Mortgage Rates Weekly Update [December 3 2018]

Mortgage Rates Weekly Update for December 3, 2018

Mortgage Rates Update for December 3, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

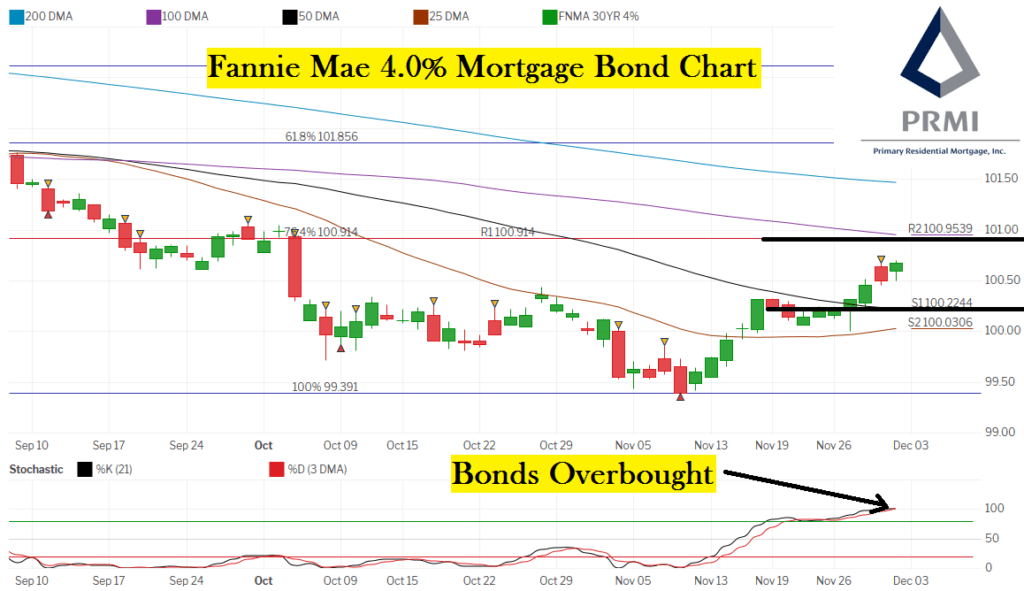

Mortgage Rates have moved lower last week after mortgage bonds were finally able to break above the 50 day moving average. If you look at the mortgage bond chart below, you can see mortgage bonds broke through the 50 day moving average on Tuesday and rallied higher the rest of the week ending on Friday with a Green Candle. Mortgage bonds are now trading in the middle of a wide trading range between the 50 day moving average acting as a support and a ceiling of resistance at 100.914. Bonds are still in overbought territory and any follow through to the downside could move rates higher as they move back down toward the 50 day moving average. We are recommending carefully FLOATING your mortgage rate to see if bonds can make a run at resistance and move rates even lower but if we get a negative crossover signal we would switch to locking right away.

In Economic News

Fed Chairman Jerome Powell spoke last week in New York City which moved both the stock market and the bond market higher. Some key points that affected the markets were the following:

- We know that moving too fast to hike rates will risk economic expansion

- It mat take a year or more to fully realize the effects of the interest rate hikes

- The Federal Reserve doesn’t see “dangerous excesses” in the stock market

- The policy rate (Fed Funds Rate) is “just below” neutral.

The Fed is still very likely to raise the Fed Funds Rate one more time in December 2018 but will probably no hike rates 3 more times in 2019 as has been previously thought was a sure bet. The markets think the Feds will only hike the rate one time 2019. This news will help mortgage rates from moving much higher next year as inflation remains low and there is slower global economic growth.

Gross Domestic Product (GDP) for 3rd quarter of 2018 came in at 3.5% for the third reading which was unchanged from the first reading and consistent with expectations.

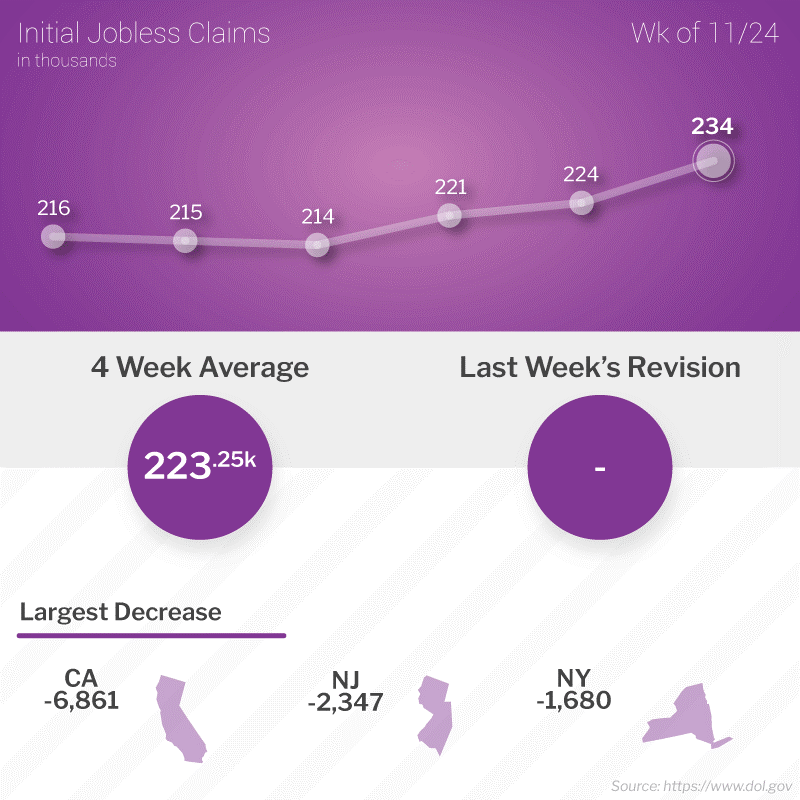

Weekly Initial Jobless Claims were released on Thursday and claims increased 10,000 claims to 234,000 claims for the week and was 15,000 higher than estimates. The previous week remained unchanged at 224,000 claims and is the “sample week” used for the November 2018 Jobs Report which will be released this Friday December 7th. This week was the highest reading since May 2018 and if this trend continues of rising jobless claims, it could signal a reversal of the trend for low unemployment.

In Housing News

Pending Home Sales for October 2018 were down 2.6% from September to 1102.1 on the index. Pending homes sales are now down 6.7% year over year. Sales in the West fell the most while the North East actually saw a 1% gain. The National Association of Realtors (NAR) is attributing the decline to higher mortgage interest rates which really hit in October.

New Home Sales for October 2018 fell 9% from September. New home sales are down 12% year over year but this is better than last month’s report which had them down 13% year over year. New Home Sales measures the number of signed contracts to purchase new homes. The median home price for a new home sale was $309,700 which is down 3.1% year over year. The average sales price was $395,000. Inventory levels for new homes is at a 7.4 month supply.

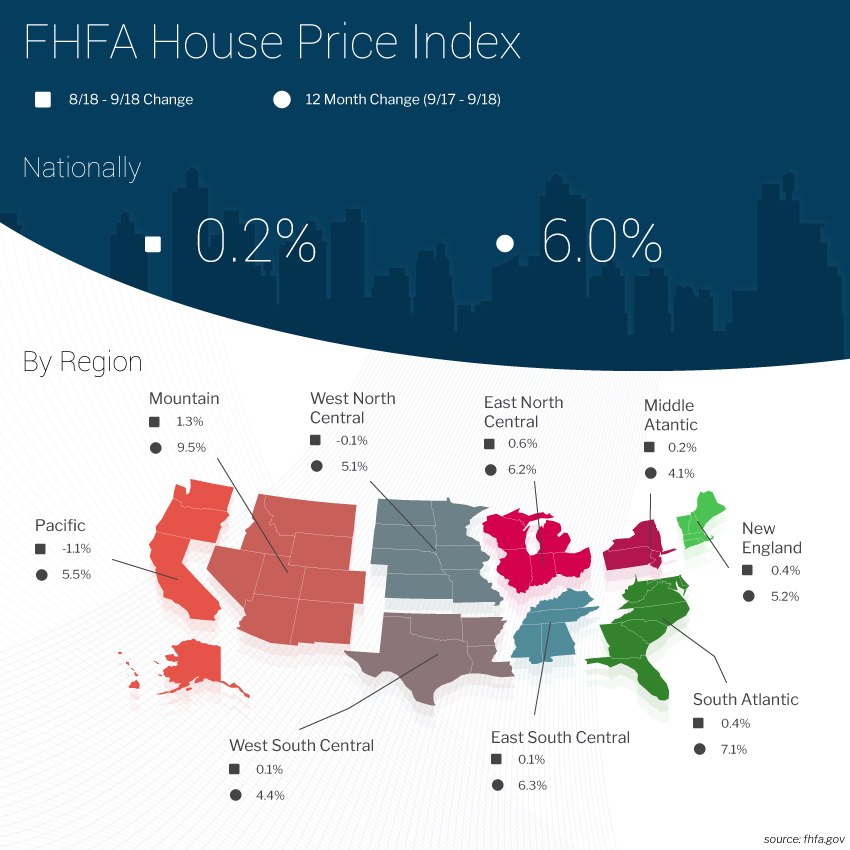

The Federal Housing Finance Agency (FHFA) released its FHFA House Price Index for September 2018 which showed home prices were up 0.2% from August and up average 6.0% year over year. Note that the South Atlantic Region which includes Delaware, Maryland, & Virginia is up on average 7.1%.

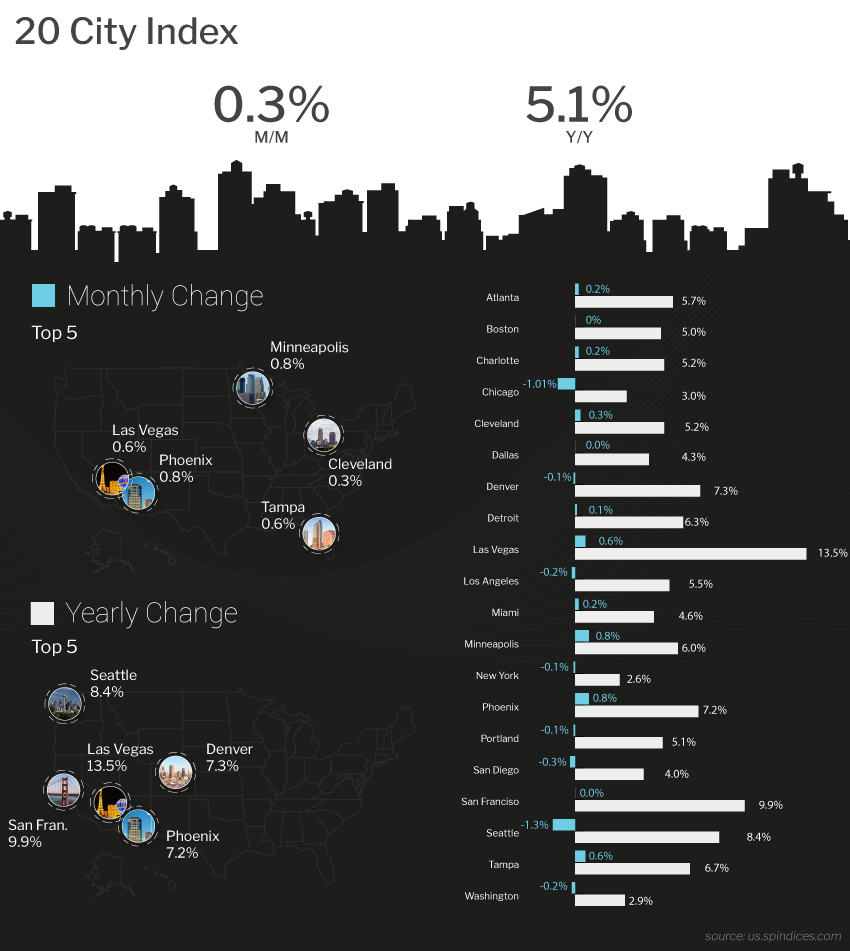

The Case-Shiller 20 City Home Price Index for September 2018 was up 5.1% year over year. This was down from 5.5% in August 2018 and shows that home price gains are slowing but homes are still appreciating and with wage growth finally rising shows a healthy housing market.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday December 15, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday December 19, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday December 15, 2018 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam