Mortgage Rates Weekly Update [November 13 2017]

Mortgage Rates Weekly Update for November 13, 2017

Mortgage Rates Update for November 13, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds sold off and broke below support. If you look at the mortgage bond chart below you can see mortgage bonds had been rallying higher and broke above resistance on previous Friday and were able to close above resistance Monday and Tuesday of last week but on Wednesday mortgage bonds broke below support and followed through on Thursday selling off to end the day even lower and Gapped down on Friday below the next floor of support. US Treasuries closed above an important level at a yield of 2.385% which is not a good technical signal for mortgage bonds so we are recommending LOCKING your mortgage rate to start the week.

In Economic News

Oil Prices rose to a two year high after tensions in the Middle East as Saudi Arabia struggles with corruption break down and the new prince trying to switch economy from Oil based economy to an Industrial based economy.

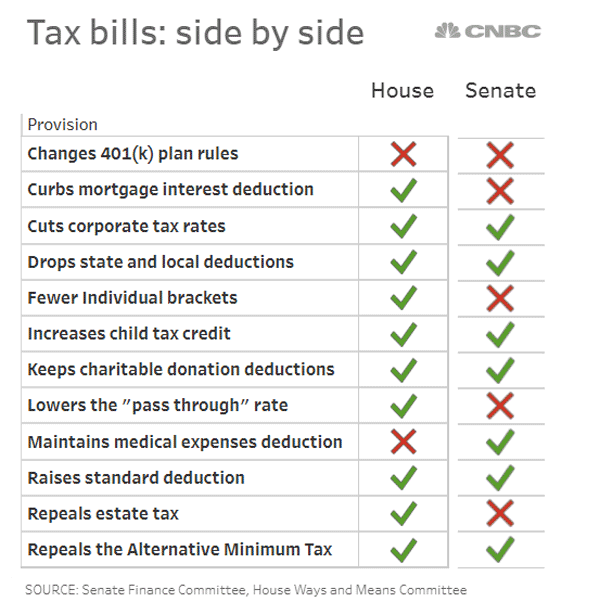

Washington is debating a tax reform with two competing bills, one in the Senate and one in the House of Representatives. Below is a chart showing a quick summary of the two plans:

Consumer Sentiment for November 2017 was released on Friday and it dropped from 100.7 to 97.8 which was below expectations of 100.7. This is still a good number as it is the second highest number since January. Consumer Sentiment measures how consumers feel about their financial situation and the economy.

Weekly Initial Jobless Claims were released on Thursday and were reported at 239,000 claims which was an increase of 10,000 claims from previous week.

In Housing News

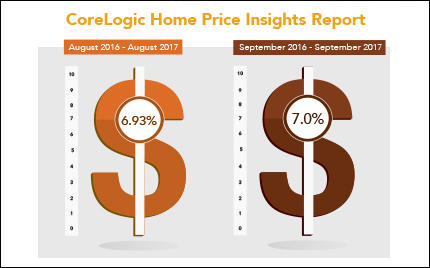

CoreLogic Home Price Index for September 2017 showed home prices were up 0.7% from August 2017 to September 2017. Home Prices are up 7.0% from September 2016. CoreLogic is predicting a 4.7% home price increase in 2018 which means home prices will continue to rise.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Wednesday November 15, 2017 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday November 18, 2017 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday December 9, 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages