Delaware Mortgage Rates Weekly Update for November 18, 2013

Delaware Mortgage Rates weekly mortgage market update for the Week of November 18, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates moved lower last week as mortgage bonds were able to rebound after the big sell-off in bonds from the October Jobs Report. If you look at the mortgage bond chart below you can see that mortgage bonds had a big red candle (big sell-off) on Friday, November 8th but have since been able to rebound each day last week to move mortgage interest rates lower each day. Interest rates ended the week almost where they before the sell-off on Friday the 8th. We are recommending FLOATING your Delaware mortgage rate to start the week to see if mortgage bonds can continue to climb higher and move home loan rates lower.

Federal Reserve Chairman Ben Bernanke will be stepping down at the end of 2013 and the new Federal Reserve Chairwoman will be Janet Yellen. Janet Yellen testified on Capitol Hill last week at her confirmation hearing and her statements were very bond friendly. Yellen said that the Feds Asset Purchase Program QE3 would continue as the economy is still running below its potential. This news helped rally the bond market last week as now it is expected the Federal Reserve will continue purchasing $85 Billion of mortgage bonds and treasuries a month at least till March 2014. This would help keep home loan rates at near record lows into 2014.

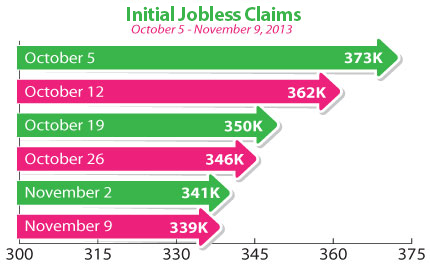

In Economic News, the Empire State Manufacturing Index Survey was reported at -2.21 which was much lower than expectations of 5.5. This is a very weak number and the employment component of the report was also very week. If we couple this with the Weekly Initial Jobless Claims which came out on Thursday at 339,000 claims, we see a very different picture of the labor market than in the October Jobs Report. This will support mortgage interest rates staying low as the economy limps along.

In the Local News, Delaware State Housing Authority released a new program for Delaware Teachers that are in the Delaware Talent Cooperative. The new program will provide eligible teachers a 0.5% reduction in the interest rate from the current DSHA interest rate for the program they choose to use. It can only be used with a DSHA loan program for first-time buyers or repeat buyers. See this article for more information: Delaware Talent Cooperative DSHA Home Buying Program

In the Local News, Delaware State Housing Authority released a new program for Delaware Teachers that are in the Delaware Talent Cooperative. The new program will provide eligible teachers a 0.5% reduction in the interest rate from the current DSHA interest rate for the program they choose to use. It can only be used with a DSHA loan program for first-time buyers or repeat buyers. See this article for more information: Delaware Talent Cooperative DSHA Home Buying Program

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, December 14, 2013, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

The next Dover Delaware Home Buyer Seminar is Saturday, January 11, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, December 7, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713