Mortgage Rates Weekly Update [December 31 2018]

Mortgage Rates Weekly Update for December 31, 2018

Mortgage Rates Update for December 31, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

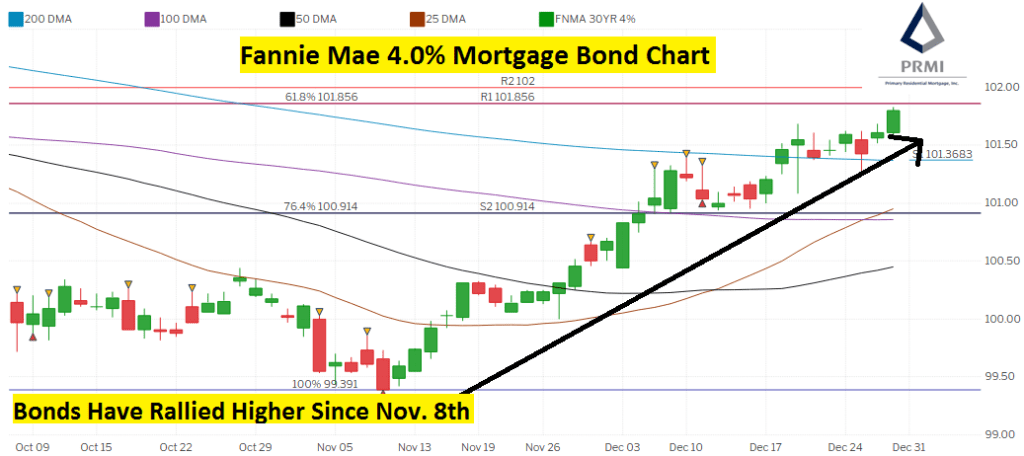

Mortgage Rates have moved to the lows not seen since last May. If you look at the mortgage bond chart below, you can see mortgage bonds have rallied higher since hitting the lowest point of the year on November 8, 2018. Since then, bonds have continued higher break through each ceiling of resistance and finally breaking through the 200 day moving average which has been a ceiling of resistance bonds could not break all year. Stocks sold off to end the week on Friday which helped mortgage bonds move higher up to the next ceiling of resistance at 101.856. Since bonds continued to start strong even in the face of a stock market recover of a 1,000 points last week, we are recommending FLOATING your Mortgage Rate to start the week to see if bonds can break through the next ceiling and move mortgage rates even lower.

In Economic News

The United States government is on a “Shut Down” over a fight on passing a budget to keep the government funded. The shut down has affected anybody needing Flood Insurance on the purchase of their home as no flood insurance has been available to be issued during the shutdown. This means roughly 40,000 homes per month could go unsold because of certain areas require flood insurance.

The National Flood Insurance Program (NFIP) was reauthorized late last week on December 21, 2018 and provided funding till May 31, 2019, FEMA changed original policy of not issuing flood insurance during the shutdown but now has reversed decision and will be issuing new flood insurance policies.

How the Government Shut Down Affects Mortgage Loans:

Conventional Loans, VA Loans, and FHA Loans will continue as usual.

USDA Loans: Will not issuing new commitments or insuring under the shutdown

ALL LOAN TYPES: IRS will not be issuing tax transcripts, depending on the buyers individual situation this could impact approval. Primary Residential Mortgage will close loans without the IRS tax transcripts in some cases so call us at 302-703-0727 if you need help getting your loan closed.

Weekly Initial Jobless Claims were released on Thursday and claims decreased 1,000 claims to 216,000 claims for the week. Last week was the sample week to used for this week’s jobs report and was revised higher from 214,000 to 217,000. The jobless claims are still very low and point to a good Jobs Report for December 2018 which will be released this Friday January 4th. The potential market movers in the Jobs Report will be the unemployment rate and the average hourly and weekly earnings, which will give us a reading on wage pressured inflation.

In Housing News

Pending Home Sales for November 2018 were down 0.7% to 101.4 on the index which was weaker than expectations of a 1% gain. Pending Home Sales are now down 7.7% year over year. Even though this report was a miss, NAR’s Chief Economist Lawrence Yun was very optimistic. He stated “The latest decline in contract signings implies more short term pullback in the housing sector and does not yet capture the impact of recent favorable conditions of mortgage rates.” Yun expects solid growth potential for housing in the long term.

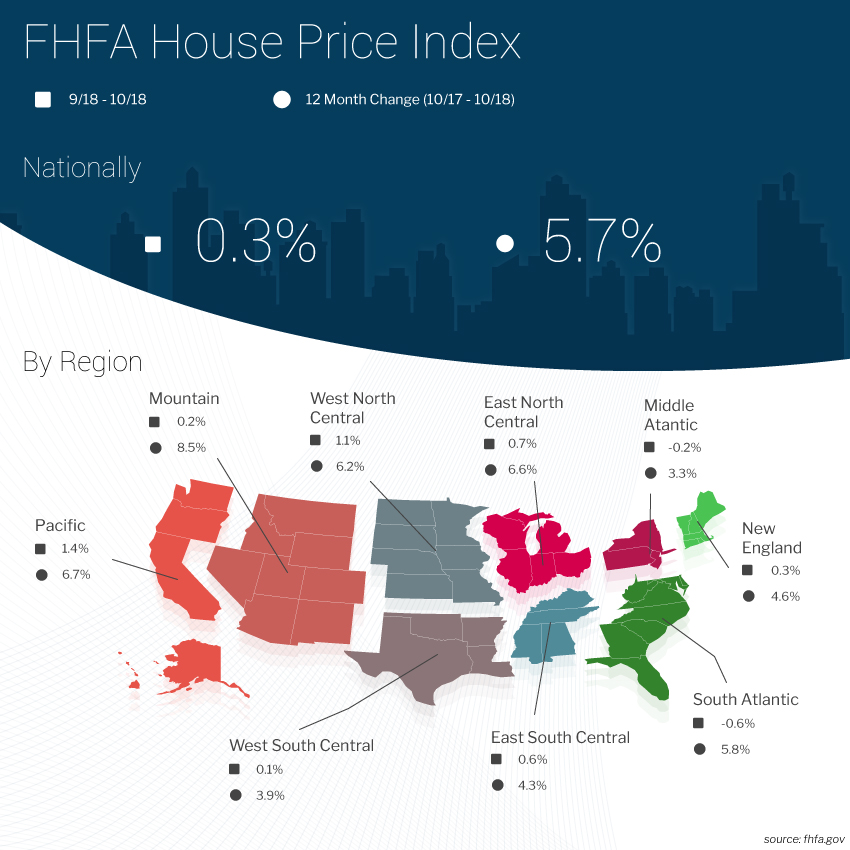

The FHFA (Federal Housing Finance Agency) released their House Price Index for October 2018 which showed home prices rose 0.3%. The House Price Index measures home price appreciation on single-family homes with conforming loan amounts. The year over year appreciation on home prices decreased from 6.0% to 5.7%. The home price appreciation has been slowing but is still moving forward. Instead of driving down the highway at 90 mph, we are now traveling at 60 mph. We are still seeing home prices appreciate, not lose any value. These levels of appreciation are still very meaningful and can help generate enormous wealth long term.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday January 12, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday January , 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday January 19, 2019 in Edgemore, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam