DSHA Advantage 4 Grant Down Payment Program

(DSHA Advantage 4 Grant NO LONGER AVAILABLE!!!)

The DSHA Advantage 4 Grant down payment assistance program is a grant of up to 4% of the first mortgage loan amount to be used for down payment and/or closing costs for Delaware home buyers that qualify for a DSHA first mortgage loan. The program was discontinued by DSHA in May of 2018 and replaced with the DSHA Preferred Plus Down Payment Program. The grant Does Not have to be paid back after closing on the home purchase and is only offered by a Delaware State Housing Authority approved mortgage lender. You can apply for the Advantage 4 Grant Program by calling 302-703-0727 or APPLY ONLINE

What are the qualifications for a DSHA Advantage 4 Grant?

In order to qualify for the Advantage 4 Grant you must meet the following requirements:

- Must be under the maximum household income limit of $97,900

- All applicants must have a 640 middle FICO credit score

- Must be purchasing the home as your primary residence

- The Maximum Total Debt to Income Ratio (DTI) is 45%

- Must use DSHA first mortgage loan to purchase the home

- Non-occupant co-borrowers are NOT allowed

The first mortgage loan with DSHA can be a FHA Loan, a VA Loan, a USDA Rural Housing Loan or a Conventional Mortgage Loan. You can also use the Mortgage Credit Certificate (MCC) Program along with the Advantage 4 Grant but must be under the lower income limits for the MCC Program.

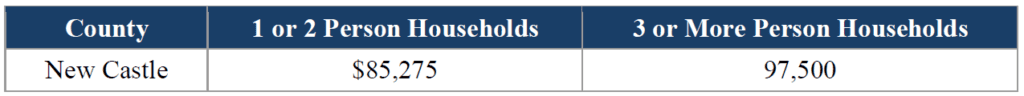

What are the maximum household income limits for Advantage 4 Grant Program?

The maximum household income limit for the advantage 4 grant is $97,900. Anybody that will be living in the property that has income will be added into the household income regardless whether or not they will be on the mortgage loan. For example if a married couple is purchasing a home and only the wife is going on the mortgage loan because the husband’s credit score is too low to qualify we must still verify the husband’s income for total household income.

For Example:

Wife Annual income – $55,000

Husband Annual income – 45,000

Even though the wife is the only one on the loan and her income is under the limit we must add the husband’s income so their total household income would be $100,000 which would be over the $97,900 limit and they would not qualify for the Advantage 4 Grant.

What are the terms of the DSHA Grant Down Payment Program?

The DSHA Advantage 4 Grant is essentially free money given to the borrowers at closing by the Delaware State Housing Authority and does not have to be paid back. The grant is up to 4% of the first mortgage loan amount so for example on a FHA purchase borrower 96.5% of the purchase price:

Purchase Price – $200,000

Base Loan amount – $193,000

Upfront MI Premium – $3,377 (financed into the loan)

Total Loan Amount – $196,377

Advantage 4 Grant – $7,755.08 (4% of the total loan amount)

*First lien interest rates maybe higher when using a DPA second or grant.

Where Can I Use the Advantage 4 Grant?

The Adv. 4 Grant Program from Delaware State Housing Authority can be used in all three counties of the state of Delaware which include New Castle County, Delaware; Kent County, Delaware; and Sussex County, Delaware. The only restriction is the maximum first mortgage loan amount cannot exceed the county limit for FHA Loan or $417,000 for VA Loan, USDA Rural Housing Loan, and a Conventional Loan. The interest rate for the first mortgage loan is set by DSHA and is the same no matter which DSHA approved mortgage lender that you choose to use.

How do I Apply for the Advantage 4 Grant Program? Keep Reading...