What Is A Delaware Manufactured Home Loan?

With housing prices being above several hundred thousand dollars, it can seem like a huge decision to buy a home. It’s a large investment – there’s a chance that it will take years to save up enough to afford a traditional home in Delaware. Manufactured homes are more affordable (typically) than homes that were built on site and are therefore more financially accessible. They also come in a variety of styles and options, giving homeowners a more traditional home feel for less. The John Thomas Team can help you navigate the Delaware Manufactured Home Loan process to secure a FHA, VA, USDA, Conventional, or a Chattel Loan all across all three counties: New Castle, Kent, & Sussex – give us a call at 302.703.0727 or Apply Online to get started.

New home shipments of manufactured homes have been increasing since 2011. Nearly 18 million Americans live in some sort of manufactured dwelling. Manufactured homes are built on chassis – think of a car and steel base with wheels and axles. All Manufactured homes today are built on HUD code. Once they reach a permanent location, the wheels, hitch, and axles come off. At that point the site is prepped, you’re connected to utilities, your home is removed from the chassis and is put on permanent foundation.

What is the Difference Between Mobile, Manufactured, and Modular Homes?

When discussing Delaware Manufactured Home Loans, it’s important to understand the three types. What many people think of as a “mobile home” is most likely a “manufactured home”. There are major differences in the home categories:

- Mobile homes are factory-built homes made before June 15, 1976. Since they were built before safety regulations were put in place by HUD, they aren’t usually approved for loans.

- Manufactured homes are factory-built homes that are built on a chassis. These homes are subject to the National Manufactured Housing Construction and Safety Standards Act of 1974 – they are required to meet safety standards set by the U.S. Department of Housing and Urban Development (HUD)that were put in place after June 15, 1976.

- Modular homes are similar to Manufactured homes but built to a different code (not HUD). They are never put on a chassis, are factory-built homes that are assembled on-site, and are typically permanently installed on a concrete foundation. They are basically a dwelling that is built in a factory, then joined together at the site on a permanent foundation in accordance with all state and local laws.

- Built to IRC Code

- Built in sections and put together at property site

- Tend to hold value and appreciate more than manufactured or mobile homes, so it’s easier to get loans for modular homes

A common misconception is that manufactured homes are in certain communities. Most buyers go out and buy land and place the home on that land. This makes Manufactured Homes a quite affordable option. Products like Fannie Mae Home Ready and Freddie Mac’s Home Possible have more flexible guidelines and reduced MI.

Very nice areas have manufactured homes – they are not always trailers.

What is Considered a Qualified Manufactured Home?

There are certain qualifications involved with the Delaware Manufactured Home Loan:

-

- One Unit Only – Can be Single Wide or Multi-Wide Homes

-

- Must be constructed after 6/15/76 (when HUD guidelines came in place for constructions of manufactured homes)

-

- Must have been attached to a permanent foundation in accordance with manufacturer’s requirements and Wheels & Tongue must be removed.

- Must have been attached to a permanent foundation in accordance with manufacturer’s requirements and Wheels & Tongue must be removed.

-

- Must be in compliance with state, local, and federal codes

-

- Must be permanently connected to utilities, a septic tank or sewer system

- Trucked in Water or Cistern Water is not acceptable

- Must be classified as Real Estate prior to the closing (Retired Title at Motor Vehicle)

Loan Programs for Delaware Manufactured Homes?

You can finance or refinance a single wide or multi-wide manufactured home through several government insured loan programs, conventional loan programs and some portfolio loan programs.

- FHA Manufactured Home Loans – As little as 3.5% down payment, allow for land + home financing. Will not finance on leased land. Can use Down Payment Assistance Programs.

- VA Manufactured Home Loans – 100% Financing available for eligible veterans and active duty service members.

- USDA Rural Development Manufactured Home Loans – 100% financing available for eligible rural properties and eligible borrowers under the income limit.

- Conventional Manufactured Home Loans – Fannie Mae and Freddie Mac allow for home loans on primary residence and second homes.

