Mortgage Rates Weekly Update [December 24 2018]

Mortgage Rates Weekly Update for December 24, 2018

Mortgage Rates Update for December 24, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

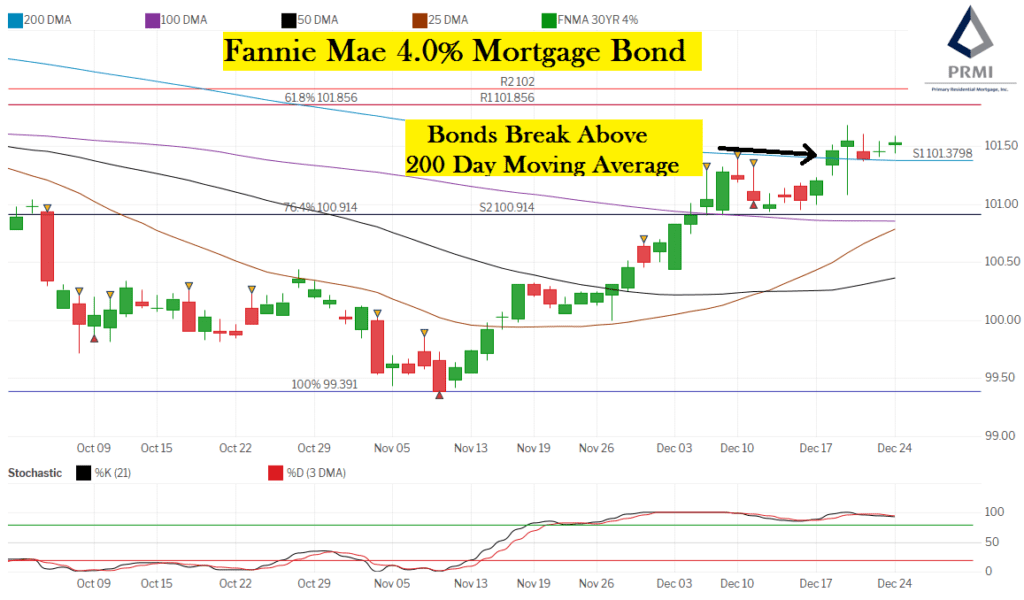

Mortgage Rates have move to the lows not seen since the spring of 2018 as bonds have benefited from a sell off in the stock market. If you look at the mortgage bond chart below, you can see bonds broke through the 200 day moving average last Tuesday which was a very significant ceiling of resistance. Bonds stayed above the 200 day moving average all week so it is now a very good floor of support for bonds. Monday stocks are expected to continue to sell off as a relief rally has not been evident and a strong floor of support for stocks is still lower. We are recommending FLOATING Your mortgage rate into holiday as bonds should benefit from a continued sell off in stocks, If stocks find a floor of support and mount a rally we quickly switch to locking your mortgage rate.

In Economic News

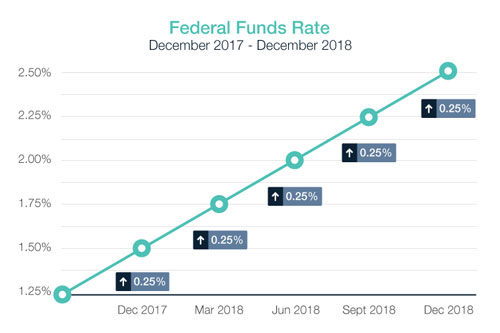

The Federal Reserve raised the Federal Funds Rate by 0.25% last week as was widely expected to 2.50%. After the statement, the stock market sold off sharply because the market was hoping for a more dovish statement from the Feds which they did not get. The market was hoping for zero rate hikes to be announced for 2019. Instead the Feds reduced the rate hikes from three next year to two hikes. The Feds made no mention of slowing the pace at which they are reducing their balance sheet of of US Treasuries and Mortgage Bonds. 2019 is going to be one of the largest issuance of Treasuries and Bonds by the government which means that there will be a huge supply of Bonds and Treasuries hitting the market. Since the Feds are no longer purchasing Treasuries and Bonds, it makes sense to predict mortgage rates will be pressured higher in 2019.

Personal Consumption Expenditure for November 2018 fell from 2.0% to 1.8% on a year over year basis which shows that inflation at the consumer level is cooling and is now below the Feds benchmark of 2%. The drop was due to lower oil prices.

The final Reading of Gross Domestic Product for Third Quarter of 2018 came in at 3.4%, which was lower than the second reading of 3.% and lower than expectations of 3.5%. The GDP measures the broad economic activity of a country and 3% or higher is a good reading on GDP.

Weekly Initial Jobless Claims were released on Thursday and claims increased 8,000 claims to 214,000 claims for the week. This is the sample week to be used in the December 2018 Jobs Report which comes out on Friday January 4th. This is a solid indicator of a good jobs report for December.

In Housing News

Housing Starts for November 2018 rose 3.2% from October to an annualized basis of 1.256 million units. Housing starts measures the number of new homes builders have started constructing. If we dig into the report, all the gains were in multi-family starts as single family construction starts fell by 40,000. Building Permits for November 2018 rose by 5% to 1.328 million units on an annualized basis. Building permits is a sign of future construction and if we dig into the report, it doesn’t look as good for housing market as the gains in building permits were from multi-family permits. Single family housing drives the housing market. The increase in multi-family permits shows there is strong demand for rentals.

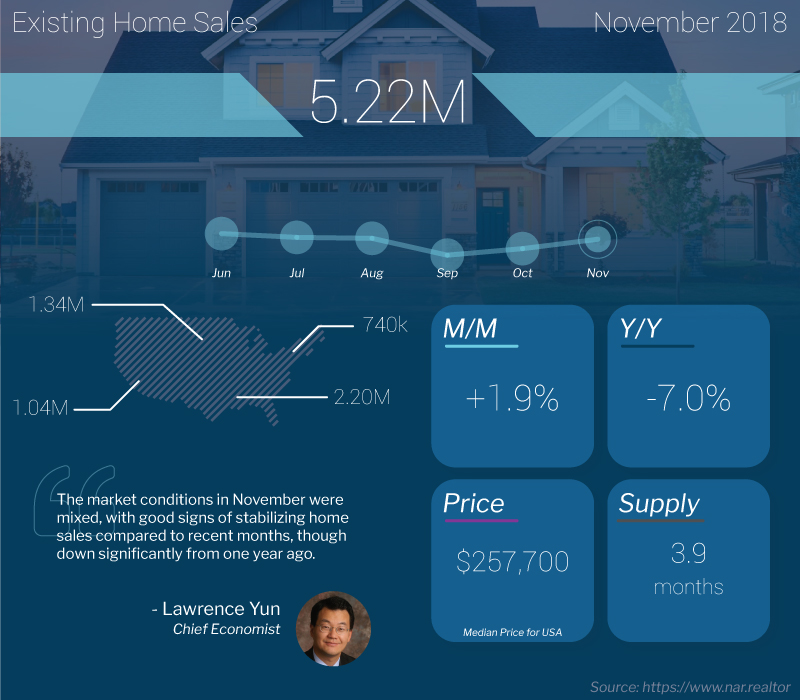

Existing Homes Sales for November 2018 were up 1.9% from October to 5.22 Million units on an annualized basis. This was the second increase in the last 6 months but sales are still down 7% year over year. Inventory of existing homes for sale increased 4.2% year over year but total inventory actually decreased from 1.85 million units last month to only 1.74 million units for November. The supply dropped from a 4.3 month supply to only a 3.9 month supply of homes. The low inventory is still affecting the housing market as there are still more buyers than there are homes for sale. The median home price of an existing home was $257,700 which is up 4.2% year over year. First time home buyers increased from 31% to 33% as cash investors decreased from 23% to 21%.

FHA Loan Limits for 2019

The Federal Housing Authority announced the increase of FHA loan limits effective January 1, 2019 by almost 7%. You can view the new FHA Loan limits in any state at the following website: https://entp.hud.gov/idapp/html/hicostlook.cfm The Delaware FHA loan limits for Delaware are going up in all three counties. Below are the new loan limits for Delaware for one unit properties:

New Castle County Delaware – $402,500

Kent County Delaware – $314,827

Sussex County Delaware – $336,950

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday January 12, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday January , 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday January 19, 2019 in Edgemore, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam