Mortgage Rates Weekly Update for December 7, 2015

Mortgage Rates Weekly Update

Mortgage Rates weekly market update for the Week of December 7, 2015 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

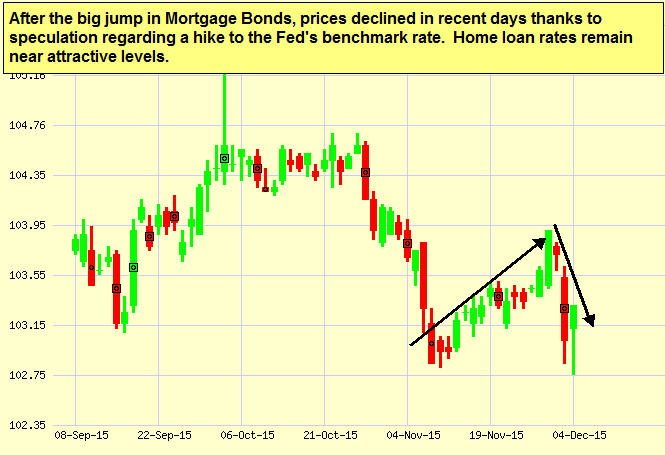

Mortgage Rates moved higher last week as the bond market sold off in anticipation of the Federal Reserve raising the short term interest rates. If you look at the mortgage bond chart below, you can see bonds sold off all week but were finally able to find a floor of support on Friday with the green candle. With the Jobs Report behind us the bond able to find a floor of support, we are recommending FLOATING your mortgage interest rate to start the week.

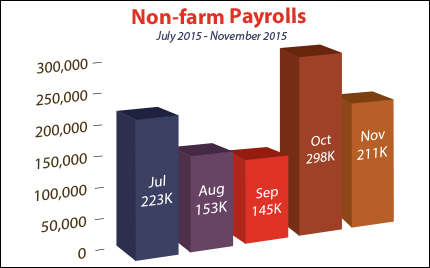

In Economic News, the U.S. Labor Department released the Jobs Report for November 2015 on Friday which showed 211,000 Jobs created for November. This was above expectations and September and October jobs numbers were revised higher. The unemployment rate remained the same at 5% which is a 7 year low. The Labor Force Participation Rate (LFPR) moved up slightly from 62.4 to 62.5%. This was overall a very good jobs report going into the Fed Meeting in December so most people are betting the Feds will finally raise their short term interest rate called the Feds Fund Rate.

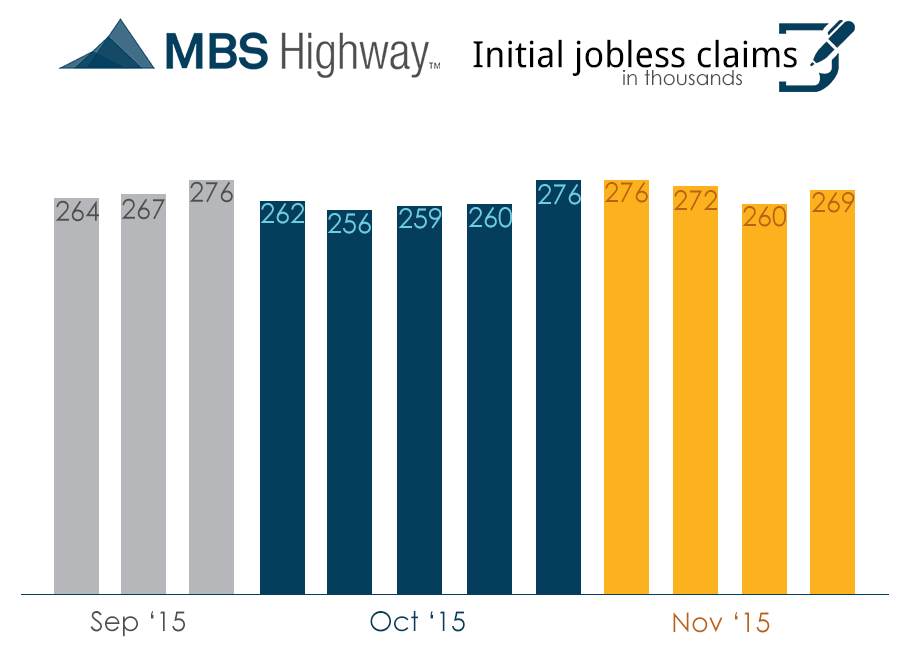

Thursday we saw the release of the Weekly Initial Jobless Claims which came in at 269,000 claims for the week which was another good report for the labor market. Jobless claims continue to show consistency in the weekly reports and are showing less firings and and stronger job market.

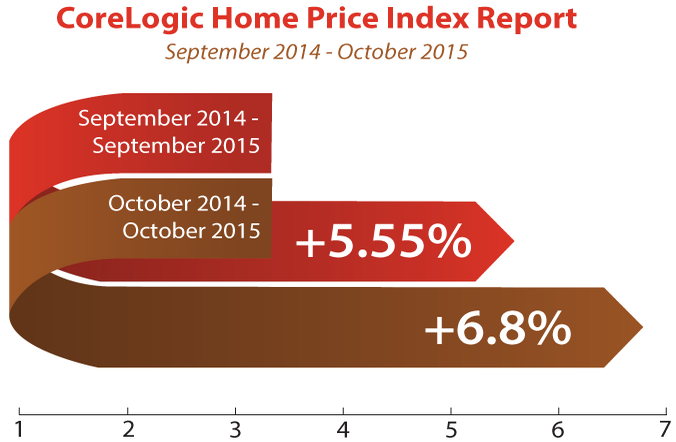

In Housing News, CoreLogic released their Home Price Index for October 2015 which showed a 6.8% year over year increase in home prices. Low Inventory of homes for sale and strong buyer demand has put upward pressure on home prices. On a month over month basis, home prices rose about 1% from September to October. CoreLogic is predicting a 5.2% year over year price increase for next year from October 2015 to October 2016. So this all means it is still a great time to purchase a home!

FHA Mortgage Loans Update – FHA implemented three condo rule changes for FHA loans with FHA Mortgagee Letter 2015-27 to make it easier to finance the purchase or refinance of a condo with a FHA loan and were effective 11-13-2015. The property must still be your primary residence but here are the three changes that have taken effect:

1) Remove second homes from the definition of investment property for calculating the percent of investment properties in the complex so more units can meet the 50 percent owner-occupied threshold.

2) Expand the allowable insurance for condo associations

3) Simplify the condo board recertification process

In local news, Delaware State Housing Authority and the Maryland Mortgage Program both have raised the minimum credit score to qualify for a housing program through them to 660. They are both no longer accepting manufactured housing and no longer accepting manually underwritten loans. There are other programs available in Delaware and Maryland depending on the area you are looking to buy a home. Call 302-703-0727 to see what programs are available in your area.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday December 12, 2015 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com