- Chattel Loans (Mobile Home Loan for Leased Land) – Ideal for mobile or manufactured homes on leased land or in mobile home parks (homes only, no land)

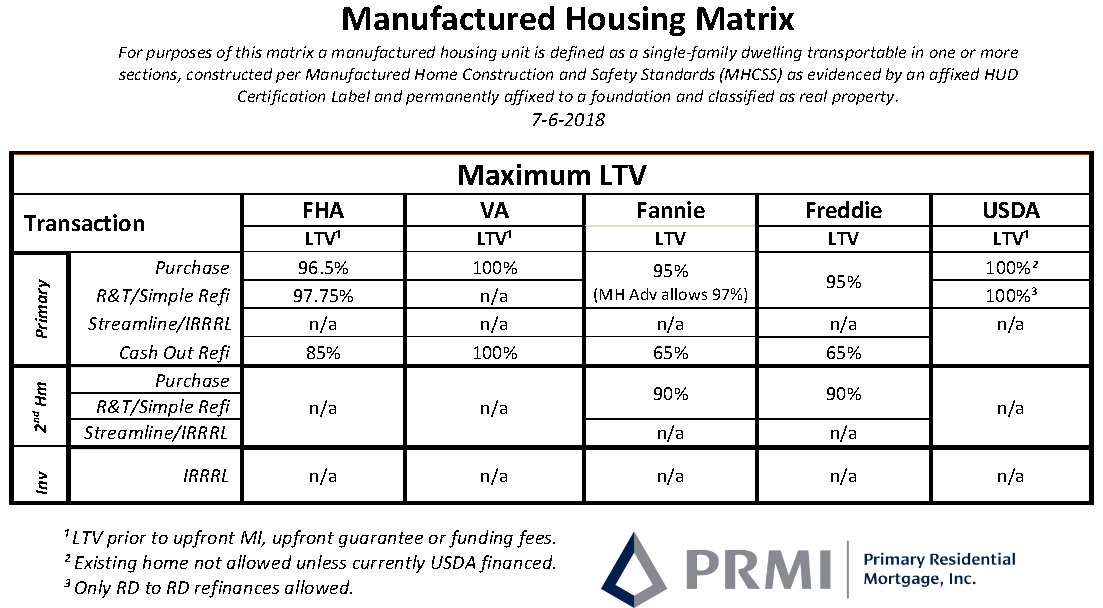

Delaware Manufactured Home Loans can be used with several government-backed loan programs, such as FHA, USDA and VA. Below is a matrix showing the maximum loan to value (LTV) for each loan type when apply for a Manufactured Home Loan.

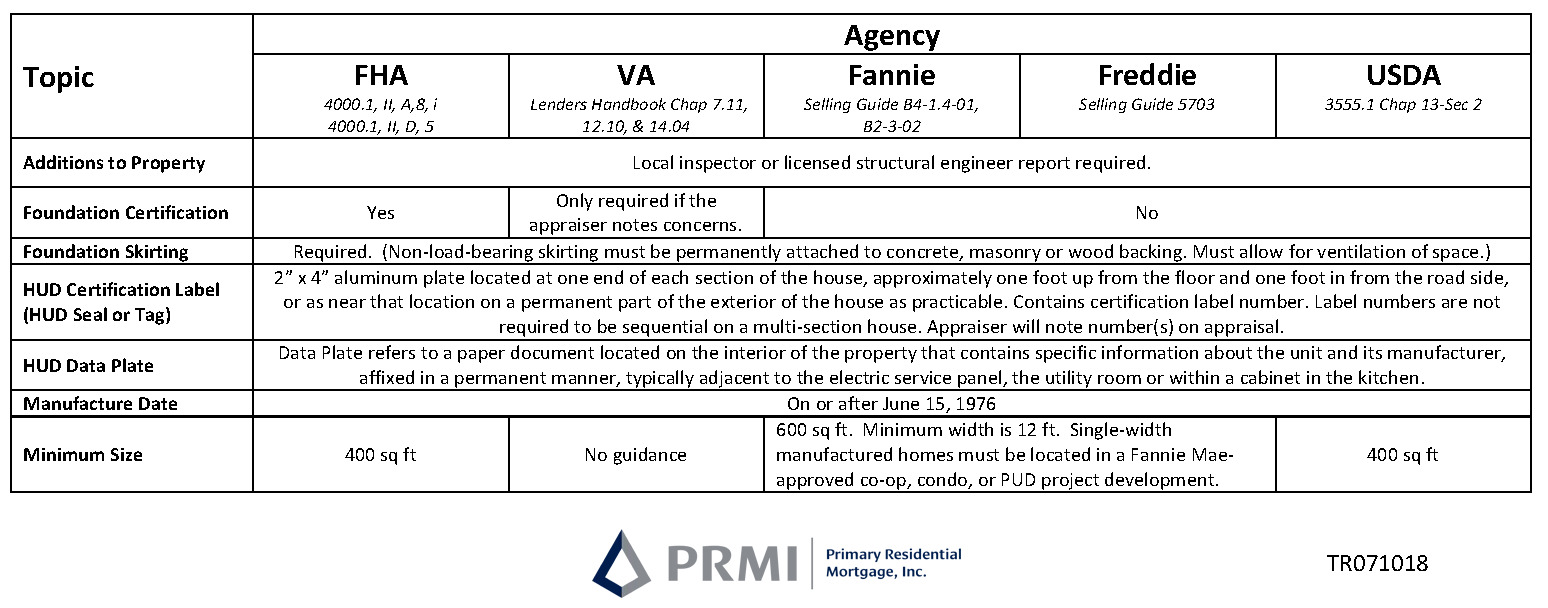

Below are the Guidelines for Manufactured Homes by Agency Guidelines per Loan Type:

What are the Legal Requirements for Delaware Manufactured Home Loans?

Your Manufactured home must have the HUD label and data plate evidence that proves the manufactured home was built to HUD code after the 1976 date. An appraisers will always take a picture of the HUD label and the data plate to include in the Appraisal Report.

HUD Tag – The HUD Certification Label is a metal plate that is affixed to the exterior of each transportable section of the Manufactured Home. The HUD Certification Number appears on each HUD Certification Label and evidences compliance with the Federal Manufactured Home Construction and Safety Standards.

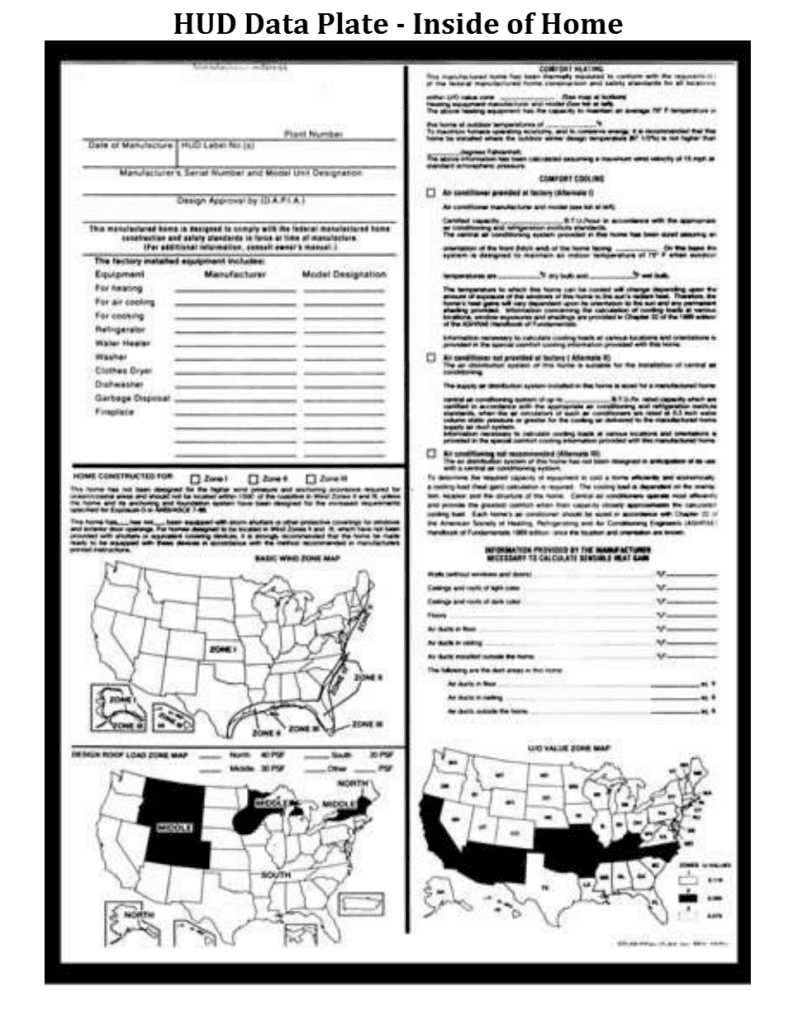

The HUD Tag label is a metal plate affixed to the exterior of the home and the HUD Data Plate is a paper label that is mounted inside the home that includes info such as:

-

- Manufacturer’s Name

-

- Year the Manufactured home was manufactured

-

- Serial Number and Model

-

- Wind and roof load zones

- Heating and Cooling Data

- HU Construction Zone

This ensures the home has the right specifications for the region.

HUD Data Plate – The HUD Data Plate / Compliance Certificate is a paper label mounted in the Manufactured Home that contains, among other things, the manufacture’s name, trade/model name, year manufactured and serial number, a list of the certification Label number(s), etc. The Data Plate is typically affixed in a readily accessible and visible location such as near the electrical panel or in a kitchen cabinet, or a bedroom.

Per 1976 HUD regulation, the HUD Data Plate form is to be affixed inside the home on or near the main electrical breaker box or other readily visible/accessible location and is printed on paper or foil stock 8 1/2″ x 11″ to 8 1/2″ x 14″ in size. Some manufactures will also use this form for modular homes.

A very important requirement to note: since manufactured homes are built on a chassis, manufactured homes are considered vehicles until closing. The manufactured home must be legally classified as real property and titled as such prior to the closing of the Delaware Manufactured Home loan.

The title will be reviewed to ensure it has been De-Titled:

-

- Vehicle title has been cancelled and is classified as a real property this is commonly called “DE-TITLING“

- Vehicle title has been cancelled and is classified as a real property this is commonly called “DE-TITLING“

-

- Title must clearly show that the home is an improvement to the land and will be treated as real property under applicable state laws

- ALTA Endorsements 7, 7.1, or 7.2 or other endorsement is in place allowing home to be treated as a real property

What if There are No HUD Data Plates and/or HUD Tags?

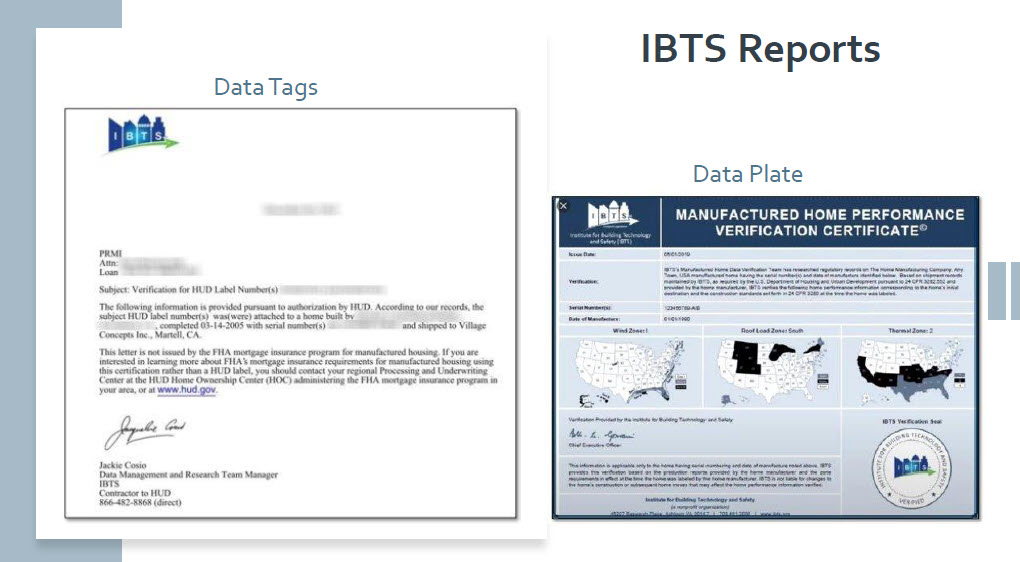

If the HUD Data Plate and/or HUD Tags have been removed from the Manufactured Home and they cannot be found then the Lender will be required to order a IBTS Report at the buyer’s expense.

The Following will require a Lender to Order a IBTS Report:

- If the Appraisal report is showing either or both HUD Data Plate and HUD Tag have been removed from the dwelling.

- If the HUD Tag and/or HUD Data Plate has been painted over or are illegible.

- HUD Tag and /or HUD Data Plate has been covered up and appraiser is unable to obtain a legible photo of them.

Below are Samples of what an IBTS Report Looks Like:

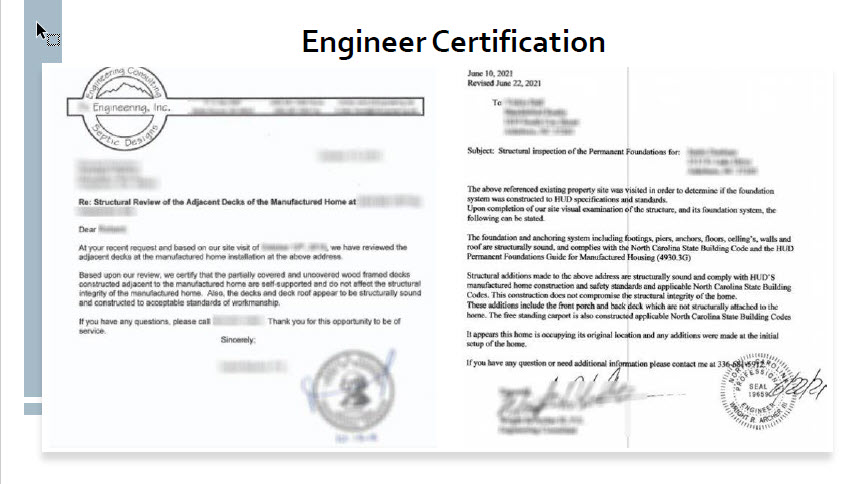

What is an Engineer’s Foundation Certification?

When financing a manufactured home a Engineer’s Foundation Certification is required that certifies the foundation meets certain criteria of structure stability. The Engineer’s certification specifies that the foundation complies with the HUD Permanent Foundation Guide for Manufactured Homes (PFGMH – HUD 7584), a requirement for all FHA-insured loans.

What Isn’t Allowed With Delaware Manufactured Home Loans?

Certain criteria will render a Manufactured Home ineligible for Real Estate financing:

-

- No investment properties for Traditional Loans such as FHA, VA, USDA, & Conventional. Must use a portfolio loan program.

-

- No Lease Hold (Will Need a Chattel Loan)

- No Lease Hold (Will Need a Chattel Loan)

-

- Renovation Lending is allowed with FHA manufactured homes only

-

- Second homes are available with Fannie Mae or Freddie Mac only or a Portfolio Loan Product.

-

- Is not eligible if it’s a property that was moved from it’s original site (was permanently affixed to a foundation and then moved to a new location – it’s fine if it is coming from a dealer) Except for VA Loans.

-

- No co-ops

- Cannot have Wheels or Tongue still affixed to the Manufactured Home.

- No cistern or trucked in water

Can I use a Down Payment Assistance Program to Purchase a Manufactured Home?

Yes, you can use a Down Payment Assistance Program to purchase a Manufactured Home. The guidelines are more restrictive in some cases. Below are options for DPAs:

Delaware State Housing Authority (DSHA) Down Payment Program requires a minimum of 660 middle credit score for all borrowers and must be a double wide through the DSHA First State Home Loan Program.

PRMI Empower Down Payment Assistance Program – requires a minimum 600 credit score and you can get up to 5% of the total Mortgage Loan toward down payment and closing costs.

PRMI Advantage DPA Grant Program – requires a 620 minimum credit score to get a 3.5% grant toward down payment.

Delaware Manufactured Home Lender

Primary Residential Mortgage is the leading Delaware Manufactured Home Lender providing mortgage loans for the purchase or refinance of a manufactured home. The John Thomas Team of Primary Residential Mortgage is well trained on the options available through FHA, VA, USDA and Conventional Loans to provide mortgage options for manufactured homes. If you are looking for a Manufactured home lender in Delaware then give John Thomas Loan Officer with Primary Residential Mortgage a call at 302-703-0727 today!

How do I Get Started With the Delaware Manufactured Home Loan?

There is a lot of information to sift through for Delaware Manufactured Home Loans. The John Thomas Team can help you cover all your basis and land the home of your dreams – give us a call at 302.703.0727 or APPLY ONLINE.

Frequently Asked Questions About Manufactured Home Loans

What is a Manufactured Home Loan?

A Manufactured Home Loan is a mortgage or financing option specifically designed for factory-built homes that meet federal HUD Code construction standards. These homes are built in a controlled environment, transported to a site, and installed on either owned or leased land. Depending on whether the home is classified as real property or personal property, different loan options may apply.

What’s the difference between a Manufactured Home and a Mobile Home?

While both are built off-site and transported to their location, the main difference is when they were built. Mobile homes were built before June 15, 1976, when HUD standards were introduced. Manufactured homes were built after that date, under strict HUD construction, safety, and energy-efficiency guidelines. Because of this, most lenders only offer financing on manufactured homes, not older mobile homes.

Can I use a regular mortgage to buy a manufactured home?

Yes, in some cases — but only if the home is considered real property, meaning it’s permanently affixed to land that you own and has a recorded title as real estate. In that scenario, you may qualify for traditional financing options like FHA, VA, USDA, or Conventional loans. If the home is on leased land, it will likely require a Chattel Loan, which treats the home as personal property instead.

What are the main types of Manufactured Home Loans?

Manufactured homes can be financed through several loan types, depending on your situation:

• FHA Title I or Title II Loans: Government-insured loans for buyers with limited down payments.

• VA Loans: For eligible veterans purchasing manufactured homes on owned land.

• USDA Loans: For rural buyers meeting income and location requirements.

• Conventional Loans (Fannie Mae & Freddie Mac): For permanently installed homes on owned land.

• Chattel Loans: For homes on leased land or in mobile home communities.

Do I need to own the land to get a Manufactured Home Loan?

Not always. If you own the land, you may qualify for traditional mortgage financing. If you lease the land, you can use a Chattel Loan, which finances only the home itself.

What are the credit score requirements?

Credit requirements depend on the loan type and lender:

• FHA Loans: As low as 580 with 3.5% down.

• VA Loans: Has no required minimum credit score

• Conventional Loans: Usually 620 or higher with stronger credit history.

• Chattel Loans: 550 minimum score

How much is required for a down payment?

• FHA Loans: As little as 3.5% down.

• VA Loans: 0% down for eligible veterans.

• USDA Loans: 0% down for eligible rural buyers.

• Conventional Loans: Typically 5%–10% down.

• Chattel Loans: Usually 5%–20% down, depending on credit and lender.

Can I get a loan for a manufactured home that’s been previously owned?

Yes, many lenders will finance used manufactured homes as long as they meet HUD standards, have a HUD data plate and certification label, and are in good condition. Appraisals and inspections are usually required.

What are the loan term lengths for Manufactured Home Loans?

• Traditional mortgages: Up to 30 years.

• Chattel loans: Typically Up to 25 years.

• FHA Title I: Maximum term of 20 years for a single-wide or 25 years for a double-wide.

Can I refinance a Manufactured Home Loan later?

Yes. Homeowners can refinance to lower their interest rate, shorten their term, or even convert from a chattel loan to a real-property mortgage once the home is permanently affixed to land they own.

Are manufactured homes eligible for government-backed loans?

Absolutely. FHA, VA, and USDA all have loan programs designed specifically for manufactured housing — as long as the property meets HUD, foundation, and site installation standards. These programs often include flexible credit requirements and low down payment options.

What documentation is needed to apply?

You’ll generally need:

• Proof of income (pay stubs, W-2s, tax returns)

• Photo ID and Social Security number

• Bank statements and asset documentation

• Home purchase agreement or bill of sale

• Title information and site details (land ownership or lease)

Are interest rates higher for Manufactured Home Loans?

Rates can be slightly higher than for site-built homes, especially for Chattel Loans, since they’re considered personal property and carry more risk to lenders. However, government-backed programs like FHA, VA, and USDA often offer competitive rates close to traditional mortgages.

What if my manufactured home is in a park or leased community?

You can still finance your home using a Chattel Loan, which doesn’t require land ownership. The lender will review your lease terms, verify the park’s compliance with HUD and local standards, and ensure your lease term covers the loan duration.

Can I use down payment assistance with a Manufactured Home Loan?

Yes — many state and local programs allow down payment assistance for eligible manufactured home buyers, especially for first-time homeowners. DSHA Allows with a minimum 660 Score.

What happens if I sell my manufactured home before the loan is paid off?

If you sell the home, the loan must be paid in full at closing.