018

Mortgage Rates Update for May 7, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

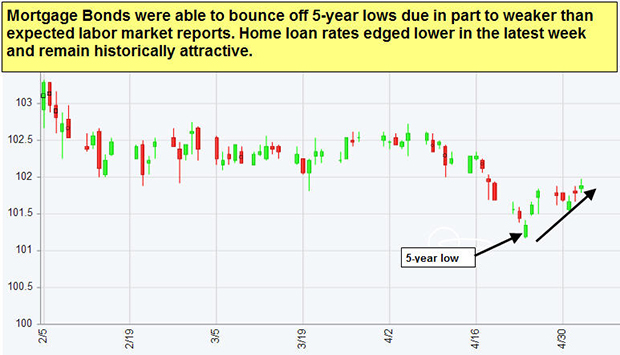

Mortgage Rates were able to maintain the gains seen the previous week as mortgage bonds were able to rally off support and move higher. If you look at the mortgage bond chart below you can see mortgage bonds are now trading in a short term upward trend channel which moves mortgage interest rates lower. The mortgage bonds were stopped on Friday at the 25 moving average and turned lower. There is still room to the downside if mortgage bonds lose steam and will not move higher from here unless can break above the 25 day moving average. We are recommending carefully FLOATING your mortgage rate to see if mortgage bonds can make a run at breaking through the 25 day moving average which would move mortgage interest rates lower but if bonds tart to sell off then we would quickly switch to a locking at stance.

In Economic News

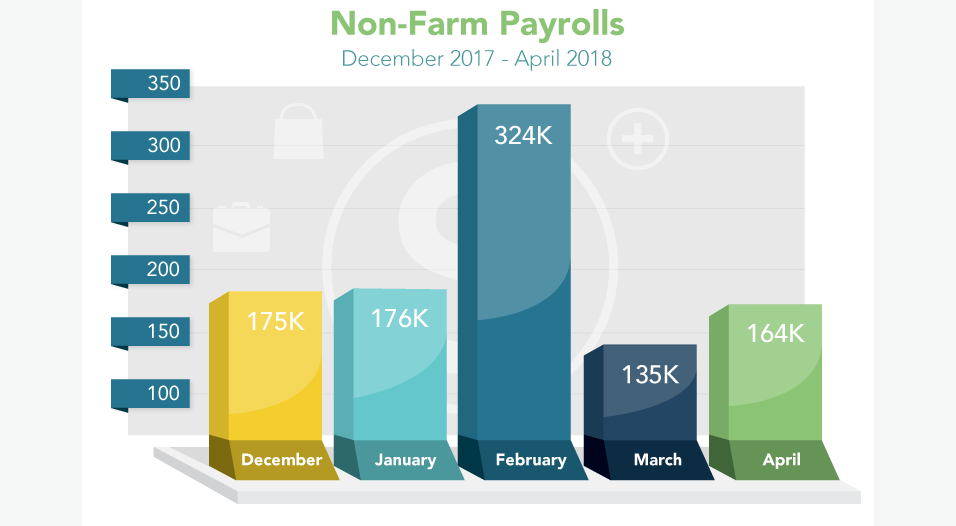

The April 2018 Jobs Report was released on Friday and showed only 164,000 jobs were created which was a disappointment and lower than expectations of about 190,000 jobs to be created. The Unemployment Rate dropped from 4.1% to 3.9% but it dropped because 236,000 people dropped out of the labor force and not because more people went back to work. This is the lowest rate of unemployment in almost 17.5 years. The all in U6 Unemployment Rate, which includes total unemployed, plus all person marginally attached to the labor force, plus total employed part time for economic reasons, dropped from 8.0% to 7.8% which is the lowest it has been in 16.5 years. Wage Growth fell to 2.6 percent on an annual basis, down from the 2018 high of 2.9 percent recorded in January 2018. Month over Month hourly earnings rose 0.1 percent versus the 0.2 percent expected so there was not much wage growth inflation which is good news for mortgage bonds.

When will the next Recession be in the United States?

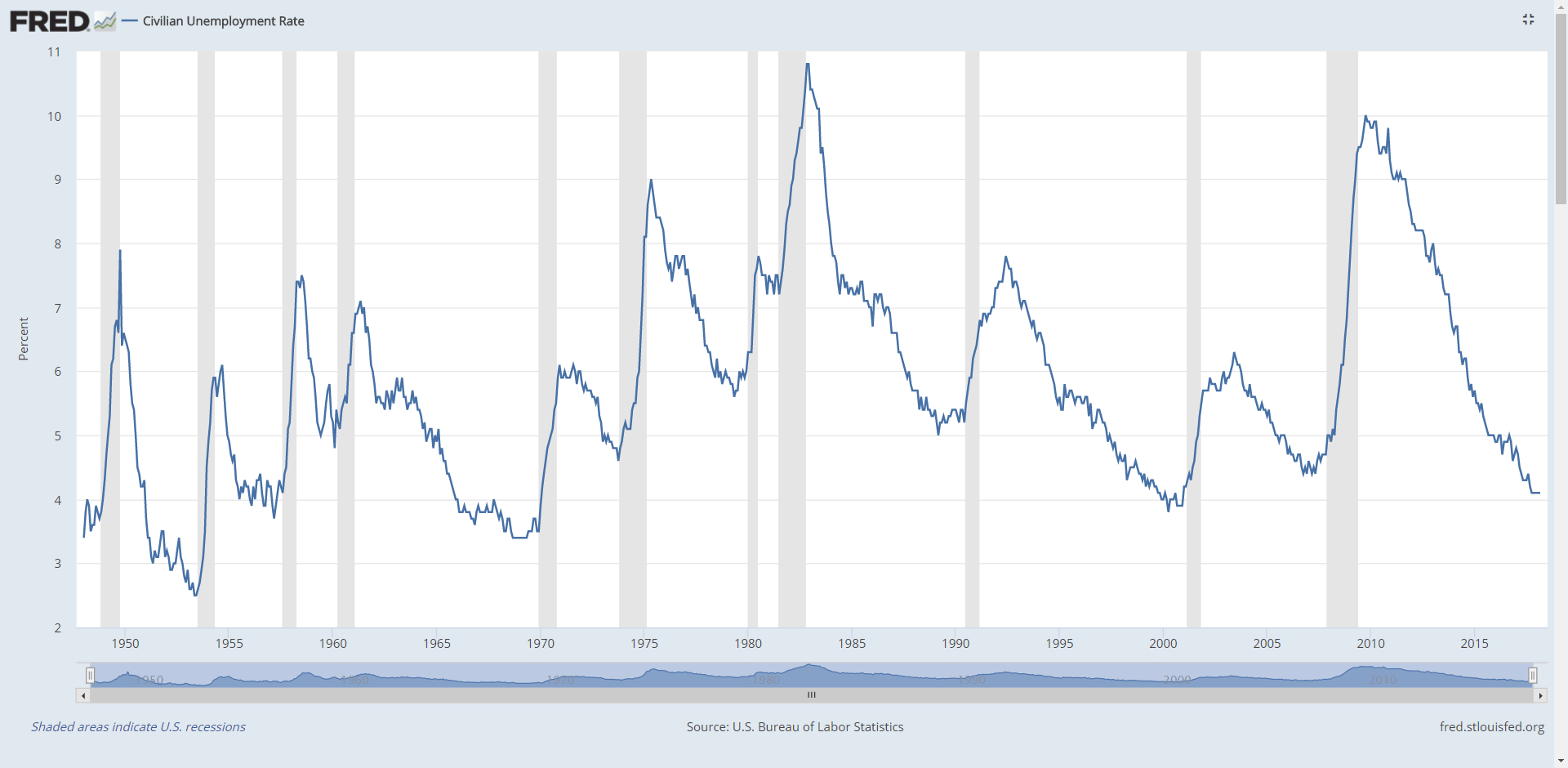

An interesting indicator of a coming recession is looking at how the unemployment rate correlates with recessions. If you look at the chart below you can see the trough or low of the unemployment rate, not the highest unemployment rate, that there is a recession. Looking at where the US economy is now at the right hand of the chart, we can predict that there should be a recession in the near term, possibly in the next two years so 2019 or 2020.

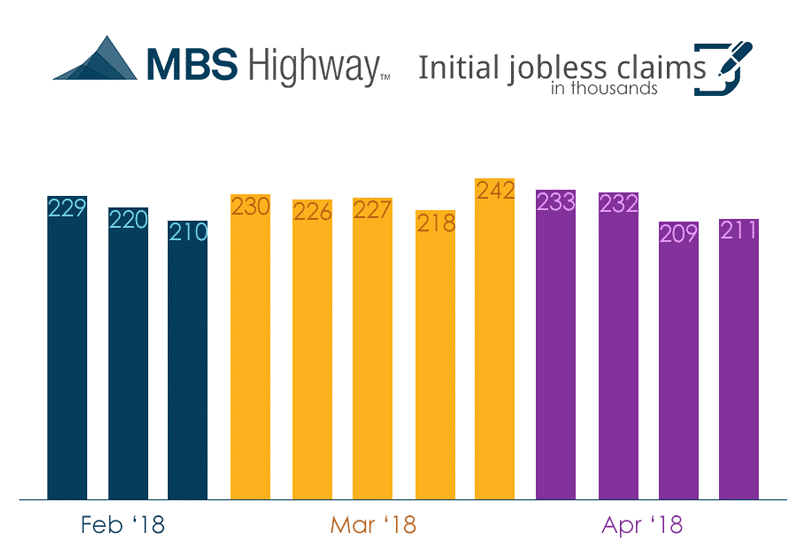

Weekly Initial Jobless Claims showed 211,000 claims filed for the week which was up slightly by 2,000 claims from the 69 year low. This was also 13,000 lower claims than expected. Initial Jobless Claims measures the number of individual filings for unemployment benefits for the first time and is one measure of the health of the US labor market.

In Housing News

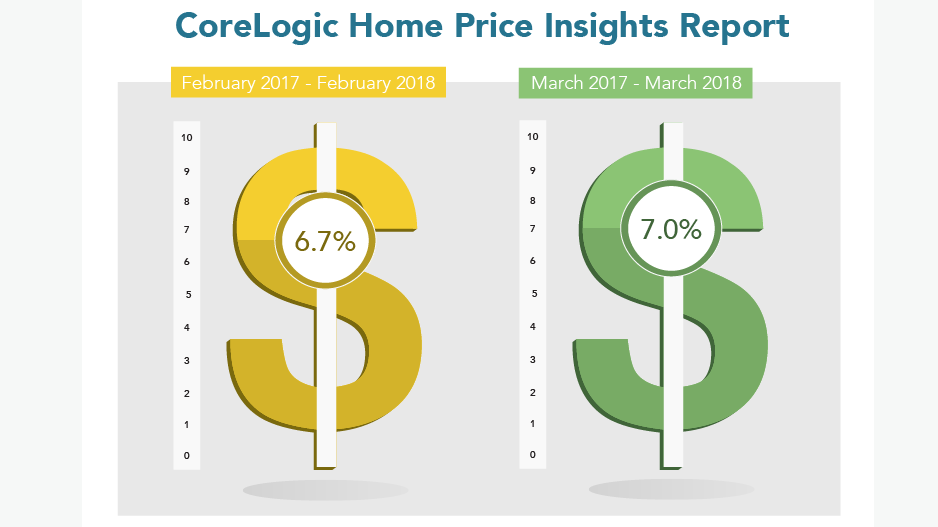

CoreLogic Home Price Index for March 2018 rose 7.0% year over year from March 2017 and were up 1.4 percent from February 2018 to March 2018. The high demand for homes and the limited supply of homes for sale and new home construction running below historically normal levels pushed home prices higher. CoreLogic forecasts a 5.2 percent rise in home prices from March 2018 to March 2019.

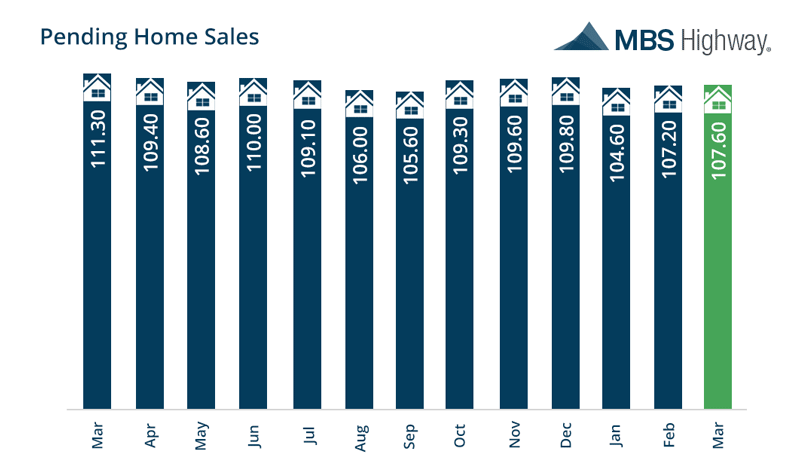

Pending Home Sales for March 2018 were up 0.4% from February 2018 but were down 3% year over year from March 2017. Tight inventory of homes for sale is reducing the number of home sales, but demand from buyers remains strong. Chief Economist for the National Association of Realtors said that “Healthy economic conditions are creating considerable demand for purchasing a home, but not all buyers are able to sign contracts because of the lack of choices in inventory.” He went on to say, “Steady price growth and the swift pace listings are coming off the market are proof that more supply is needed to fully satisfy demand.”

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday May 23, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday May 19, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates