Mortgage Rates Update for Jan 11 2016

Mortgage Rates Update Weekly Jan 11 2016

Mortgage Rates update weekly for the Week of January 11, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move lower last week as the Major Stock Market Indexes have had their worst start to begin a new year on record. If you look at the mortgage bond chart below, you can see mortgage bonds rallied higher last week with the green candles on the chart. The bond closed above the 200 day moving average which had been a strong overhead resistance so we are recommending FLOATING your mortgage rate to start the week to see if bonds can continue to rally.

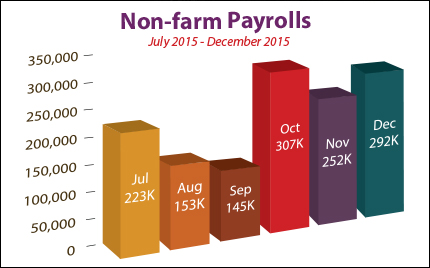

In Economic News, the Jobs Report for December 2015 was released on Friday and it showed the US economy added 290,000 jobs in December which was well above expectations of 200,000 jobs. 2015 marked the fifth straight year that we had 2 million job growth. The wage growth for 2015 was 2.5 percent and the Unemployment Rate remained steady at 5% which is a 7 year low. If we dig into the report, 40% of the jobs created were for 16-19 year olds which more than likely are mostly temporary jobs and/or not high pay jobs.

Last week we saw the major stock markets sell off in response to China’s economic struggles and the price of Oil continuing to drop. China halted trading several times last week on its stock market as the market dropped 7 percent. We also saw news that North Korea might have tested a Hydrogen Bomb which is even more powerful than an atomic bomb.

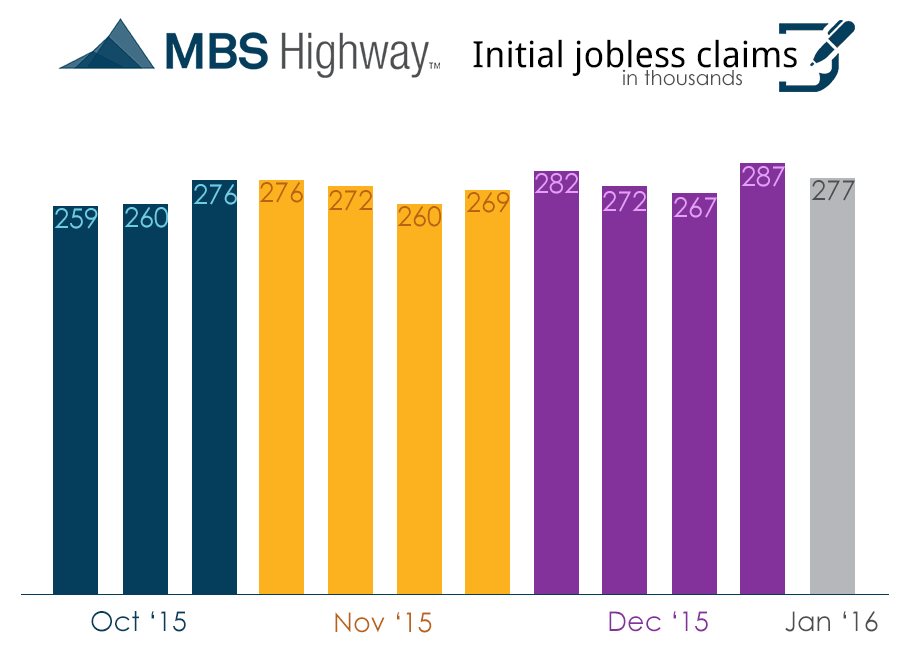

Thursday we saw the Weekly Initial Jobless Claims released and they dropped 10k claims to 277,000 for the week. This marks the 44th straight week of below 300,000 claims.

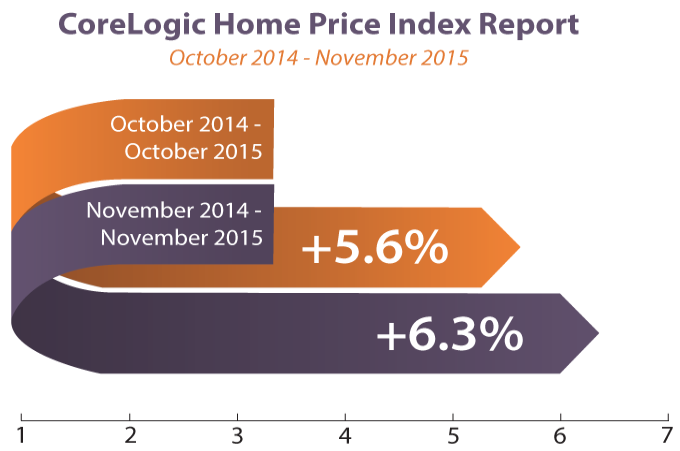

In Housing News, CoreLogic released its Home Price Index for November 2015 which showed a 0.5% increase in home prices from October to November and a 6.3% increase from November 2014 to November 2015. CoreLogic is predicting a 5.4% increase home prices from November 2015 to November 2016.

The Federal Budget for 2016 that passed included the renewal of the $1,000 to $2,000 Tax Credit for Energy Efficient New Homes. The bill made the credit retroactive for 2015 and extended through 12/31/2016. If you bought a new construction home or are planning on buying one, find out if you qualify for the new home energy efficient tax credit! If you have questions call us at 302-703-0727

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 16, 2016 in Newark, Delaware.

The next Dover Delaware Home Buyer Seminar is Saturday January 30, 2016 in Dover, Delaware

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com