Mortgage Rates Update for March 6 2017

Mortgage Rates Update for March 6, 2017

Mortgage Rates Update for March 6, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates Moved Higher last week as mortgage bonds sold off all week. If you look at the mortgage bond chart below you can see mortgage bonds sold off on Monday after hitting tough ceiling of resistance on previous Friday. Mortgage Bonds continued to see off all week until finally finding a floor of support on Friday and closing with a green candle on the chart. Bonds were able to close above support into the middle of the trading channel so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

The GDP for fourth quarter (Q4) of 2016 came in at 1.9% for the second of three readings which matched the first reading and was below expectations of 2.1%. GDP is a measure of the goods and services produced by the nation’s economy and is considered the broadest measure of economic activity for a country. Expectations for 2017 GDP are between 2.25% -2.5% with taxes and regulator reform being the main reason for the higher expectations.

Federal Chairwoman Janet Yellen spoke on Friday all but said the Feds would be hiking their Feds Funds Rate at their March 15, 2017 meeting. She said the Feds target for Jobs and inflation have basically been met which means it time to hike rates. This could have a short term negative effect on Mortgage Rates but could cause rates to move lower after short term move higher as happened after December 2016 Rate Hike.

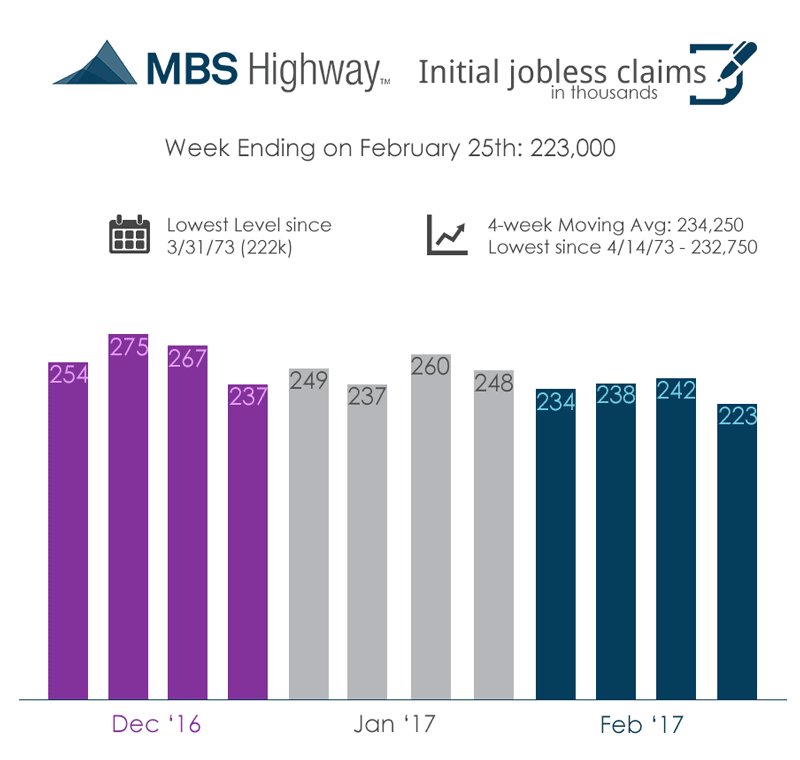

Weekly Initial Jobless Claims were released on Thursday and showed a drop of 19,000 claims to 223,000 claims for the week which is the lowest since March 1973. The four week moving average for initial jobless claims moved lower to 234,250 claims which is the lowest since April 1973. The weekly Jobless Claims point to a very strong jobs report for February which comes out this Friday.

In Housing News

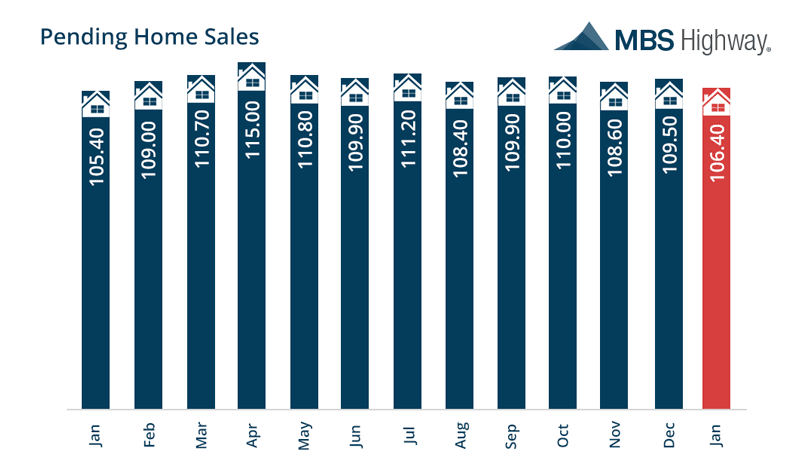

Pending Home Sales for January 2017 were a disappointing -2.8% which was below the 0.9% expected. Pending Home Sales measures the number of existing homes that went under contract. December 2016 Pending Home Sales were also revised lower from 1.9% to only 0.8%. So not a great start to the year for projected Existing home sales for the first quarter based on the number of pending home sales. But Pending Home Sales are down for a very good reason, we have very low inventory of homes for sale and strong demand for homes from buyers. This is good new for home buyers as it means the price of their home will continue to rise supply/demand pressure push home prices higher.

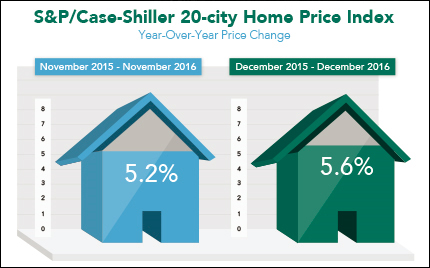

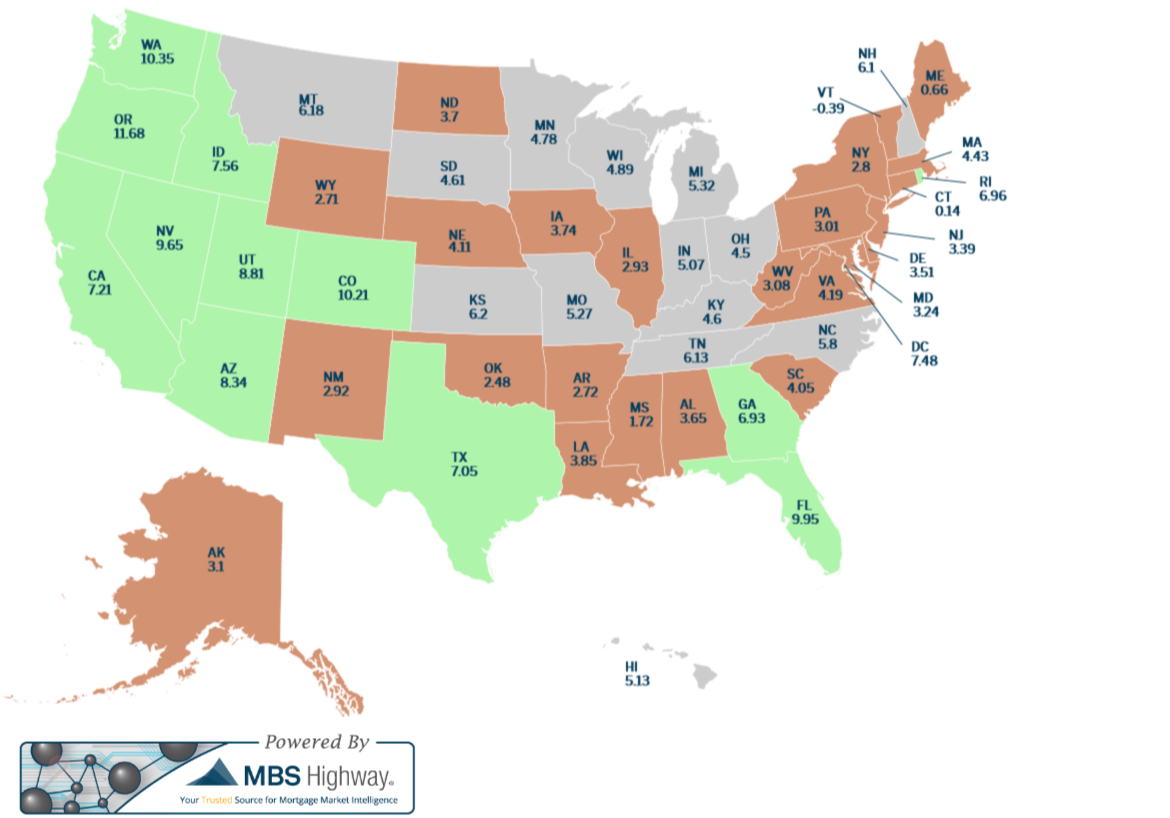

Home Prices posted strong gains at the end of 2016. The S&P/Case-Shiller 20 City Home Price Index for December 2016 rose 5.6% from December 2015 and was up 0.4% from November 2016. The National Case-Shiller Home price index showed home prices moved up from 5.6% to 5.8%.

Below is chart showing the one year price appreciation for each state in the United States. Locally we can see the following:

- Delaware – 3.51%

- Maryland – 3.24%

- New Jersey – 3.39%

- Pennsylvania – 3.01%

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday March 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate