DE Mortgage Rates Weekly Update 10-17-2016

DE Mortgage Rates Weekly Update October 17, 2016

DE Mortgage Rates weekly update for the Week of October 17, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

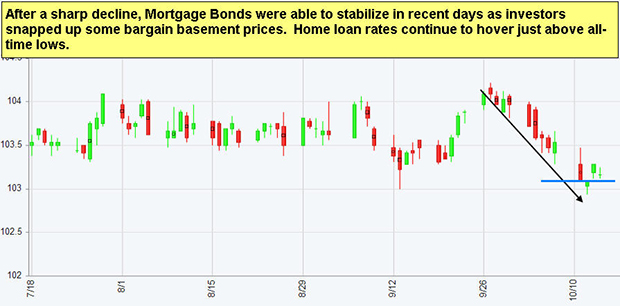

Mortgage Rates moved higher again last week as mortgage bonds continued to sell of as investors took profits. If you look at the mortgage bond chart below you can see mortgage bonds ended the week lower and closed below the 100 day moving average. There is still room to the downside for mortgage bonds before they hit a floor of support at the 200 day moving average so we are going to recommend starting the week LOCKING your DE mortgage rate as mortgage interest rates will probably continue to move higher in the short term.

In Economic News:

The September Federal Open Market Committee meeting minutes were released and revealed the Fed’s are leaning toward a hike in the Fed Funds Rate by the end of the year which would probably come at the December 2016 meeting. The markets did not react favorably to the news with stocks and bonds selling off. The sell off in the bond market caused mortgage interest rates to move higher and has set the trend for rates to continue to move higher till the end of the year. This means now is the time to buy or refinance so give us a call at (302) 703-0737 to get pre-approved or you can APPLY ONLINE

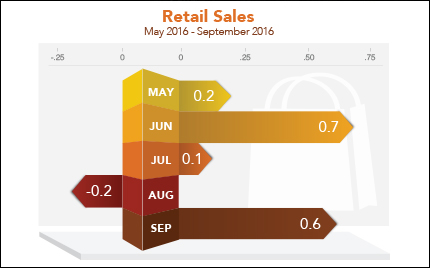

Retail Sales for September 2016 were released last week and Sales jumped higher by 0.6 percent. This shows consumers are spending money as we head into the holiday season. This is a good report on the surface after very disappointing August Retail sales which were -0.2%. The Retail Sales for September were led by increased sales of autos and increased costs in gasoline spending as the price of gas has increased. If we look at the Core Retail Sales which strips out Automobile sales, Gasoline, and building materials we only see a 0.1% increase which is not good and is probably signaling a low GDP report for 3rd quarter.

The Producer Pricer Index (PPI) for September 2016 rose by 0.3 percent and is now up 0.7 percent for the year. The PPI measures inflation at the wholesale level which has been tame but if it it heats up it could be bad for DE mortgage rates.

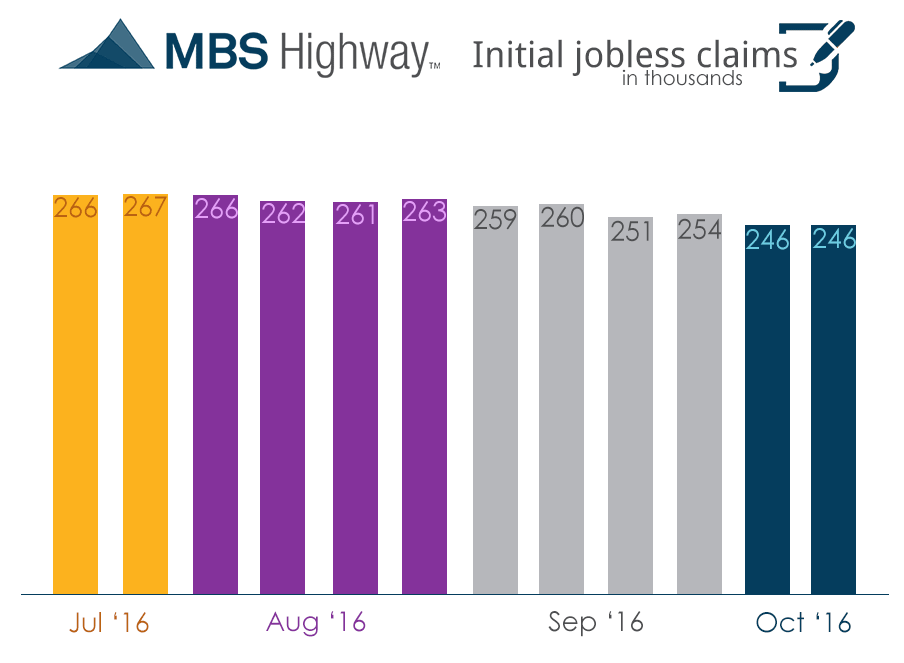

Weekly Initial Jobless Claims were released on Thursday and came out at 246,000 claims which is the best number since November 1973! Last week’s claims which was 249,000 was revised lower to 246,000 claims. This week’s Jobless claims will be the sample week for the October Jobs report which would look to be a very good report.

In Housing News:

CoreLogic released its National Foreclosure Report for September 2016 which showed only 351,000 homes in some form of foreclosure which is down from September 2015 which was 449,000 homes. This was an improvement of 30%. In 2011, there were 1.5 Million homes in some form of foreclosure so we have come a long way in the housing market. The number of bank owned properties is now a very much percentage of homes for sale in the current inventory and many require repairs to be done that the banks won’t fix. The best way to purchase these properties is with a FHA 203k Renovation Loan or a Fannie Mae Homestyle Renovation Loan.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate

#DEMortgageRates