Mortgage Rates Weekly Update for August 10, 2015

Mortgage Rates weekly market update for the Week of August 10, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

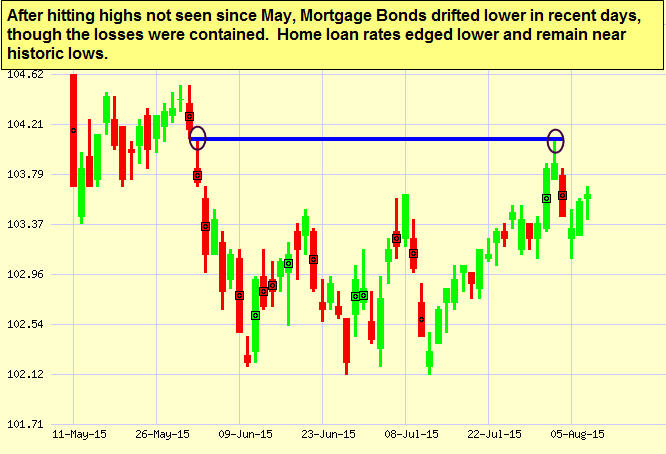

Mortgage Rates reached the lows not seen since May on Monday last week but then sold off till hit floor of support on Wednesday. If you look at the mortgage bond chart below you can see bonds were able to rally off support on Wed. Bonds ended the week below where they started so mortgage interest rates did rise but with mortgage bonds rallying off support, we are recommending FLOATING your mortgage rate to start the week.

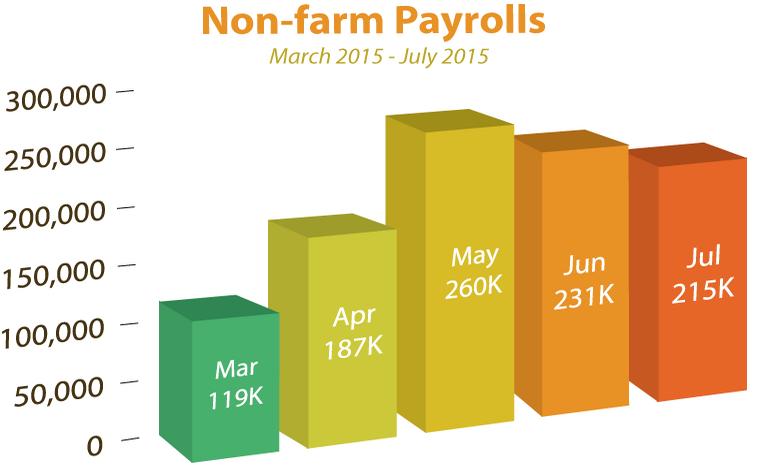

In Economic News, the Jobs Report for July 2015 was released on Friday and it showed 215,000 jobs created. This was slightly below expectations of 229,000 jobs. May and June were revised higher by a total of 13,000 jobs. The Unemployment Rate stayed the same at 5.3%. The Labor Force Participation Rate (LFPR) remained very low at only 62.6%. The LFPR measures the number of people 16 years and older that are able to work who are actually working.

This Jobs Report will put the Federal Reserve in a position to raise Short Term Interest Rates at their next meeting on September 17th. If the Feds raise short term rates, this will most likely benefit mortgage bonds as the stock market will most likely sell off. So we could see mortgage interest rates move lower after the Feds hike interest rates.

The Federal Reserves Favorite measure of inflation was released last week, which is the Core PCE. The Core PCE only rose by 0.1% which was below expectations and is only 1.3% year over year so inflation still remains very tame.

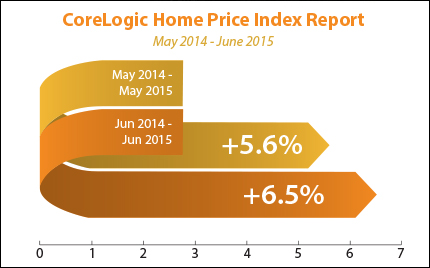

In Housing News, CoreLogic reported its Home Price Index for June 2015 which showed home prices increased by 6.5% year over year which is up from May’s 5.6%. June 2015 represented the 40th consecutive month of the year of year price increases. Home Prices moved up 1.7% from May 2015 to June 2015. Home Prices are now only 7.4% below the peak of April 2006.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 8/7/2015 they are working on reviewing files that have been submitted on 7/21/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

FYI – USDA is Increasing the upfront Guarantee Fee from 2% to 2.75% on October 1, 2015.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, August 29, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713