Mortgage Rates Weekly Update [November 26 2018]

Mortgage Rates Weekly Update for November 26, 2018

Mortgage Rates Update for November 26, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

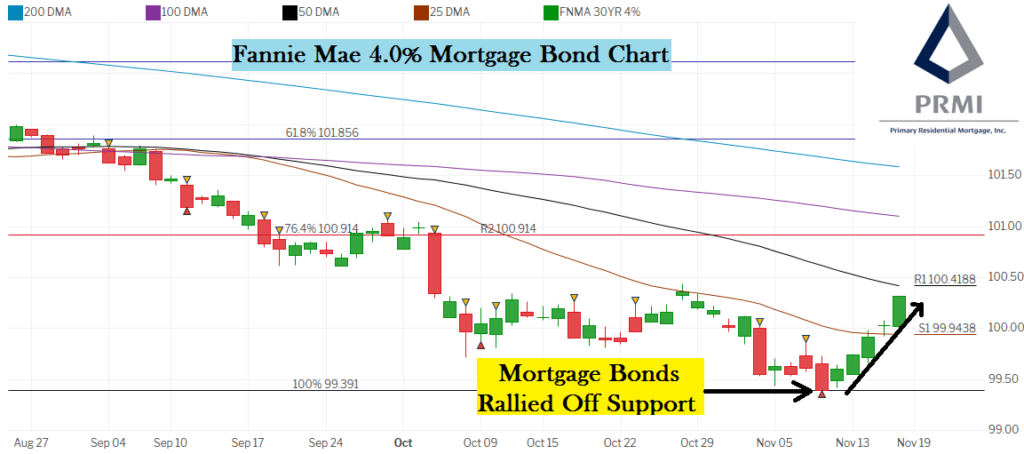

Mortgage Rates have rebounded since hitting a 7 year high in November, helped by a sell off in the stock market which continued on Friday. If you look at the Fannie Mae 4.0% Mortgage Bond Chart below you can see mortgage bonds have been trapped in a tight trading range this past week between the 25 day moving average (Support) and the 50 Day Moving Average (Resistance). If bonds can break above the 50 day moving average they have some room to move higher which would move mortgage interest rates lower. When we looking at the trading technicals there has been an overbought sign on the stochastic chart and if we see a negative crossover confirm it could mean a selloff in mortgage bonds which would move mortgage interest rates higher. We are recommending CAREFULLY FLOATING Your Mortgage Rate to start the week to see if bonds can break above the 50 day moving average but if we see bonds test the 25 day moving average or we see a crossover on the Stochastic chart, we would quickly switch to a locking stance.

In Economic News

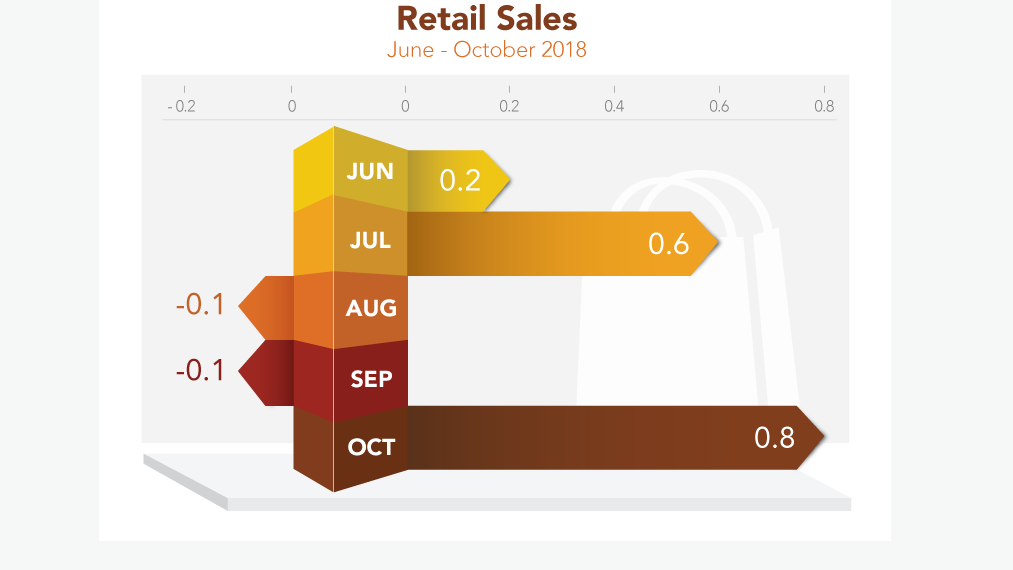

Retail Sales for October 2018 jumped 0.8 percent which was well above the 0.5 percent expected. This was a very nice rebound from a 0.1 percent decline in September.This was the largest increase in retail sales since May and it a great way to start the holiday shopping season. Retail Sales measure consumer spending which accounts for two-thirds of the U.S. economic activity.

Weekly Initial Jobless Claims were released on Thursday and claims increased to 224,000 claims for the week and was higher than estimates but is still a very low number. This is the “sample week” to be used in the Jobs Report for November 2018 so this points to a strong jobs report.

In Housing News

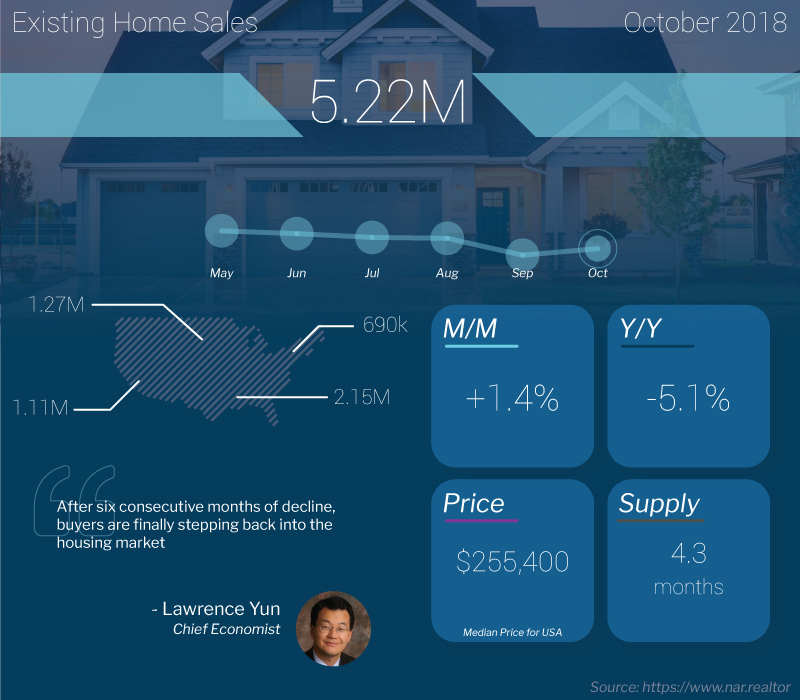

Existing Home Sales for October 2018 were up 1.4% from September to 5.22 Million Units on an annualized basis. This was the first increase in existing home sales seen in 6 months. Year over year existing home sales are down 5.1%. The median home price of an existing sale was up 3.8% year over year at $255,400. The supply of homes for sale increased 2.8% year over year and the total months of properties for sale was 4.3 month supply and a 6 month supply is considered healthy.

Housing Starts for October 2018 were up 1.5% to 1.228 million units on an annualized basis which is the number of new homes that builders started constructing. Building Permits for October 2018 dropped 0.5% to 1.263 Million units on an annualized basis. Permits are down 6% year over year which shows a slowing in new home construction.

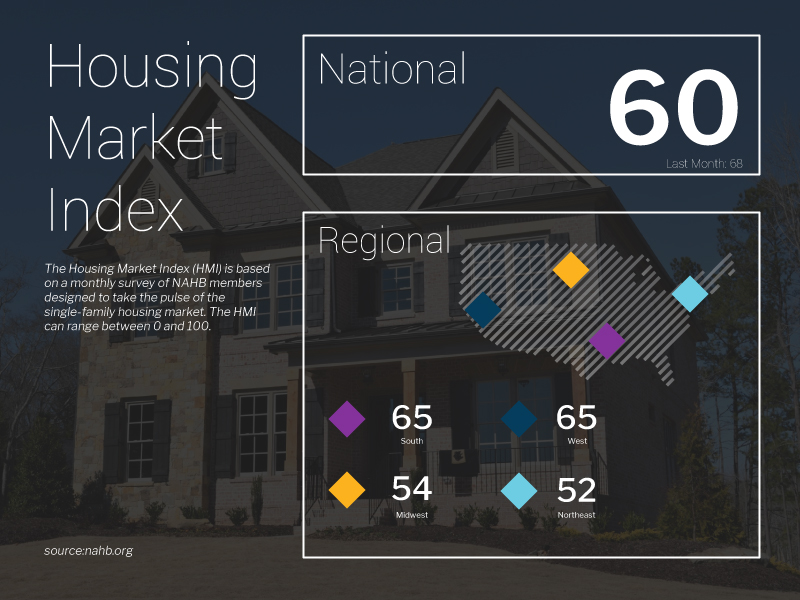

The National Association of Home Builders (NAHB) Housing Market Index for October 2018 dropped 8 points from 68 to 60. This is a reading on builder confidence in the new home construction market. Buyer Traffic at new home sites dropped 8 points which shows a slight contraction in the new home market. Builders sight concerns of rising interest rates and rising home prices for the slow down.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday December 15, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday November 28, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday November 17, 2018 in Edgewood, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam