Mortgage Rates Weekly Update [November 27 2017]

Mortgage Rates Weekly Update for November 27, 2017

Mortgage Rates Update for November 27, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

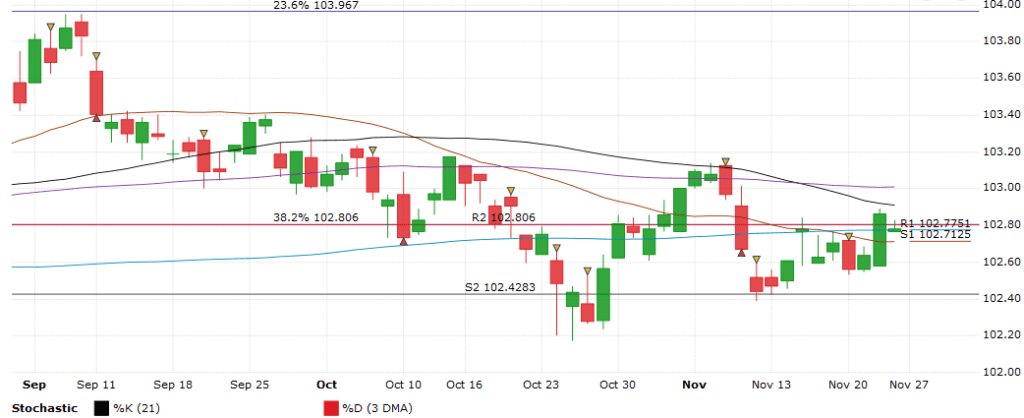

Mortgage Rates moved lower last week as mortgage bonds were able to rally above the 25 moving average. If you look at the mortgage bond chart below you can see mortgage bonds ended the week on the 200 day moving average and could make another run at breaking above the 50 day moving average. Bonds are in a tight trading pattern and the short term trend has been for bonds to move higher after bouncing off floor of support on November 13th. We are recommending FLOATING Your mortgage rate to start the week to see if bonds can break through ceiling of resistance and continue to move higher.

In Economic News

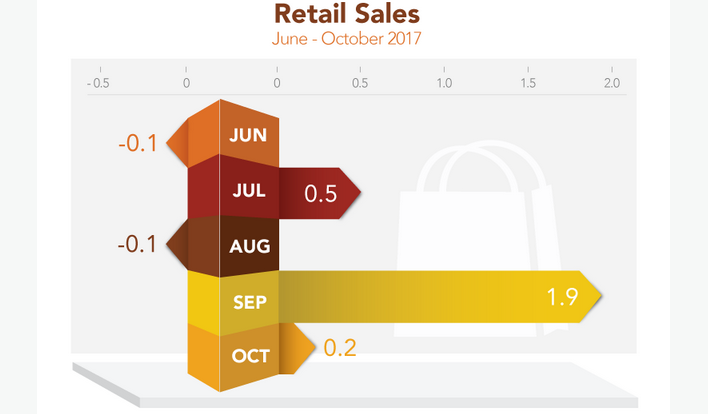

Retail Sales for October 2017 rose 0.2% which was a big drop from 1.9% in September which was boosted by post hurricane spending. Year over year retail sales are up 4.9% and the National Retail Federation is expecting better numbers than last year heading into the holiday shopping season.

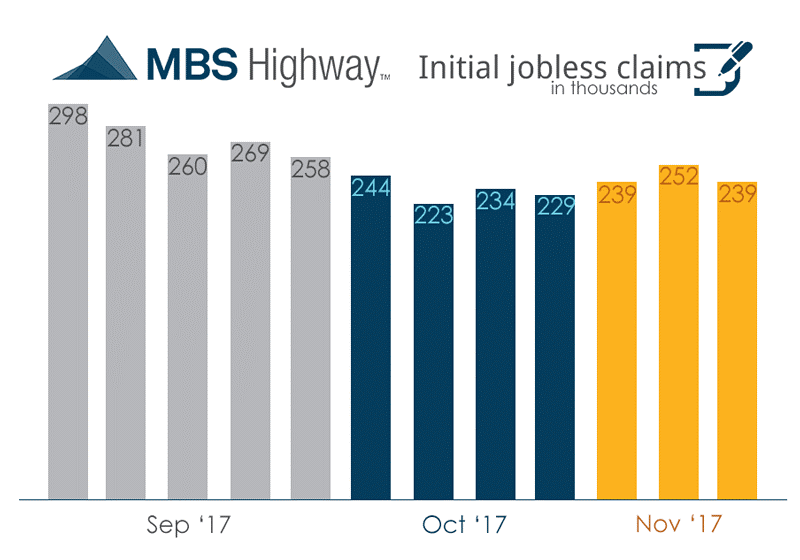

Weekly Initial Jobless Claims were released on Thursday and claims dropped 13,000 claims to 239,000 claims for the week. This will be the sample week used in the November Jobs Report so this points to strong jobs number.

In Housing News

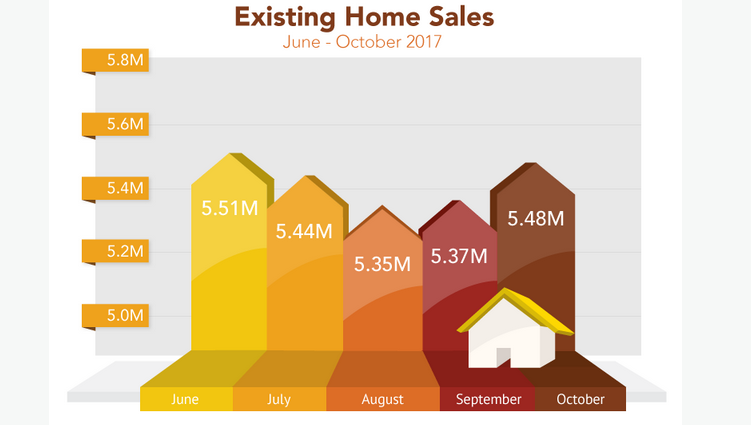

Existing Home Sales for October 2017 rose 2 percent from September to 5.48 million units. This was the highest existing home sales number since June 2017. A severe lack of inventory of homes for sales continues to push home prices higher across the country.

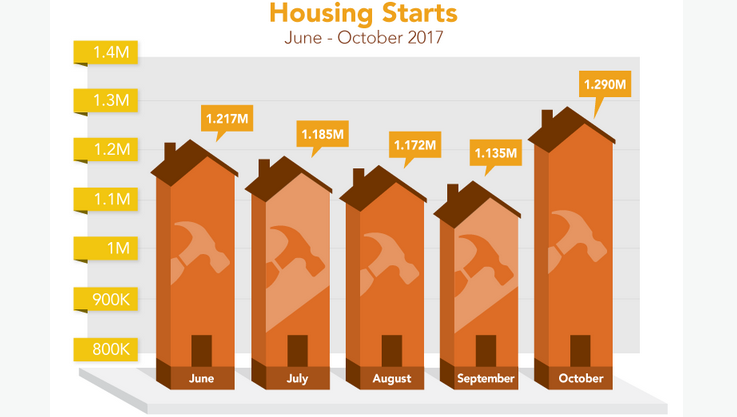

Housing Starts for October 2017 hit a one year high at 1.29 million units which was up 13.7 percent from September which was abnormally low because of disruptions to home building from hurricanes Irma and Harvey. Building Permits for October 2017 were up 5.9 percent from September to 1.297 million units. This bodes well for new home construction.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday December 16, 2017 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday December 9, 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages