Mortgage Rates Weekly Update [July 31 2017]

Mortgage Rates Weekly Update for July 31, 2017

Mortgage Rates Weekly Update for July 31, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week lower than they started after failing to stay above the 50 day moving average on Monday but were able to rally to end the week just below the 50 day moving average. If you look at the mortgage bond chart below you can see mortgage bonds are trading in a tight range between the blue lines to end the week. It is going to be tough for bonds to break above the 50 day moving average in the short term so we are recommending LOCKING Your mortgage rate to start the week to take advantage of the rally off support on Friday for mortgage bonds.

In Economic News

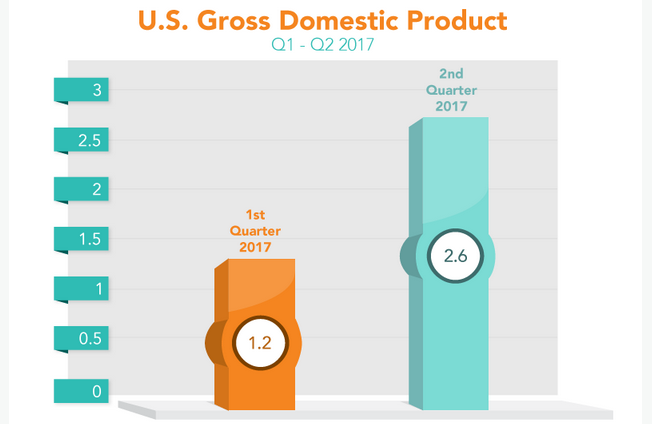

The Bureau of Economic Analysis reported the first reading of Gross Domestic Product (GDP) for the 2nd quarter of 2017 last week and it was a solid 2.6 percent. Consumer spending was the driver for the increase in GDP as it rose 2.8 percent and government spending helped as well by rising by 0.8 percent. The GDP for the first quarter of 2017 was revised lower from 1.4 percent to only 1.2%.

The Federal Reserve had its open market committee meeting last week and announced they were leaving the Federal Funds Rate unchanged which was pretty much expected. The Feds also said they expect inflation to remain tame for some time which is very good news for mortgage bonds and continued low interest rates.

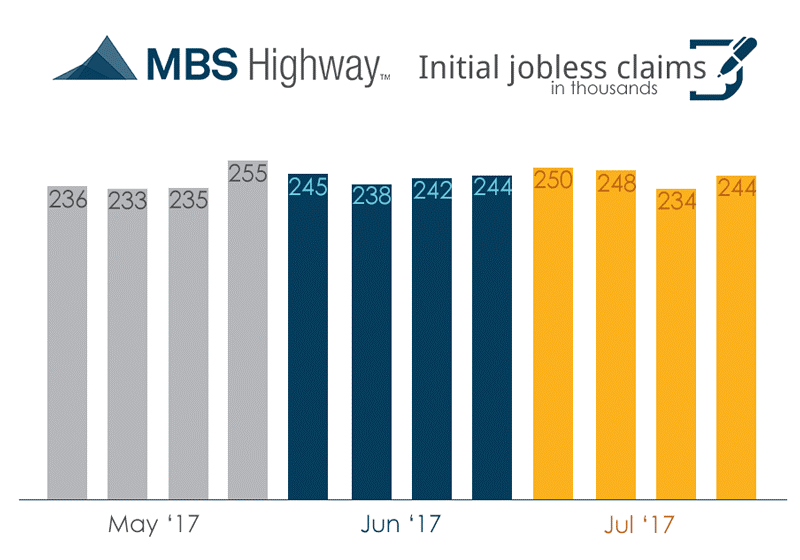

Weekly Initial Jobless Claims were released on Thursday and were up 10,000 claims from last week at 244,000 jobless claims. The previous week’s jobless claims of 234,000 claims will be the sample week for the July Jobs Report which will come out on Friday and points to a very strong jobs report.

In Housing News

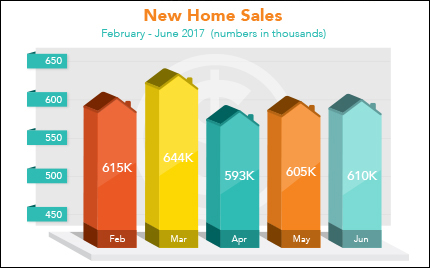

New Home Sales for June 2017 edged higher by 0.8 percent from May 2017 to 610,000 units. New home sales were up 9.1 percent from June of 2016 which is a very strong number and shows new home construction is doing very well.

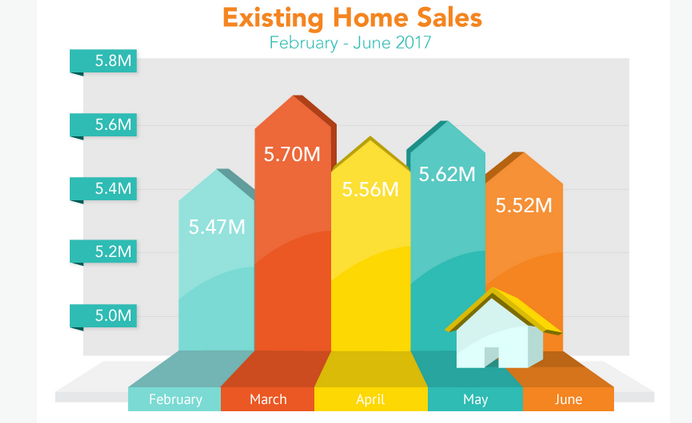

Existing Home Sales for June 2017 were reported by the National Association of Realtors (NAR) last Monday and they fell 1.8 percent from May 2017 to only 550,000 units on annualized basis. Existing home sales are only up 0.7 percent from June 2016 which was the second lowest reading of 2017. The decrease in existing home sales is because of the lack of inventory of homes for sale which is at a 4.3 month supply nationally and has been falling for 25 consecutive months. The demand from buyers is high but inventory is low so the average existing home price is up 6.5 percent from June 2016.

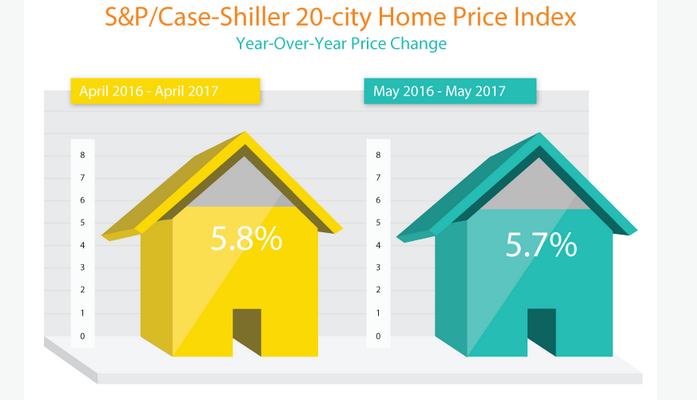

The Case-Shiller 20 City Home Price Index for May 2017 showed home prices were up 5.7% from May of 2016. Demand continues to out weight supply in most areas of the United States. Home Prices are continuing to rise and are out pacing inflation and wage growth.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday August 19, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage