Mortgage Rates Weekly Update [June 2 2019]

Mortgage Rates Weekly Update for June 2, 2019

Mortgage Rates Update for June 2, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

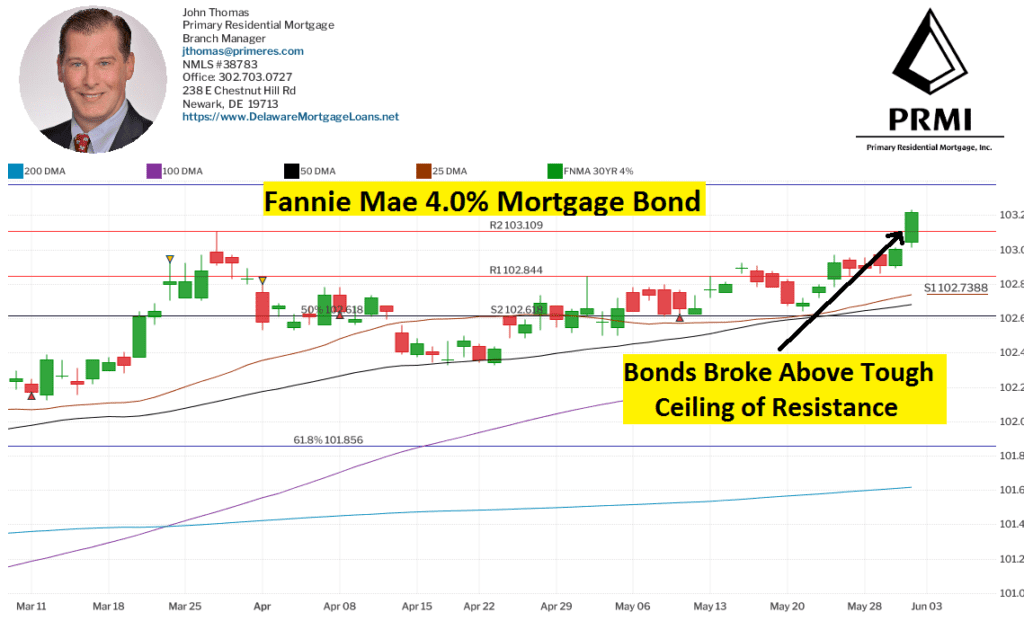

Mortgage Rates ended last week at the lows of the year as mortgage bonds were able to break above a very tough ceiling of resistance after stock market sold off from Tariffs threatened against Mexico by President Trump. If you look at the mortgage bond chart below, you can see the big green candle on Friday that closed well above ceiling of resistance. If mortgage bonds can confirm this break above the resistance on Monday then we could see mortgage rates move even lower so we are recommending FLOATING Your mortgage rate to start the week.

In Economic News

The Personal Consumption Expenditures (CPE) for April 2019 increased from 1.4% to 1.5%. This looks like a slight increase of 0.1% from March but March report was revised lower from 1.5% to 1.4% so inflation pretty much stayed the same at consumer level. The CPE is the Federal Reserve’s favorite measure of inflation and 1.5% is well below their target of 2.0% which is great news from mortgage rates as low inflation will help keep mortgage rates low.

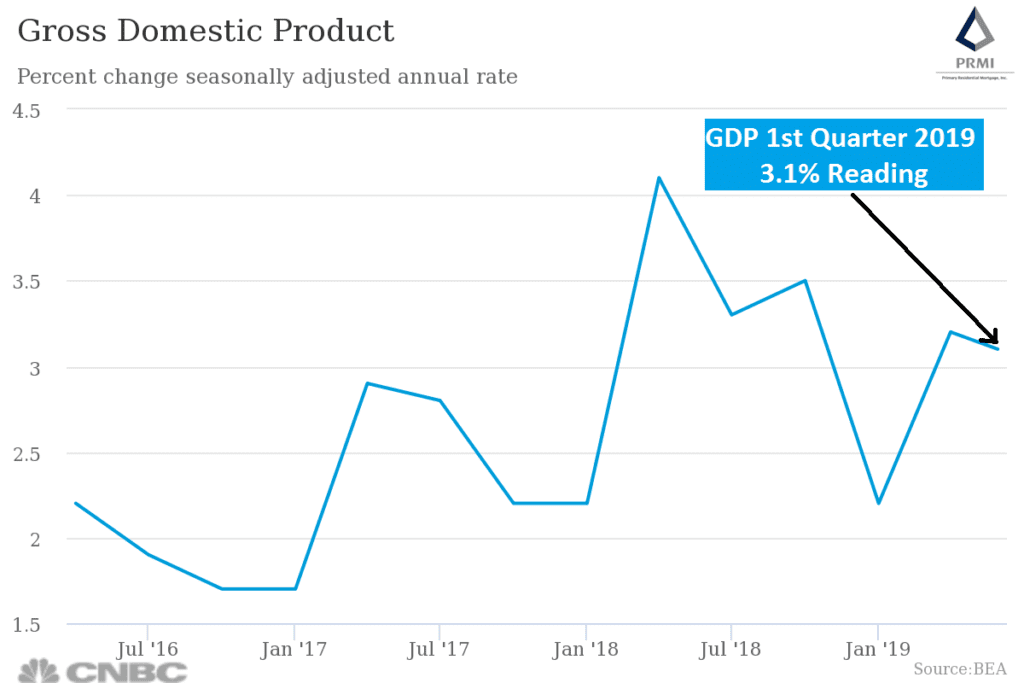

Gross Domestic Product (GDP) for 1st Quarter of 2019 came out at 3.1% on the second reading. When you dig into the report, most of the GDP increase was from inventory build up and spending & investment was lowest level since second quarter of 2013. We also saw business profit was up only 2.9% which is down from 4.6% in Q4 of 2018. If this holds as inventory build up dwindles we will see GDP go down.

Weekly Initial Jobless Claims were released on Thursday showed 215,000 jobless claims which was an increase of 3,000 claims from last week’s 212,000 revised number. This week is the sample week to be used in the Jobs Report for May 2019 which will be released on Friday June 7th. This is a very good report on jobless claims so points to a strong Jobs Report for May.

In Housing News

New Home Sales for April 2019 dropped 6.9% to 673,000 units on an annualized basis BUT this doesn’t tell the whole story. March New Home Sales were revised significantly higher which means April New Home Sales were only down 2.8% from the original March numbers which was in line with expectations of a 3% drop. New Home Sales are still up 7% year over year so still a very solid report on housing. The Median New Home Price was up nearly 9% year over year to $342,200.

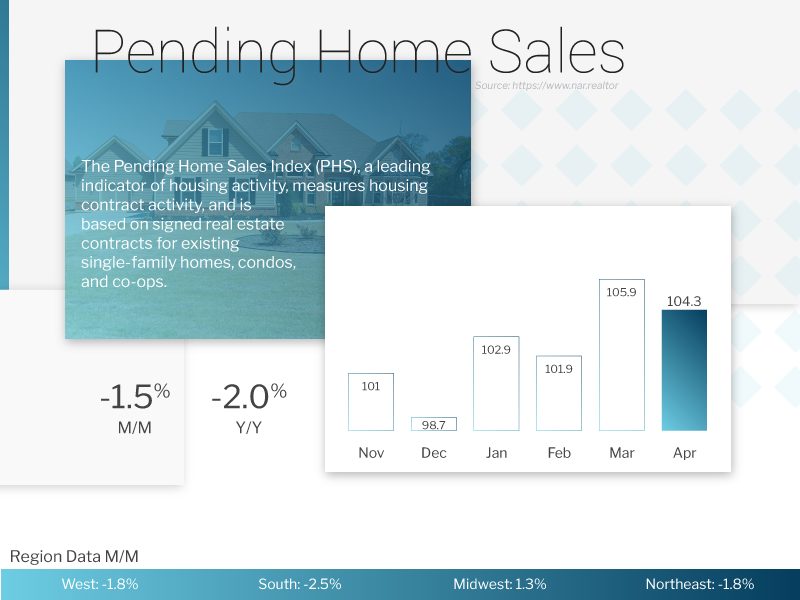

Pending Home Sales for April 2019 were down 1.5% to 104.3 on the index but was still a good number comparatively. If you look at the chart below, you can see April is the best month of pending home sales in the last 6 months if we ignore March. Pending home sales are now only down 2% year over year.

National Flood Insurance Program (NFIP) Update – The NFIP received a last minute extension for two weeks as the program would have expired at Midnight on May 31, 2019. The program has received 12 extensions in the last two years as Congress has failed to pass a permanent solution. Congress is expected to pass funding through September 2019 prior to the expiration of this two week extension.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday June 15, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday June 19, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday June 22, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam