Mortgage Rates Weekly Update for May 18, 2015

Mortgage Rates weekly market update for the Week of May 18, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

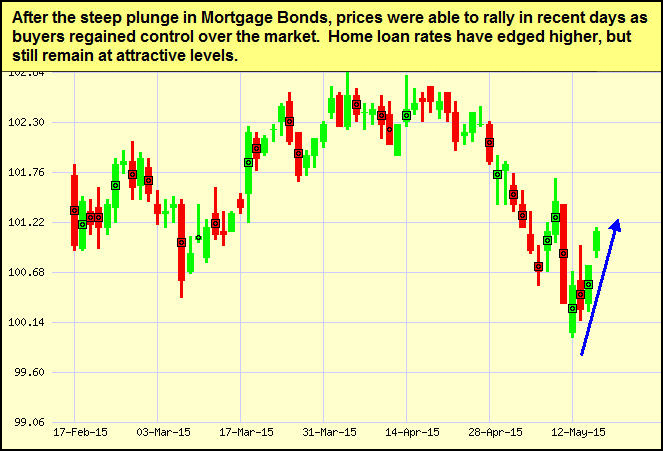

Mortgage Rates were able to finally move lower after two weeks of moving higher. If you look at the mortgage bond chart below you can see mortgage bonds were finally able to find a level of support on Thursday and bounce higher. A good technical sign is a bond being able to move above the 200 days moving average on Friday and close above it. This is a bullish signal for bonds so we are recommending FLOATING your mortgage rate to start the week.

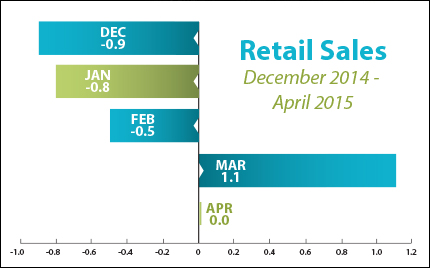

In Economic News, Retail Sales for April 2015 came in flat at 0% increase from March. The flat Retail Sales is because consumers are putting the savings from lower gasoline prices into savings accounts not spending it which would help drive the economy. This was a bad retail sales report and reports like these may push the Federal Reserve to not raise short term interest rates until 2016.

The Producer Price Index for April 2015 was down -0.4%. The Producer Price Index measures inflation at the wholesale level and has been down 7 of the last 9 months. The lower price of Energy has contributed to tame inflation here and abroad.

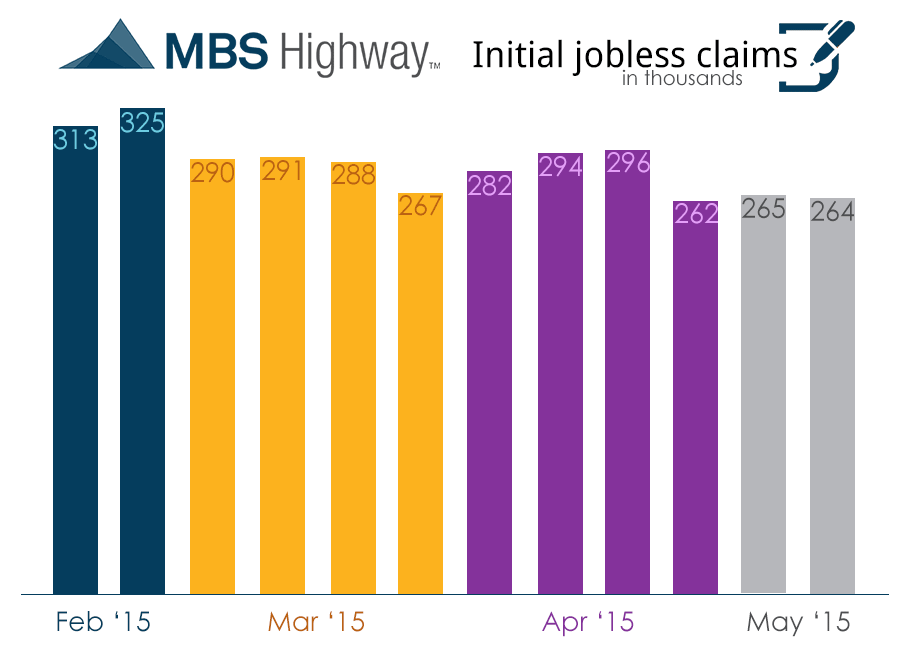

Weekly Initial Jobless Claims came out on Thursday at 264,000 claims which were still at a 15 year low and down a 1,000 claims from the previous week. This was much better than expected claims of 275,000 claims. Next week’s jobless claims will be used in May’s Job Report.

In Economic News Abroad, China’s Central Bank, People’s Bank of China, cut its one-year lending rate and its one-year deposit rate by 25 basis points due to continued economic weakness in China. The rest of the world’s central banks are continuing to loosen their economic policies by cutting short term interest rates which will make it hard for the Feds to raise short term rates here in the U.S.

In Housing News, CoreLogic released its National Foreclosure Report for March 2015 and it showed continued improvement at only 542,000 homes are in some form of foreclosure compared to 729,000 last year which is a decrease of 25.7%. The Foreclosure Inventory represented 1.4% of all homes with a mortgage, down from 1.9% last year.

FHA Announced Changes to its FHA Mortgage Program that will go into effect September 15, 2015, with the implementation of its new Single Family Mortgage Handbook. One of the big changes is for dealing with Student Loan Debt, Lenders will no longer be able to exclude Student Loan Payments from qualifying ratios even if deferred for more than 12 months from the settlement. This will effect LOTS of First Time Home Buyer’s ability to get a mortgage to purchase a home.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 5/15/2015 they are working on reviewing files that have been submitted on 4/23/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, May 30, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713