Mortgage Rates Weekly Update for Jan 4 2016

Mortgage Rates Weekly Update Jan 4 2016

Mortgage Rates weekly market update for the Week of January 4, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to stabilize last week and end the week slightly lower than they started as the bond was able to hammer out a bottom and bounce higher. If you take a look at the mortgage bond chart below from 12-31-2015 you can see mortgage bonds ended the week with a Green Candle showing bonds bouncing off support. We are recommending starting the new year FLOATING your mortgage rate to see if bonds can continue to rally higher. If bonds switch and sell off, we would quickly switch to a locking stance.

In Economic News, U.S. Congress passed a massive 1.8 Trillion Spending bill and it was signed into law by President Obama. In the bill is included extending the tax deductibility of mortgage insurance through 12/31/2016 for borrowers who make $100,000 or less, they can deduct 100% of MI paid. It then is reduced by 10% per $1,000 and totally phases out for borrowers making $110,00 or more. The Bill also extend the Mortgage Debt Forgiveness Relief Act so that anybody who had a short sale or foreclosure in 2015 and through 12/31/2016 will not owe any income taxes on the forgiven debt.

U.S. Retail Sales for 2015 Holiday season grew by 8% which is up from 2014 retail sales on only 5.5%. Online Sales grew by 20% for 2015 Holiday season. Consumer Confidence for December 2015 improved by hitting 96.5 which was above expectations and up from last month of 92.6. These are good numbers for consumer spending and show a good economy.

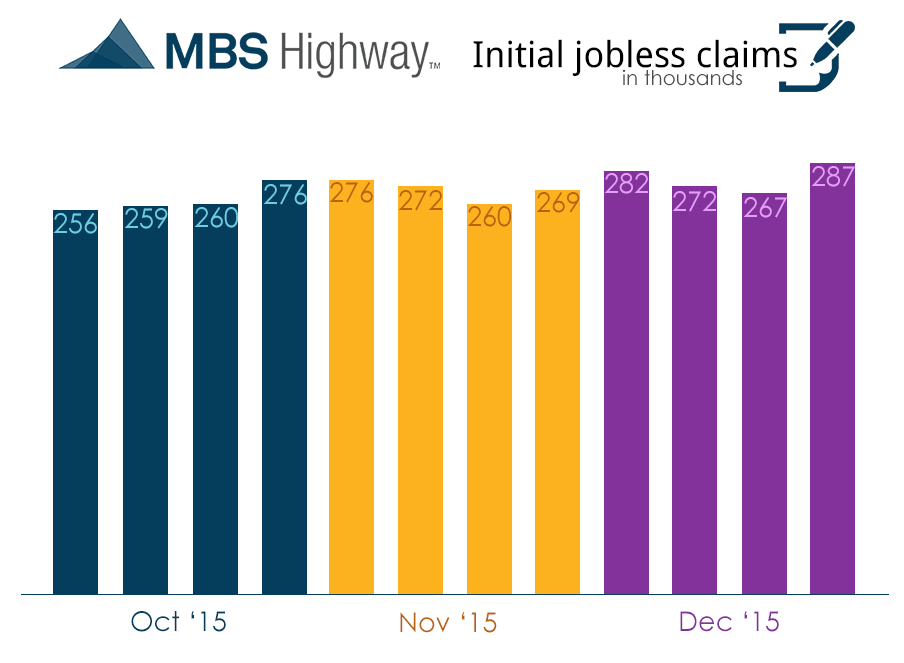

Weekly Initial Jobless Claims rose to 287,000 claims for the week which was above expectations of 270,000 claims and a jumpy of 20,000 claims from previous week. This is still below 300,000 claims and the 43rd week of being below 300k so nothing to be alarmed about in the labor market.

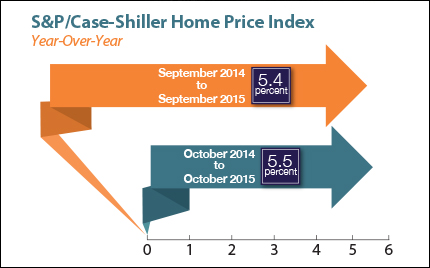

In Housing News, the Case-Shiller Home Price Index for October 2015 was released and showed a 5.5% year over year increase from October 2014. Home prices were up 0.9% from September 2015 to October 2015. A 5.5% year of year home price appreciation is very sustainable as not too hot and not too cold.

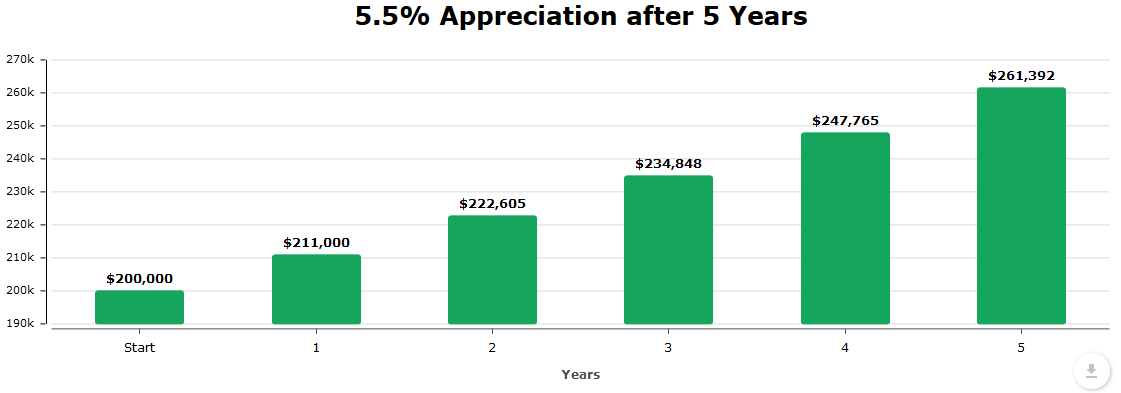

Why should you buy a home 2016? If home price appreciation can maintain 5.5% and you were to buy a home for $200,000 in January 2016, your home would be worth $261,392. If you paid $7,000 in closing costs then your net gain would be $54,392.

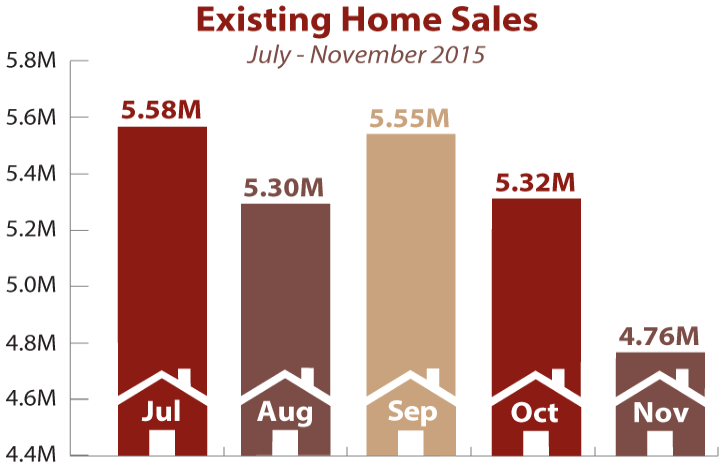

Existing Home Sales for November 2015 were released and dropped 10.5 percent from October 2015 to annualized rate of 4.76 Million homes. It was the sharpest monthly decline since July 2010. The new TRID regulations is the biggest culprit in the drop. The TRID regulations are causing significant delays in closing and there is no fix in site. Very important to align with a mortgage lender that can close on time. Primary Residential Mortgage has been closing TRID loans in 30 days or less. Call 302-703-0727 to get pre-qualed now.

Pending Home Sales for November 2015 were down 0.9% from October which was miss as the market was looking for a 0.5% gain. Pending Home Sales measures the number of new contracts to purchase existing homes so is a measure of future home sales. NAR is predicting 5.25 Million total sales in 2015 which is the highest since 2006.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 16, 2016 in Newark, Delaware.

The next Dover Delaware Home Buyer Seminar is Saturday January 30, 2016 in Dover, Delaware

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com