Mortgage Rates Weekly Update for Dec 14 2015

Mortgage Rates Weekly Update for Dec 14, 2015

Mortgage Rates weekly market update for the Week of December 14, 2015 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates have been moving up and down by about 0.25% over the last couple weeks as bonds have traded in a choppy fashion. If you look at the mortgage bond chart below, you can see the up and down black arrows following the changing short term trend of the bond going up and down. We ended the week with mortgage bonds once again bouncing off support and starting to reverse a downward trend and moving higher with the green candle on Friday. Therefore we are recommending FLOATING your mortgage rate to start the week.

In Economic News, the Stock Market Sold off in the worst week of trading this year last week because of the price of Oil falling to a 7 year low on excess supply and because of the Chinese Yuan fell to its lowest level against the Dollar in 4.5 years on concern of an economic slow down in China and because of expectations of a Rate Hike from the Federal Reserve.

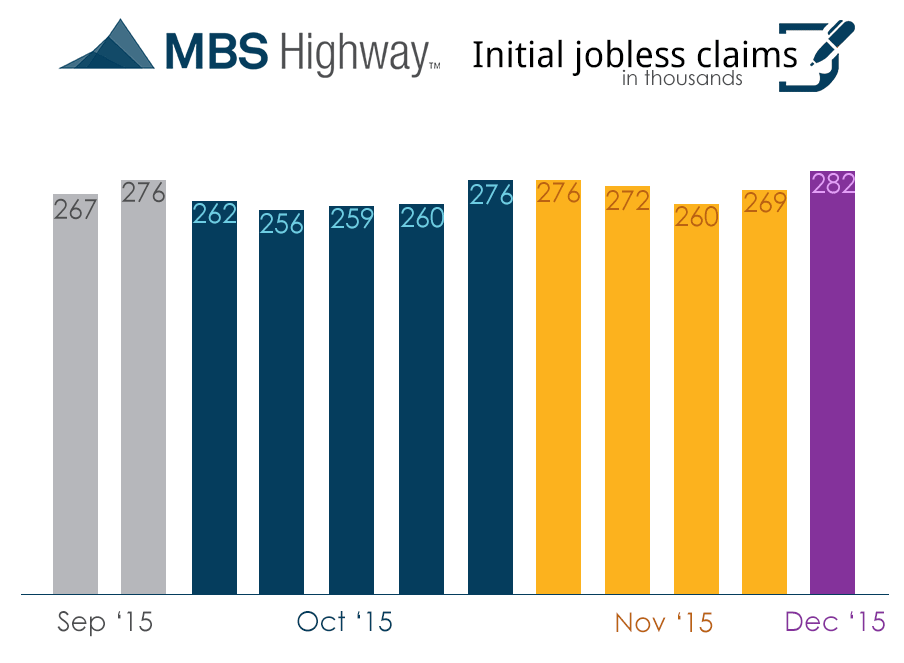

Thursday we saw the release of Weekly Initial Jobless Claims which came out slightly higher than previous week at 282,000 claims this is still the 39th consecutive week of claims below 300,000 claims. With 2 Strong Jobs Reports and weekly initial claims staying below 300k claims, it is now a 90% chance that the Federal Reserve will raise their Fed Funds Rate at their meeting this week on December 15th and 16th.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 16, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com