Mortgage Rates Update August 8 2016

Mortgage Rates Update August 8 2016

Mortgage Rates weekly update for the Week of August 8, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

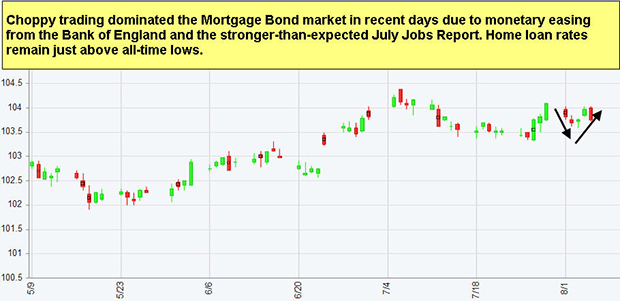

Mortgage Rates moved higher on Friday after the Jobs Report for July 2016 was released by Labor Department. If you look at the chart below you can see mortgage bonds ended the day lower on Friday with the red candle and closed below the 25 day moving average. The short term trend is for bonds to move higher so we are recommending carefully FLOATING your mortgage rate to start the week. If mortgage bonds can close above the 25 day moving average they could run higher and move mortgage rates back to all time record lows.

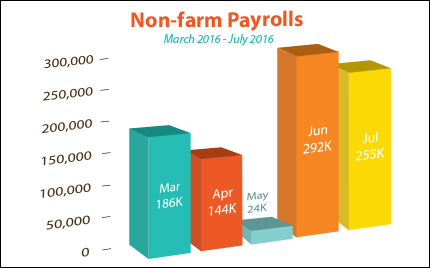

In Economic News, The US Labor Department released the Jobs Report for July 2016 on Friday August 5, 2016 which showed 255,000 jobs created in July which was above expectations and the second month of rebound from the low May Job Report. July 2016 report shows that May low number may have been a one off report and not a trend. The Unemployment Rate remained the same at 4.9%

The Jobs Report also showed a 2.5% increase in average hourly earnings which is the hottest number post recession. Wage growth can lead to higher inflation which is the enemy of mortgage bonds, so if wage growth continues we could see mortgage bonds sale off and increase mortgage rates. For Now, Inflation does remain tame as the Core Personal Consumption (CPI) remained very tame at a 0.1% increase in July and only 1.6% year over year. As long as inflation remains low, that will support low mortgage rates.

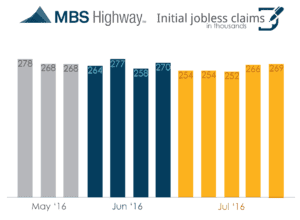

Weekly Initial Jobless Claims were reported on Thursday and showed 269,000 claims for the week which is up only 3,000 claims. Jobless claims remain below 300,000 claims which is a sign of a good labor market.

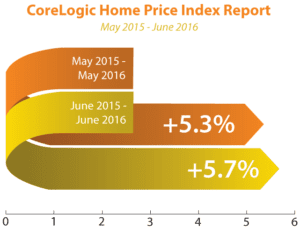

In Housing News, CoreLogic reported home prices rose 5.7% from June 2015 to June 2016. CoreLogic is predicting a 5.3% increase in home prices from June 2016 to June 2017.

First Time Home Buyer Seminars Coming Up:

The next Dover Delaware Home Buyer Seminar is Saturday August 13, 2016 in Dover, Delaware.

The next Delaware First Time Home Buyer Seminar is Saturday August 20, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRates