Mortgage Rates Weekly Update [May 14 2018]

Mortgage Rates Weekly Update for May 14, 2018

Mortgage Rates Update for May 14, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were slightly higher to end the week as mortgage bonds traded in a wide range between support and resistance. If you look at the mortgage bond chart below you can see bonds started the week just below a ceiling of resistance and failed to break through and sold off till hitting floor of support on Wednesday and then rallying off the support to end the week in the middle of the trading channel. We are recommending FLOATING your mortgage interest rate to start the week to see if mortgage bonds can continue to move higher and challenge the ceiling of resistance but if bonds fail to rally and sell off we would quickly switch to a locking stance.

In Economic News

President Trump unveiled plan to lower drug prices lat Friday and dubbed the plan “American Patients First“. The plan seeks to increase competition, improve negotiation and create incentives to lower list prices of prescription drugs and out of pocket costs for consumers. Some of the steps it outlines are rebate-sharing in Medicare drug plans, promoting generics and copycat version of biologic drugs and requiring drug manufactures to publish list prices for drugs in television advertisements.

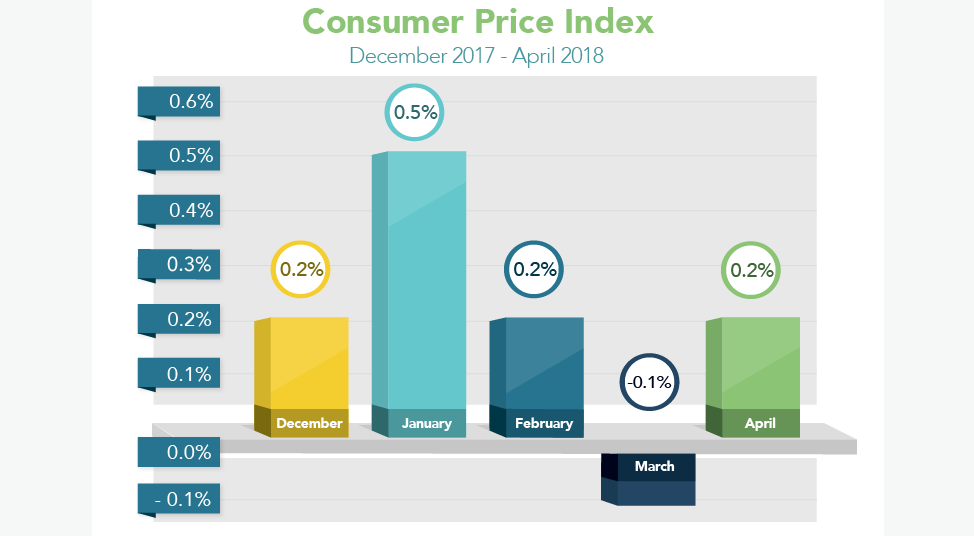

The Consumer Price Index for April 2018 (CPI) rose 0.2 percent which was just below expectations. The CPI measures inflation at the consumer level. April’s CPI reading was down from the 2018 high of 0.5 percent recorded in January. Tame inflation is good for mortgage bonds which help mortgage bonds rally to end the week. Inflation at the wholesale level was also tame as the Producer Price Index (PPI) for April 2018 rose only 0.1 percent.

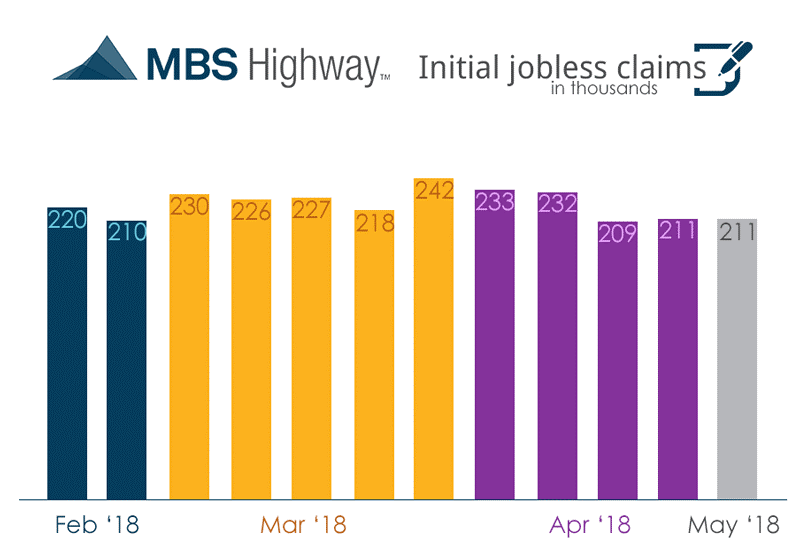

Weekly Initial Jobless Claims showed 211,000 claims filed last week which represented no change from the previous week and was 9,000 lower than expectations. Jobless remain at historically low levels which bodes well for the US labor market.

In Housing News

CoreLogic Loan Performance Insights for February 2018 were released and showed that mortgage loans that are 30 days or more past due decreased from 5.0% in 2017 to only 4.8% in 2018. Mortgage Loans that are in some form of foreclosure decreased from 0.8% in February 2017 to only 0.6% in February 2018. Chief Economist at CoreLogic Frank Nothaft said that delinquency rates would be even lower if it wasn’t for the hurricanes from last year as people in those areas are still impacted as delinquency rates in February were 50% higher than in August 2017 in Texas and nearly double that in Florida.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday May 23, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday May 19, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday June 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates