Mortgage Interest Rates Update October 3, 2016

Mortgage Interest Rates Update October 3, 2016

Mortgage Interest Rates update for the Week of October 3, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Interest Rates again moved to the lowest rates of the year but have stalled again at these record low interest rates. If you look at the mortgage bond chart below, you can see that mortgage bonds moved to the highs of the year and have been stalled at tough ceiling of resistance which means going to be tough for rates to move lower and very big risk of rates moving higher. Therefore we are recommending LOCKING your Mortgage Interest Rate to start the week.

In Economic News, the Gross Domestic Product (GDP) final reading for 2nd quarter of 2016 came in at 1.4% which is better than the previous reading of 1.1% BUT is still well below a healthy economy which would be GDP of 2.5% to 3.0%. This also marks the 3rd consecutive quarter that GDP has been below 1.5%.

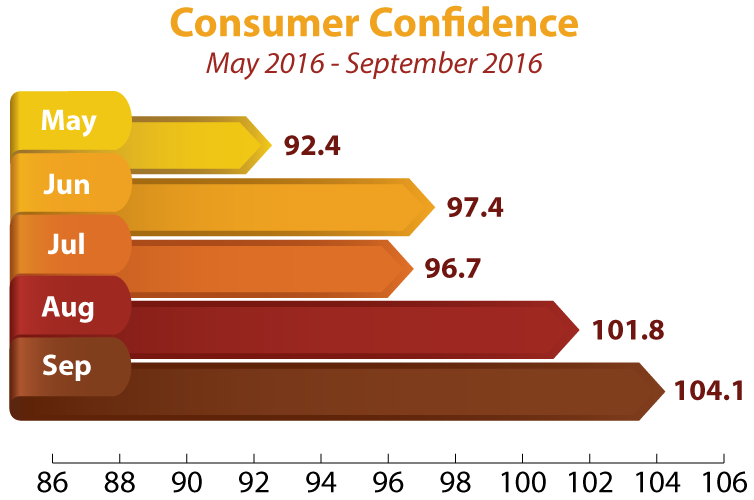

Consumer Confidence for September 2016 soared higher to 104.1 from 101.8 in August 2016. This reading for Consumer Confidence was the highest reading since the recession of 2008.

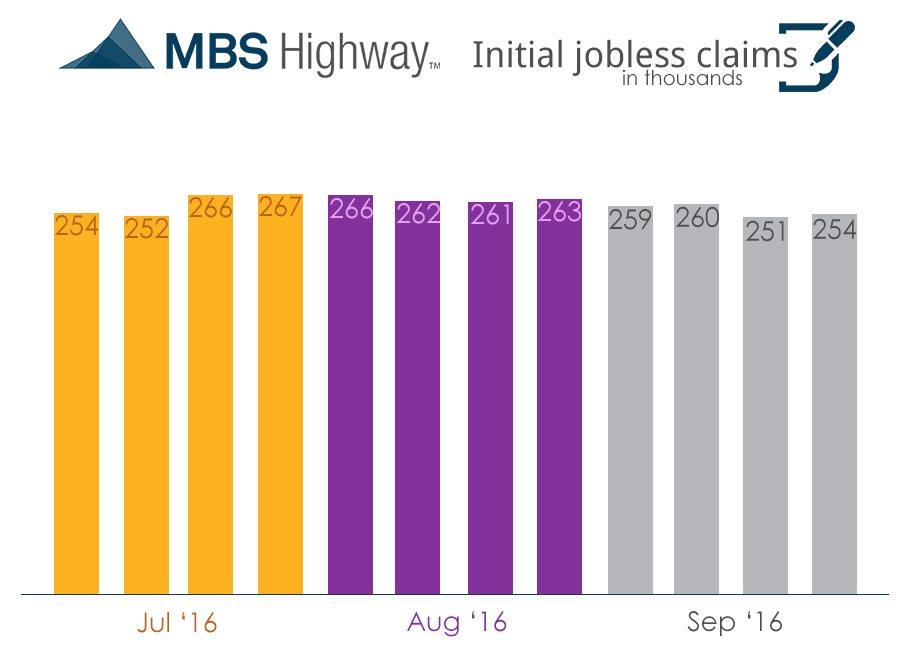

Weekly Initial Jobless Claims were released on Thursday and came out at 254,000 claims which was up 3,000 claims from last week but still a very good number. Weekly initial jobless claims measures the number of people filing for unemployment benefits. Last week’s number was revised lower to 251,000 which is important to note because this is the sample week to be used for September Jobs Report which comes out this Friday. This points to a very good Jobs Report number.

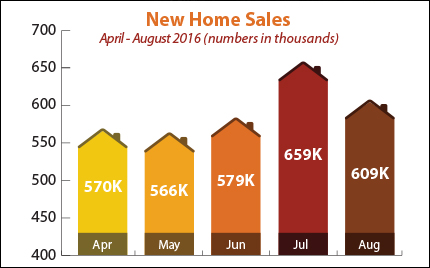

In Housing News, New Home Sales for August 2016 fell 7.6% from July 2016 to 609,000 units on annualized basis but was still a very good report because it beat expectations of 585,000 units. New Home Sales are still up a whopping 20.6% from August 2015 to August 2016. New Construction is still doing very well and shows a strong housing market.

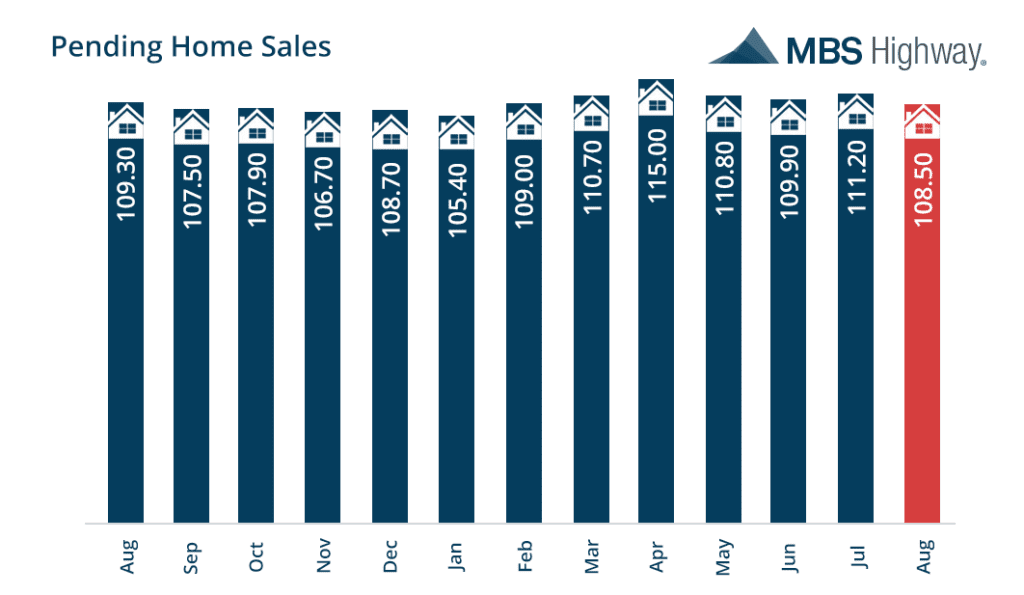

Pending Homes Sales for August 2016 fell 2.4% from July to 108.50 on the index which was down from 111.20 in July. The slow down in pending home sales is attributed to the low inventory of homes for sale across the country. The low inventory does support an increase in home values as it puts upward pressure on home prices.

USDA Rural Housing Loan Update – Effective October 1, 2016 USDA lowered the upfront guarantee fee from 2.75% to 1.0%. They also lowered the monthly mortgage insurance factor from 0.5% to only 0.35%. This makes the USDA loan option a much more affordable option for first time home buyers.

FHA Back to Work Program ended September 30, 2016. The FHA back to work program reduced the wait times for getting a new FHA Mortgage after a bankruptcy, short sale, and/or foreclosure to only 1 year if event was caused by a loss of employment or income. Now the wait times are backed to normal for FHA Loans which are as follows:

Foreclosure or Deed in Lieu = 3 year wait from date deed is transferred out of your name

Short Sale = 3 year wait from date of short sale

Bankruptcy Chapter 7 – 2 years from discharge date

Bankruptcy Chapter 13 – 1 year wait after made on time payments and current on the bankruptcy

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Next Dover Delaware First Time Home Buyer Seminar is Saturday October 15, 2016 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Mortgage Interest Rates remain near all time record low rates, so it is the perfect time to purchase or refinance a home before rates move higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you.

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate