Mortgage Rates Weekly Update [January 7 2019]

Mortgage Rates Weekly Update for January 7, 2019

Mortgage Rates Update for January 7, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

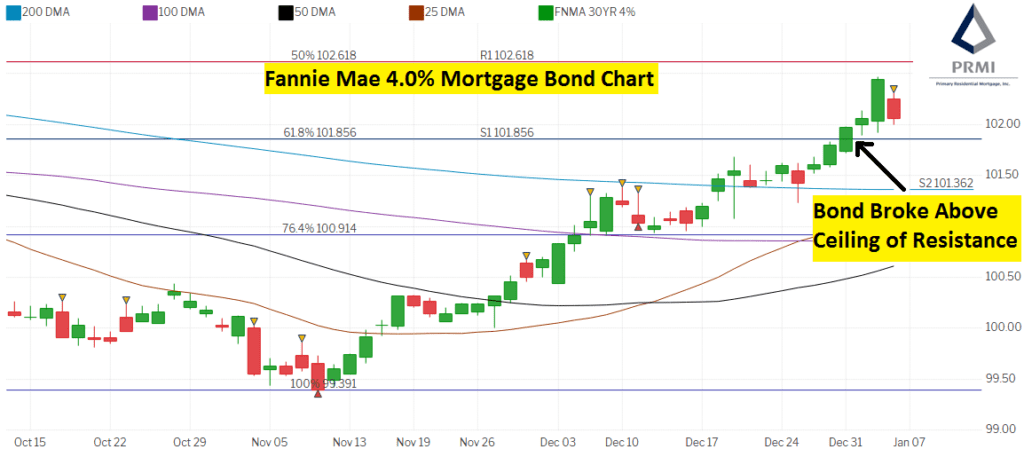

Mortgage Rates moved lower again last as mortgage bonds rallied and broker through another ceiling of resistance. If you look at the mortgage bond chart below, you can mortgage bonds have been on an upward trend since reversing course on November 8, 2018. Bonds started the new year at the highs of 2018 as we moved into 2019. Mortgage bonds did end the week by moving lower from the high after a very strong jobs report and ended in the middle of the trading range. Bonds have more room to the downside before reaching a floor of support and with the stock market rallying to end the week, we are recommending LOCKING your mortgage rate to start the week to take advantage of the best mortgage interest rates seen in almost a year.

In Economic News

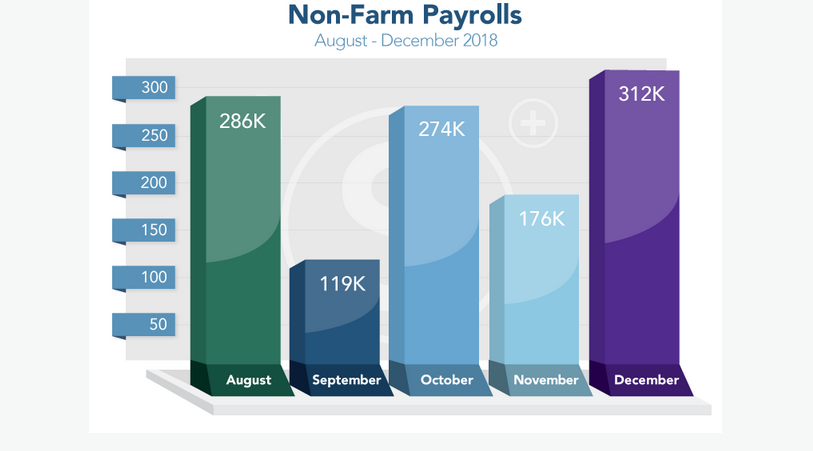

The Jobs Report for December 2018 was reported on Friday and showed a surprising 312,000 jobs created which was well above expectations of only 180,000 jobs. The previous two months jobs report were revised higher by a combined 58,000 jobs. The three month average for jobs created now stands at 254,000 jobs.

The Unemployment Rate moved higher from 3.7% to 3.9% which seems odd when there were 312,000 Jobs Created. The reason for the disconnect is that the Jobs Report uses the Business Survey but the Unemployment Rate uses the Household survey which showed only 142,000 jobs created and that the labor force increased by 419,000. The Labor Force Participation Rate moved up from 62.9% to 63.1%. The Average Hourly Earnings were up 0.4% and up 3.2% year over year which ties October for the best Wage Growth since April 2009. Wage Growth creates wage pressure inflation which is bad news for bonds.

Weekly Initial Jobless Claims were released on Thursday and showed and increase of 10,000 claims to 231,000 claims for the week. This is a higher level of claims than we have been seeing but this could be skewed because of the holidays, end of the year, and partial government shutdown. We will have to see if smooths out in a couple of weeks or if this is the start of a trend.

In Housing News

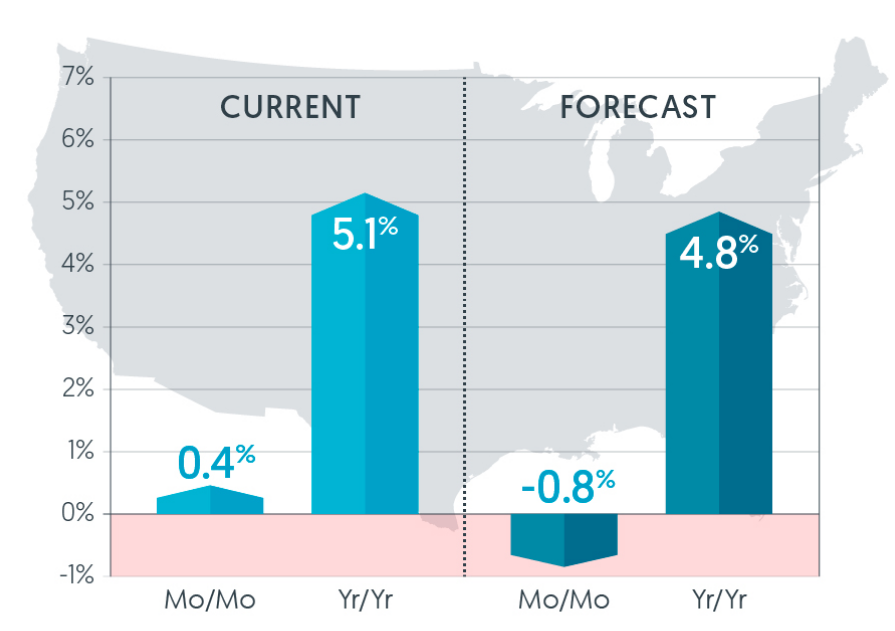

CoreLogic Home Price Insight Report for November 2018 showed home prices were up 0.4% from October and are up 5.1% year over year. CoreLogic is predicting home prices to be up 4.8% year over year from November 2018 to November 2019. The report shows home price appreciation is slowing but is still going up which is good news for wealth creation if you own real estate. If you are not yet a homeowner, then purchasing a home in 2019 would be a very wise investment decision.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday January 12, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday January 23, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday January 19, 2019 in Edgemore, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam