Delaware Down Payment Grants Bridge the Gap

For Delaware buyers that are having trouble stretching their savings for the required down payment for their desired mortgage, Delaware Down Payment Grants Down can be a life saver. The grants were designed to assist buyers who find themselves short of the down payment and usually don’t have to be repaid. This makes them an ideal helper to anyone looking to secure financing for their home buying journey.

It is definitely worth it to go through the sometimes tedious process to get approved for the grants – much of the money goes unclaimed. There are a few things you need to know about Delaware Down Payment Grants:

- The money awarded for Down payment assistance is allocated to Delaware via HUD.

- The main eligibility requirements include credit score and income, the price of the home, and the area the home is located.

- Applicants must be first-time buyers purchasing a primary residence.

- It is essential to understand the fine print – there are strict rules that could result in the money needing to be returned.

The John Thomas Team can help you determine if you’re eligible for a Delaware Down Payment Grant – contact us by calling 302-703-0727 or simply APPLY NOW.

Delaware Down Payment Assistance Programs Can Ease The Process for First Time Homebuyers

It’s no secret that first time home buyers face a number of issues, the biggest being down payment costs. Delaware Down Payment Assistance Programs can help create a more manageable experience on the home buyer journey. Programs like Delaware Down Payment Grants are designed to help eligible buyers create a bridge between their savings and the down payment costs for a mortgage.

It is important to understand the difference between a grant and a loan. Grants do not have to be paid back if the borrower meets the guidelines for the program. Loans have to be paid back at some point. Some loans may have a deferment period with no payments and some have no payments only have to be paid back when the home is sold or refinanced.

If you’re in the market for a home and struggling to find funds, it’s important to understand the information below to help you navigate Delaware down payment grants successfully.

Where Should You Look For Delaware Down Payment Grants?

Before you get started, it’s important to understand how these down payment grants work. The grants are not provided directly to individuals by the government. HUD allocates money to states instead, and from there states award the funds to qualified buyers. The process works like this in Delaware – all grants are awarded at the local level.

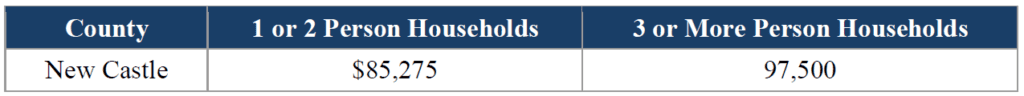

The Delaware Down Payment Assistance (DPA) program have different guidelines. The main program in Delaware has been the DSHA Advantage 4 Grant program which provides a grant of up to 4% of the mortgage loan amount. Programs can change and/or be discontinued to it is important to check with a mortgage lender to make sure which programs are currently available.

Are You Eligible for Delaware Down Payment Grants?

Although every grant and assistance program vary, here are some general qualifications that you may be expected to meet:

- You must be a first-time buyer purchasing a primary residence for most programs.

- Income limits apply for most programs

- There is usually a maximum home sales price, which depends on local housing costs.

- You will likely have to attend a homebuyer HUD approved counseling program. These courses help educate future homeowners about managing their financial responsibilities. For list of Delaware home buyer seminars click here: http://www.DelawareHomeBuyerSeminars.com

- Most times, the home must be located within certain geographic boundaries.

Delaware First-time Home Buyer Definition

What constitutes as a first-time home buyer in Delaware? There are a couple of exceptions in Delaware that you might not have thought about. A Delaware F

irst-Time Home Buyer Keep Reading...