Mortgage Rates Weekly Update [December 25 2017]

Mortgage Rates Weekly Update for December 25, 2017

Mortgage Rates Update for December 25, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds sold off after failing to break through a tough ceiling of resistance. If you look at the mortgage bond chart below you can see mortgage bonds have been on downward trend since failing to break through a tough ceiling of resistance at the beginning of December. Mortgage bonds had been trading in a sideways pattern stuck between a ceiling of resistance and a floor of support. Mortgage bonds broke out of that trading channel to the downside last week moving mortgage interest rates higher. Mortgage bonds did find a floor of support on Friday so we are recommending carefully FLOATING your Delaware mortgage rate if you failed to lock your rate but if mortgage bonds continue to sell off and break below this current floor of support we will have to recommend you lock your interest rate ASAP.

In Economic News

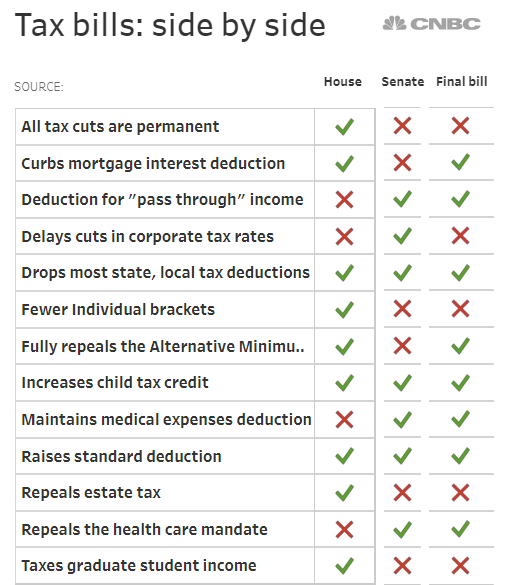

The United States Congress passed sweeping Tax Reform Bill termed Tax Cuts and Jobs Act which takes effect January 1, 2018. The passage of the bill sent the major stock indexes to record highs which pulled money out of the bond market and having a negative impact on mortgage rates. Below is a quick comparison of what ended up in the final tax bill that is going to the President’s desk for signature into law.

The Federal Reserves Favorite measure of inflation was released last week with the Personal Consumption Expenditure for November 2017 and the headline PCE moved up from 1.6% to 1.8% while the Core PCE which strips out food and energy moved up from 1.4 to 1.5% which is well below the Fed target rate of 2.0%. Low inflation is bond friendly news so that can help mortgage bonds in the long term to help keep mortgage rates low.

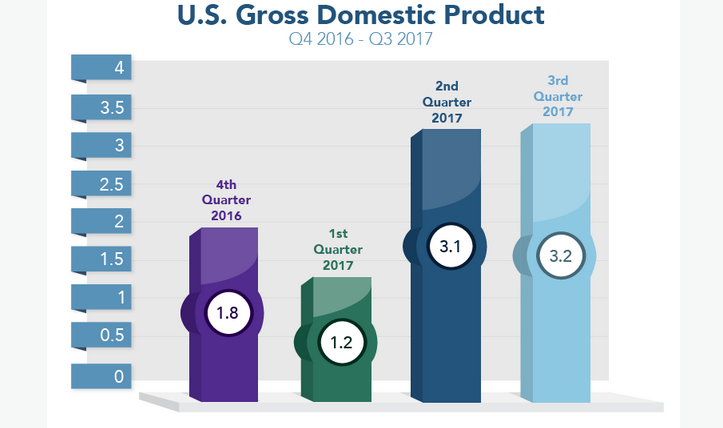

Gross Domestic Product Final Read for Q3 of 2017 came in at 3.2% up from 3.1% from second quarter of 2017. GDP is a measure of the monetary value of the goods and services produced by a country and is considered the broadest measure of the US economy. The increased GDP for the third quarter was spurred in by robust business spending.

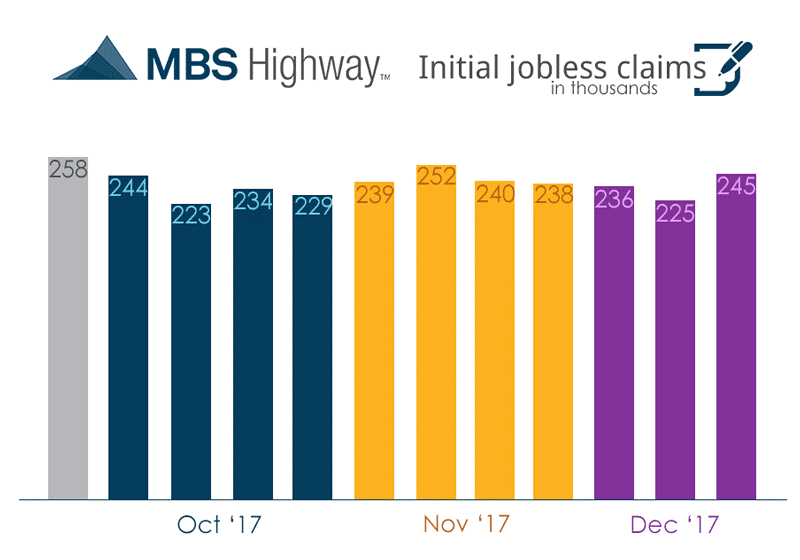

Weekly Initial Jobless Claims were released on Thursday and jumped 20,000 claims to 245,000 claims for the week. This report will be the sample week used for the December Jobs Report so this piece of the puzzle points to a strong jobs report with initial claims well below 300,000 claims.

In Housing News

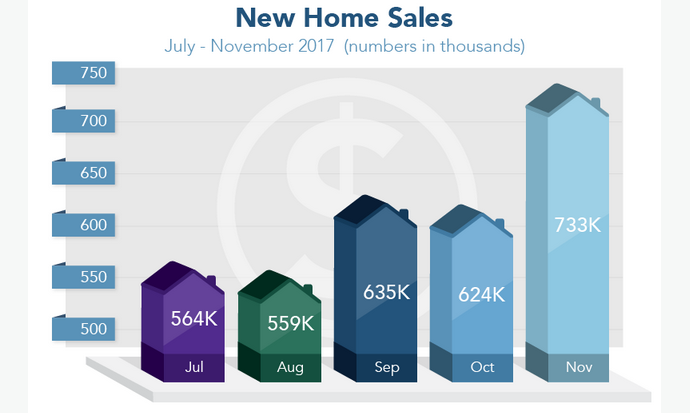

New Homes Sales for November 2017 soared higher to 733,000 units which is an increase of 17.5% from October 2017 and a 10 year high for new home sales. Demand for New Homes was very high across the country which helped boost new home sales. November had the biggest monthly gains in new home sales since 1992. New Home Sales for November 2017 were up a whopping 27% from November 2016.

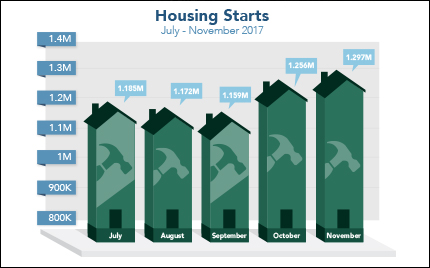

Housing Starts for November 2017 rose 3.3 percent from October 2017 to 1.297 million units on annualized basis. Housing Starts measures the number of new homes that home builders started construction on for that month. Building Permits for November 2017 fell 1.4 percent to 1.298 million units. Building permits is a measure of future construction as it shows how many homes builders will start construction on in the future.

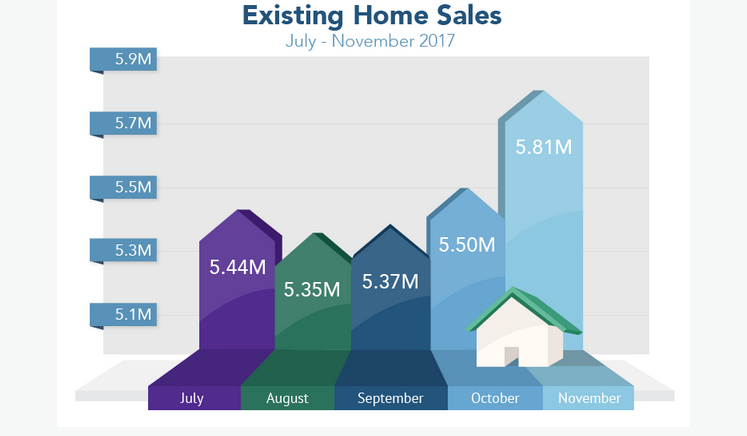

Existing Home Sales for November 2017 surged higher to an annual rate of 5.81 Million units which was an increase of 5.6% from October 2017. Existing Home Sales for November 2017 were up 3.8% from November 2016. Existing Home Sales hit an 11 year high in November because of faster economic growth, record high stock markets and a very strong labor market have home buyers feeling much better about the economy. Inventory levels dropped nearly 10 percent from last year to a 3.4 month supply nationally which is well below a normal inventory supply of 6 months. Low inventory is pushing the median home price higher each month and Median home price was up 5.8 percent from November 2016.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday January 20, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday January 10, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates