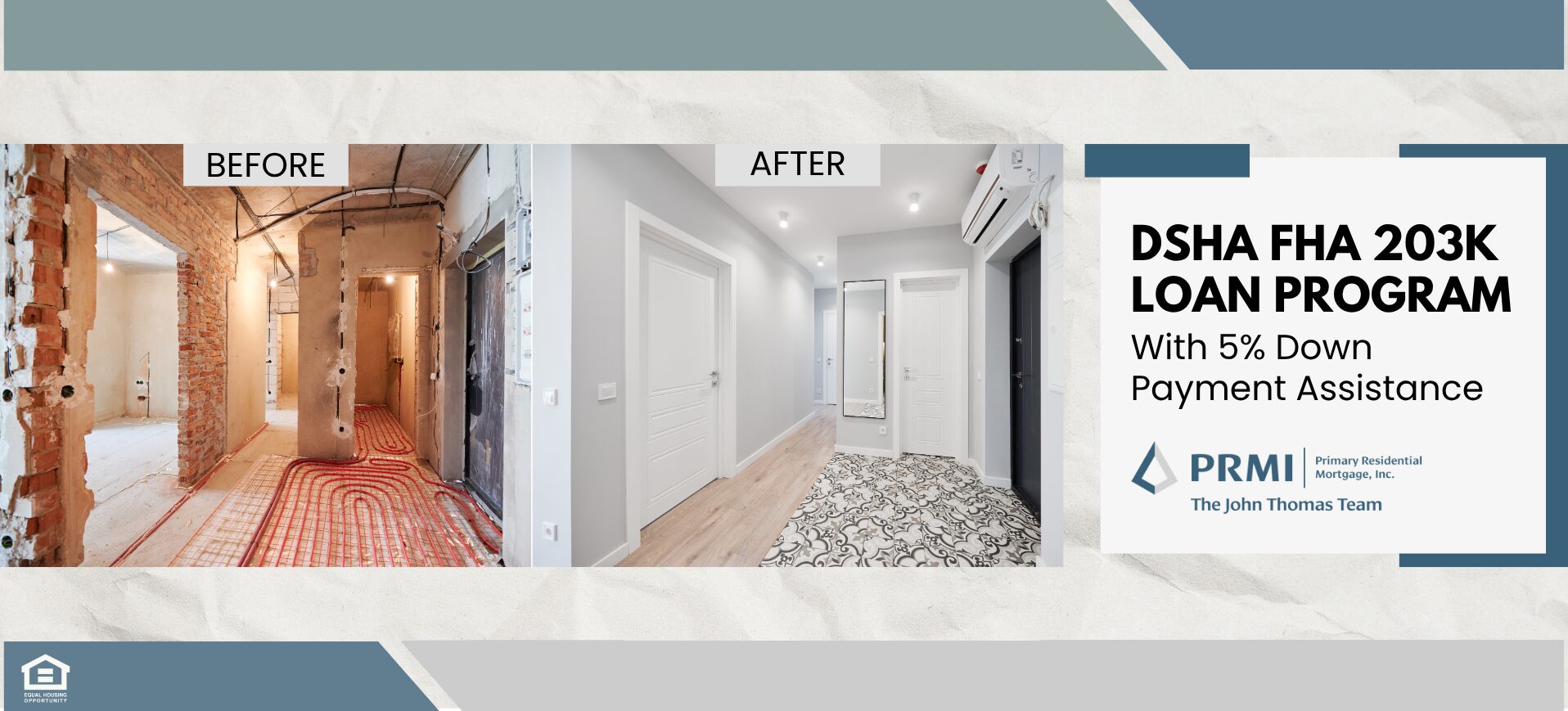

DSHA FHA 203k Loan Program: Renovate Your Home with 5% Down Payment Assistance

Are you buying a home in Delaware that needs repairs or updates but short cash to close? The DSHA FHA 203k Limited Loan Program is a powerful mortgage option that allows you to finance both the purchase and renovation of a primary residence—with help from the Delaware State Housing Authority’s (DSHA) 5% down payment and closing cost assistance to make your home purchase more affordable.

This is a top option for first-time homebuyers in Delaware looking to purchase and renovate with one streamlined loan and get a 5% DPA Program. Find out if you qualify today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What Is the DSHA FHA 203k Limited Loan Program?

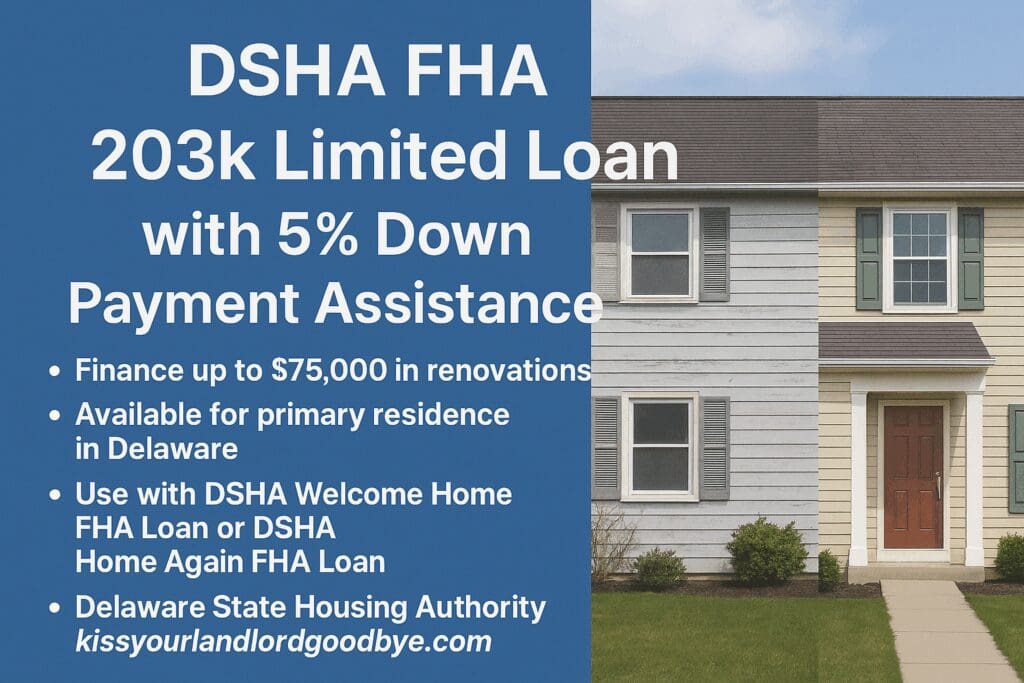

The FHA 203k Limited Loan (also known as the Streamline 203k) is a government-backed renovation loan that allows buyers to finance up to $75,000 in home repairs and improvements directly into their mortgage. When paired with DSHA’s down payment assistance programs, you can buy and improve a home with less out of pocket.

Key Features of the DSHA FHA 203k Loan Program:

- FHA 203k Limited loan version only

- Renovations capped at $75,000

- Must use either the DSHA Welcome Home FHA Loan or the DSHA Home Again FHA Loan

- Up to 5% Down Payment Assistance from DSHA

- For owner-occupied homes in Delaware only

- Available for primary residence purchases

- Minimum credit score requirement typically 640 or higher

- Income limits and purchase price limits may apply

This program is offered through the Delaware State Housing Authority in conjunction with a DSHA Approved Lender such as the John Thomas Team with Primary Residential Mortgage.

Who Is Eligible for the DSHA FHA 203k Limited Program?

This loan program is ideal for the following Delaware Home Buyers:

- First-time homebuyers in Delaware

- Repeat homebuyers in Delaware

- Buyers with limited cash for renovations and for down payment & closing costs

- Anyone purchasing a fixer-upper or outdated home that needs upgrades

- Buyers who qualify for the DSHA’s First State Home Loan Down payment assistance program

You must occupy the property as your primary residence and meet the credit, income and program guidelines set by DSHA.

What Renovations Are Allowed Under the FHA 203k Limited Loan?

The FHA 203k Limited loan is designed for non-structural improvements that enhance livability, safety, or cosmetic appeal.

Eligible projects include:

- Roof replacement or repairs

- Heating and air conditioning upgrades

- Flooring and carpeting

- Kitchen or bathroom updates

- New appliances

- Painting (interior and exterior)

- Energy-efficient improvements

- Accessibility upgrades

Luxury upgrades (like pools or hot tubs) and major structural changes are not allowed. All work must be completed by a licensed contractor approved through the lender process.

How the 5% Down Payment Assistance Works

When you use the DSHA FHA 203k Limited Loan, you must pair it with either the:

Both programs offer 5% of your total loan amount in down payment and closing cost assistance through the DSHA First State Home Loan DPA Program, provided as a second mortgage with 0% interest. There are no payments required and is termed a silent second mortgage. The loan only has to be repaid when you refinance or sell the home.

This assistance can be used to cover:

- FHA’s required 3.5% down payment

- Closing costs

- Prepaid taxes and insurance

Benefits of the DSHA FHA 203k Loan in Delaware

Here’s why Delaware homebuyers are taking advantage of this unique mortgage opportunity:

- Finance renovations into your mortgage with one loan

- Access up to $75,000 for upgrades and repairs

- Receive 5% in down payment and closing cost help

- Build instant equity by improving your home at purchase

- Buy homes that are overlooked due to repair needs

- Take advantage of affordable home prices in Delaware

Whether you’re a first-time buyer or just looking for more affordable options as repeat or move up buyer, this loan makes it possible to turn a fixer-upper into your dream home—without draining your savings.

Ready to Get Started Today with a DSHA FHA 203k Loan?

If you’re interested in purchasing a home in Delaware that needs a little work—and want to take advantage of DSHA’s down payment assistance—the FHA 203k Limited Loan may be the right fit. Get started today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

Want to know the current interest rates, you can find them on the DSHA Website at KissYourLandLordGoodBye.com

John R. Thomas NMLS 38783

FHA 203k Renovation Loan Expert

302-703-0727 Office

FAQ: DSHA FHA 203(k) Loan + Down Payment Assistance

Q1: What is the DSHA FHA 203(k) Limited Loan program?

A: It’s an FHA-backed renovation mortgage that lets you finance eligible repairs and improvements into your loan. When paired with DSHA down payment assistance, you can buy and renovate with less cash due at closing.

Q2: Who is eligible?

A: You must purchase in Delaware, occupy the home as your primary residence, meet DSHA income/purchase price limits and credit score requirements, and follow FHA/DSHA renovation rules (licensed contractors, eligible repairs).

Q3: How does DSHA down payment assistance (DPA) work with 203(k)?

A: DSHA offers a 5% DPA with deferred, 0%-interest second mortgage that can cover your FHA down payment, closing costs, and prepaids. It’s typically repaid when you sell, refinance, transfer title, or move out.

Q4: What renovations are allowed?

A: Non-structural items like roofing, HVAC, flooring, kitchens/baths, paint, windows, insulation, and accessibility upgrades. Luxury items and major structural changes are generally not eligible under the FHA 203k Limited version.

Q5: What credit, income, and other guidelines apply?

A: Standard FHA underwriting plus DSHA program limits (income, price caps) and minimum credit score. Homebuyer education is required if credit score is below 660.

Q6: What’s the process to apply?

A: Get pre-approved with a DSHA-participating lender such as John Thomas Team with Primary Residential Mortgage, submit contractor bids and renovation scope, complete appraisal/underwriting (as-is and after-improved values), close, and complete repairs with inspections and draw releases.

Q7: Benefits vs. considerations

A: Benefits: One loan for purchase + renovation, lower upfront cash via DPA, potential equity gains. Considerations: More documentation, contractor/bid oversight, possible timeline delays, DPA must be repaid upon certain events.

Q8: How much DPA can I get?

A: DSHA programs can offer assistance toward the required FHA down payment and closing costs; the exact amount is 5% of the Total Loan Amount.

Q9: When is the DPA repaid?

A: When you sell, refinance, transfer title, or no longer occupy the home as your primary residence.

Q10: Can repeat buyers qualify?

A: Some DSHA pathways allow repeat buyers if program eligibility is met (not all assistance is limited to first-time buyers) such as DSHA Home Again Program.

Q11: How do I get started?

A: Speak with a DSHA-approved FHA 203k lender such as John Thomas Team with Primary Residential Mortgage, confirm eligibility, gather documents, and price out your renovation plan with licensed contractors.