Mortgage Rates Weekly Update [April 30 2018]

Mortgage Rates Weekly Update for April 30, 2018

Mortgage Rates Update for April 30, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

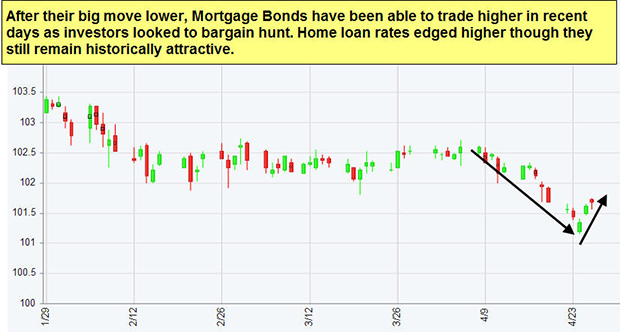

Mortgage Rates were finally able to move lower as mortgage bonds rallied higher last week. If you look at the mortgage bond chart below you can see the short term trend of bonds selling off was able to reverse last week as mortgage bonds were able to move higher. The move lower in mortgage interest rates was expected as the 10 Year US Treasury finally hit 3.04% and then backed off from there. There was a very important technical level that needed to be reached before we could see Treasuries and mortgage bonds take a breather and reverse course in the short term. Long term we feel it is only a matter of time before US Treasuries break above this ceiling and mortgage rates again begin to move higher. In the short term we are recommending FLOATING your mortgage rate to see if we can see a relief rally continue in mortgage bonds.

In Economic News

Mortgage Rates hit a 5 year high last Wednesday as mortgage rates hit highs not seen since 2013. The market is reacting to strong economic reports and statements from the Federal Reserve who appear to be continuing their policy of raising short term interest rates. The 10 Year Treasury crossed the 3 percent range for the first time in nearly four years last week. We do believe bonds and treasuries will take a breather here but the long term outlook still is for mortgage rates to continue to rise. This pause in the market move higher will be short lived so cautiously floating may get you a slightly lower interest rate but the move higher could be abrupt and one could miss the opportunity so monitoring the market is essential if you choose to float your mortgage interest rate.

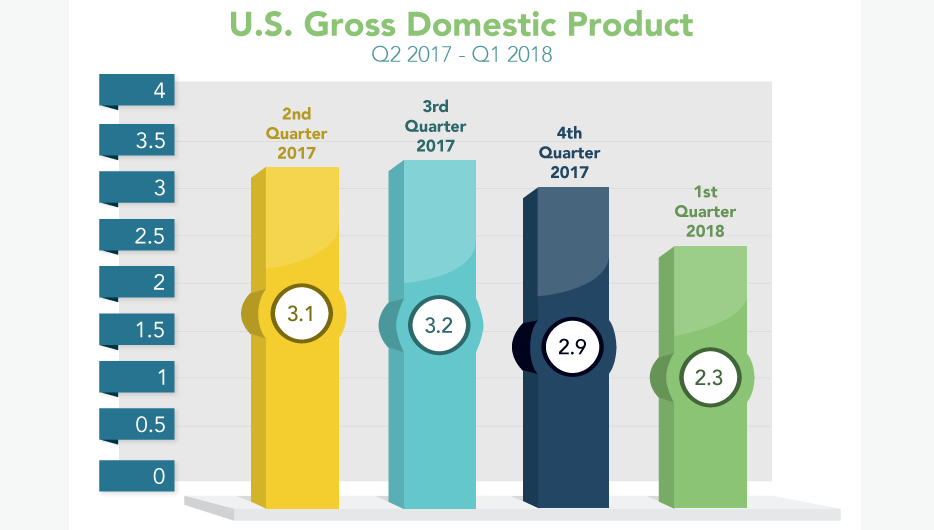

Gross Domestic Product (GDP) for 1st Quarter 2018 showed a gain of 2.3 percent down from 2.9 percent recorded from the previous quarter which was last quarter of 2017. This was above the 2.1 percent expected. GDP is the monetary value of finished goods and services produced within a country’s borders in a specific time period. GDP is considered the broadest measure of a country’s economic activity.

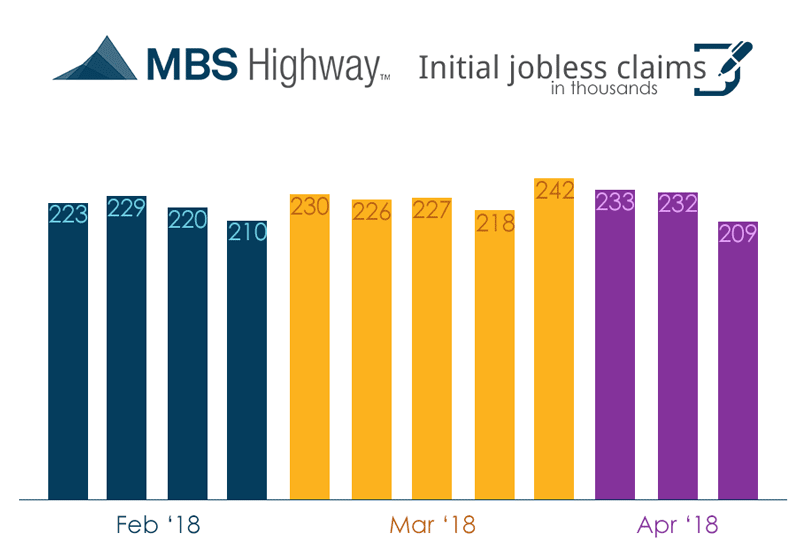

Weekly Initial Jobless Claims dropped 24,000 claims to 209,000 claims for the week which was 21,000 lower than expectations. This was the best jobless claims number since 1969! This shows the labor market is doing extremely well. The jobs report this Friday for April 2018 is expected to be a strong report based on the weekly initial jobless claims.

In Housing News

Millennial Home Buyers ready to purchase – Below is great interview on the Daily Ledger TV Show on One American Network between host Graham Ledger and Mortgage Banker John Thomas with Primary Residential Mortgage discussing Millennial HomeBuyers.

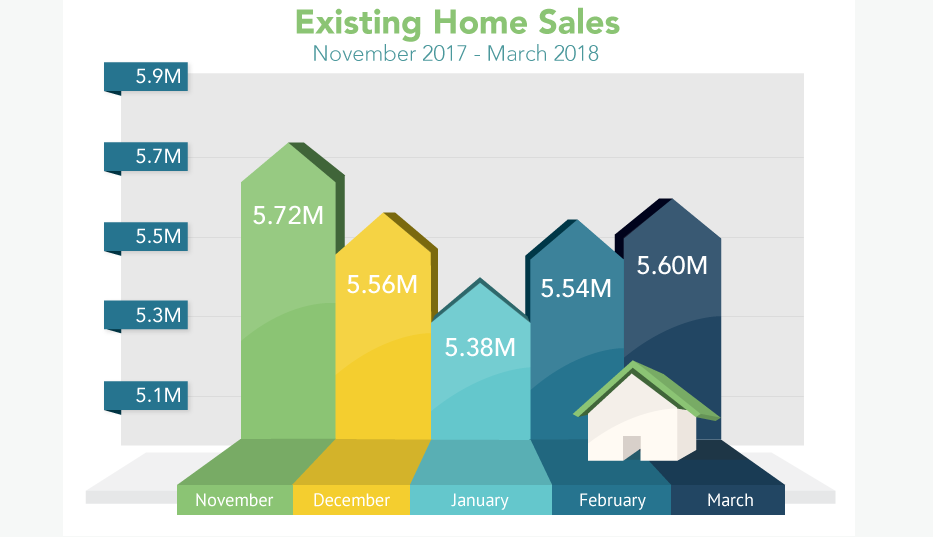

Existing Home Sales for March 2018 rose 1.1 percent from February 2018 to an annual rate of 5.60 million units according to the NAR (National Association of Realtors). Sales are down from a year ago by 1.2 percent because of the continued low inventory problem across the county. Total housing inventory stands at a 3.6 month supply which is well below the 6 month level which is considered a health level and is the 24th consecutive month of inventory level drop. The median home price of an existing home was up 5.8 percent from March 2017 to $250,400 which is the 73rd consecutive month of year over year home price gains. Housing market remains strong but is being hampered by a severe lack of inventory.

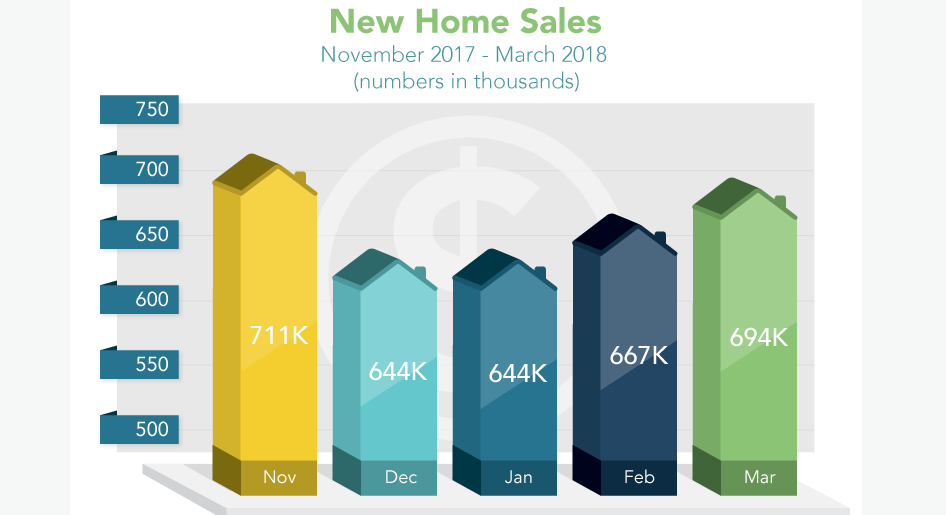

New Home Sales for March 2018 surged higher as we move into the Spring Buying Season to an annual rate of 694,000 units. This was above the 631,000 expected and was a four month high. New Home Sales were up 8.8 percent from March 2017. The median Sales price for a new home sold in March was $337,200 which was up 10% year over year. New Home Sales report shows the number of newly constructed homes by Home Builders with a committed sale during the month.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday May 23, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday May 19, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates