Mortgage Rates Weekly Update [April 23 2018]

Mortgage Rates Weekly Update for April 23, 2018

Mortgage Rates Update for April 23, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates continued to move higher last week as mortgage bonds broke through another floor of support. If you look at the mortgage bond chart below you can see the trend is for mortgage bonds to sell off in the short term and the long term. Mortgage bonds broke out of a sideways trading channel to the downside because Treasury Yields have spike higher forcing mortgage bonds to sell off. Mortgage bonds are sitting another floor of support that doesn’t seem likely to hold so we are continuing to recommend LOCKING your mortgage rate to start the week.

In Economic News

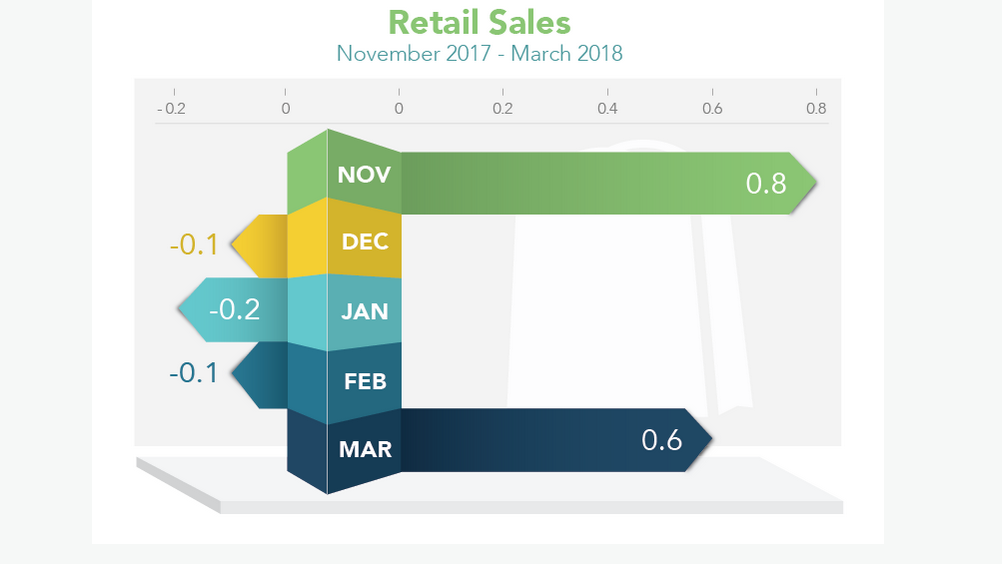

Retail Sales for March 2018 were up 0.6 percent after three straight months of decline for retail sales. Consumers opened their wallets in March and leading the way was the purchase of automobiles and health& personal care items. Consumer spending makes up two-thirds of the United States economic activity and is crucial to a healthy economy so recovering retail sales is a good sign for the economy. The retail sales report is a measure of the total receipts of retail stores from a sample of stores that represent all sizes and kinds of business in retail trade throughout the United States.

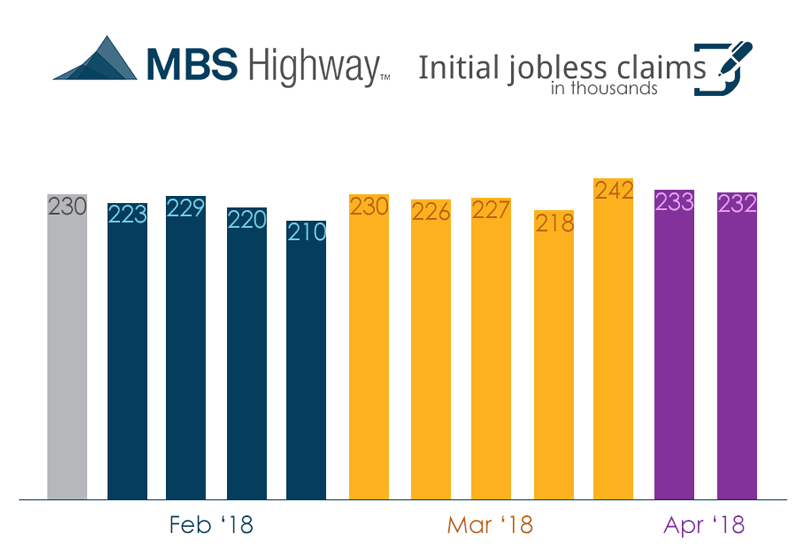

Weekly Initial Jobless Claims dropped 1,000 claims to 232,000 claims for the week which was 2,000 higher than expectations. This report will be used as the “Sample Week” for the April 2018 Jobs Report so this points to another strong Jobs Report for April which will be released on Friday May 4th.

In Housing News

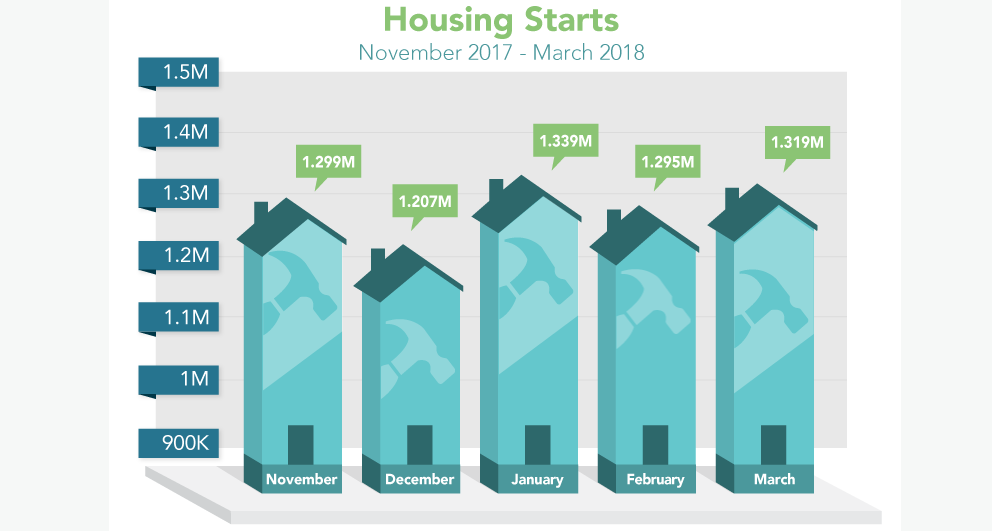

Housing Starts for March 2018 rose by 1.9 percent from February 2018 to 1.319 million units on an annualized basis which was higher than expectations of 1.268 million units. Housing Starts are up 10.9 percent from March 2017 to March 2018. Housing Starts measures the number of homes that home builders started constructing. Building Permits for March 2018 were up 2.5 percent from February 2018 to March 2018 to 1.354 million units on annualized basis which was more than expected so New Home Construction is doing very well.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday May 23, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday May 19, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates