Mortgage Rates Weekly Update [April 28 2019]

Mortgage Rates Weekly Update for April 28, 2019

Mortgage Rates Update for April 28, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

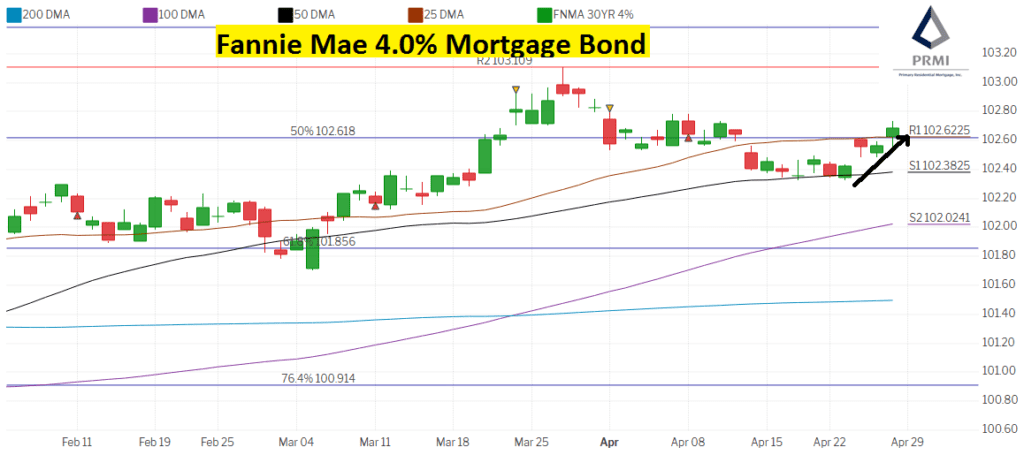

Mortgage Rates moved lower last week as mortgage bonds rallied off support. If you look at the mortgage bond chart below you can see mortgage bonds rallied off floor of support on Tuesday and broke through a tough ceiling of resistance on Friday putting mortgage bonds into position to follow through and rally higher in the coming week. We are recommending FLOATING Your mortgage rate to start the week to see if mortgage bonds can stay above the 25 moving average and continue to rally higher.

In Economic News

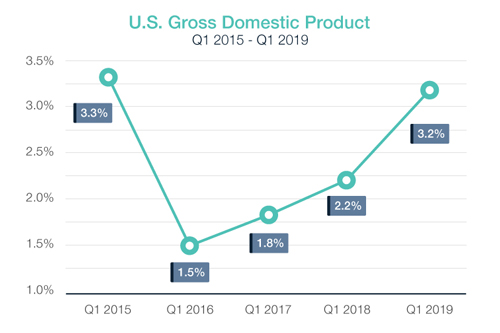

Gross Domestic Product (GDP) first readying of Q1 came in at a blistering 3.2% which was much stronger than expectations of 2.3%. This was the best GDP for first quarter to start a year since 2015.

Weekly Initial Jobless Claims were released on Thursday and jumped surprisingly higher by 37,000 claims to 230,000 claims for the week. The previous week of 193,000 is the “sample week” to be used in the April Jobs Report being released this Friday.

In Housing News

New Home Sales for March 2019 were up 4.5% to 692,000 units on an annualized basis which was stronger than an expected 3% drop in new home sales. New Home Sales are up 3% year over year and are at their highest level in almost a year and a half. The Median Home Price of a New Home Sale was $302,700 and there is a 6 month supply of new homes on the market.

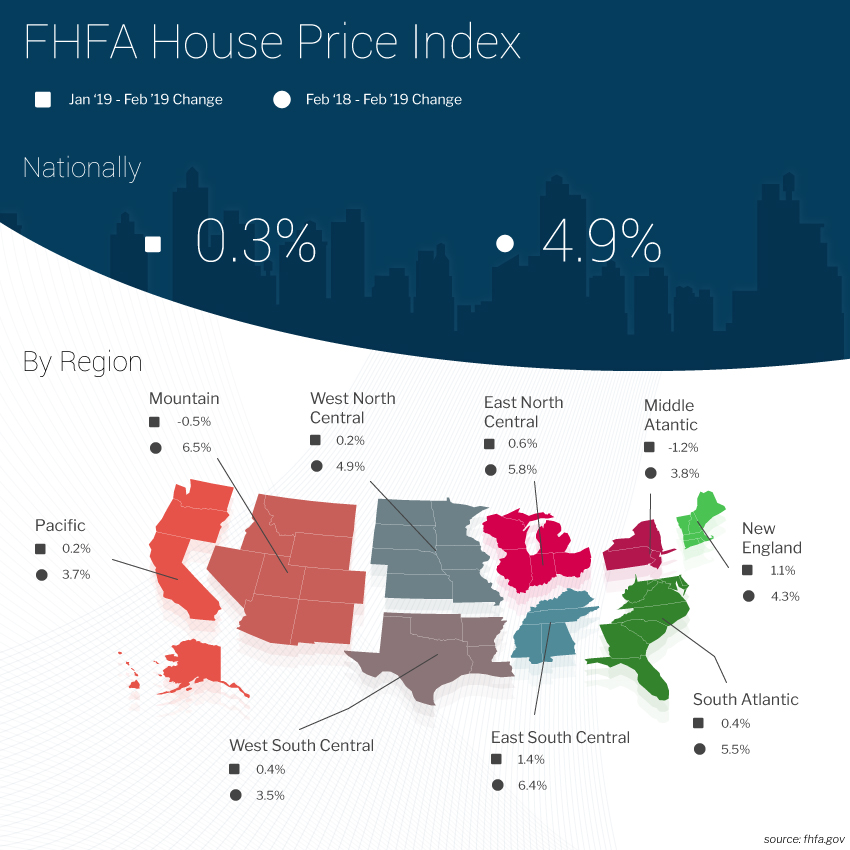

The Federal Housing Finance Agency (FHFA) released their House Price Index for February 2019 which showed home prices were up 0.3% in February from January and year over year house prices are up 4.9%.

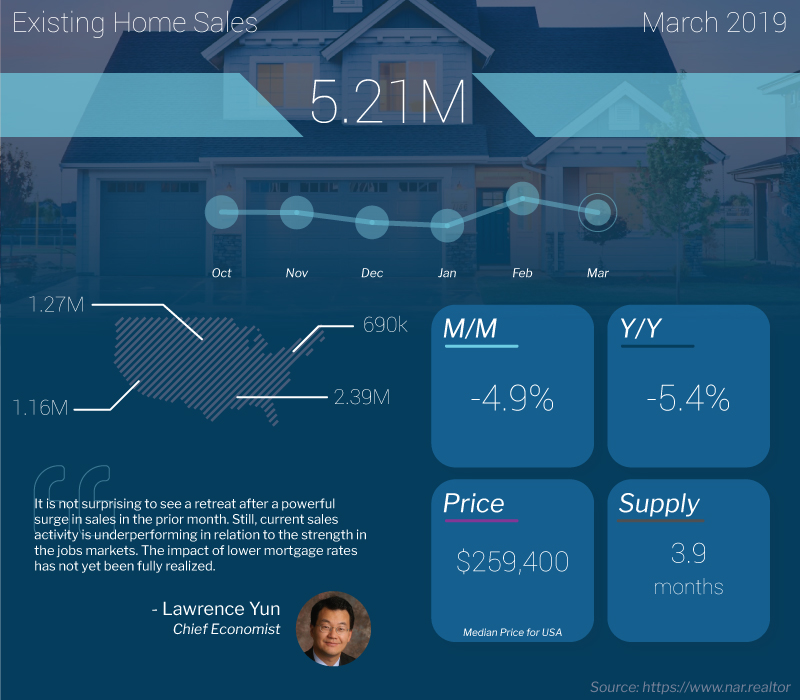

Existing Home Sales for March 2019 fell 4.95% to 5.21 Million units on an annualized basis. Existing home sales are down 5.4% year over year.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday May 11, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday May 22, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday June 22, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam