Mortgage Rates Weekly Update Dec 21 2015

Mortgage Rates Weekly Update Dec 21 2015

Mortgage Rates weekly market update for the Week of December 21, 2015 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

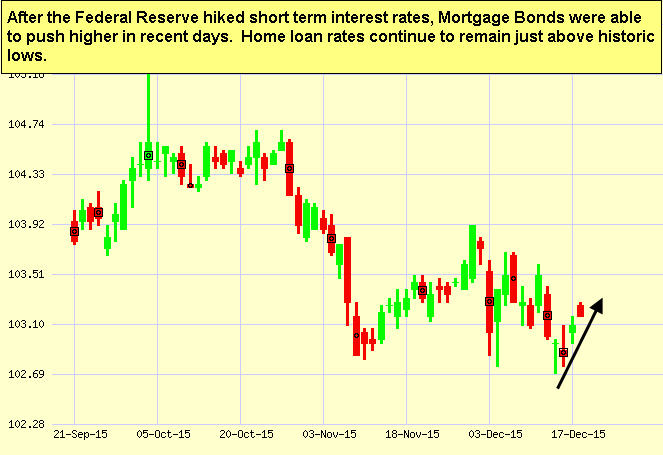

Mortgage Rates were able to move lower after several weeks of moving up. If you look at the mortgage bond chart below you can see bonds were finally able to bounce off a floor of support and move higher after several weeks of trending lower. The short term trend is for bonds to move higher and interest rates lower but bonds are up against a tough over head ceiling of resistance so in order to continue to move higher will need to break through and close above ceiling of resistance. With the short term trend of bonds to move higher, we are recommending FLOATING your mortgage interest rate to start the week. But if bonds get turned lower at overhead resistance, we will quickly recommend switching to a locking stance.

In Economic News, the Federal Reserve Open Market Committee met last week and agreed to raise the Fed Funds Rate by 0.25% which ended a 7 year period of the benchmark rate remaining near zero percent. This Fed Funds Rate is a short term interest rate which is charged between banks when they lend each other money.

The Feds believe the economy has made considerable progress since the United States was hit by the worst recession since the Great Depression. The decision to increase the Fed Funds Rate also supports their belief that the economy will continue to strengthen.

What does the Fed Raising the rate mean for you? It doesn’t directly affect the long term mortgage rates and most times has the opposite effect in the short term, mortgage rates can move lower. The direct affect is on Credit Card Interest Rates, Auto Loan Interest Rates, HELOC Rates and Business Loan Interest Rates.

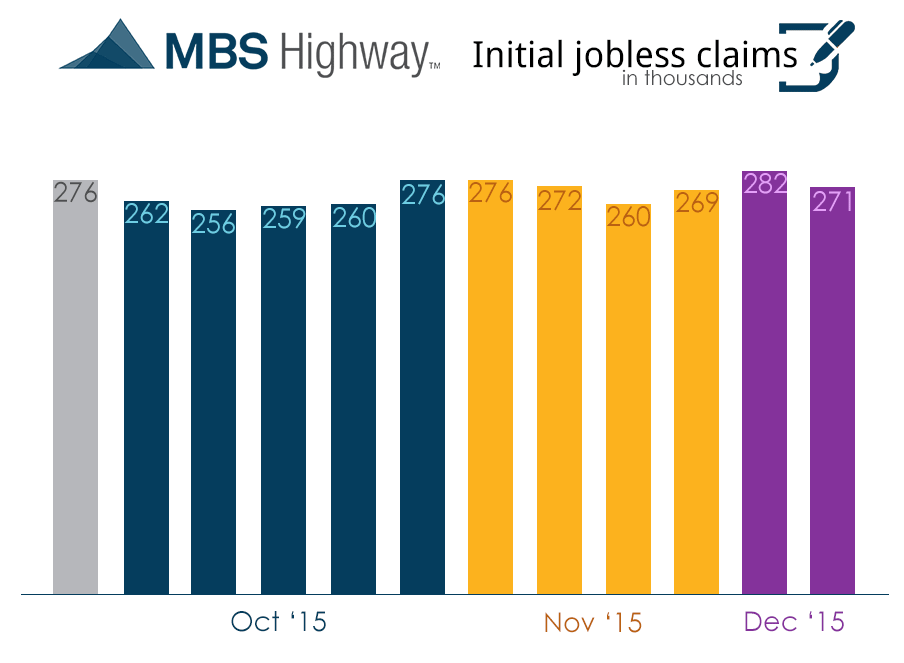

Weekly Initial Jobless Claims were reported on Thursday at 271,000 claims which is a drop of 11,000 from the previous week of 282,000 claims. Initial jobless claims remain below the 300,000 claim mark which is a very good sign for the labor market.

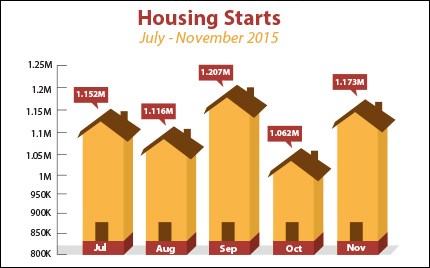

In Housing News, November 2015 Housing Starts rose 10.2 percent from October 2015 to November 2015 to 1.173 Million units on annualized basis. This rise nearly completely wiped out the 12 percent drop in housing starts we saw from September to October. The single family home starts were up to the highest level since January 2008. Housing Starts measures the number of new construction homes started building in the month of November.

November 2015 Building Permits were also up, up 11% from October to 1.289 million units which is better than expectations. Building Permits is a measure of future construction as it measures the permits applied for to build new homes. This is a sign that new home construction continues to be very strong.

FHA Loan Limits 2016 announced December 9, 2015 by Federal Housing Authority with the release of Mortgagee Letter 2015-30.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 16, 2016 in Newark, Delaware.

The next Dover Delaware Home Buyer Seminar is Saturday January 30, 2016 in Dover, Delaware

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com