Mortgage Rates Weekly Update for April 27, 2015

Mortgage Rates weekly market update for the Week of April 27, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates have been moving up and down by about 0.25% in either direction over the last couple weeks as mortgage bonds have traded in a tight range. If you look at the mortgage bond chart below you can see mortgage bonds have traded in a tight range bound between the two blue lines. The longer bonds trade in this channel the more momentum for a breakout. We are recommending FLOATING your Mortgage Rate to start the week as mortgage bonds were able to bounce off support on Friday.

In Economic News Abroad, the German private sector growth slowed, French business activity barely grew in April 2015 and China factory activity contracted at its fastest pace in a year.

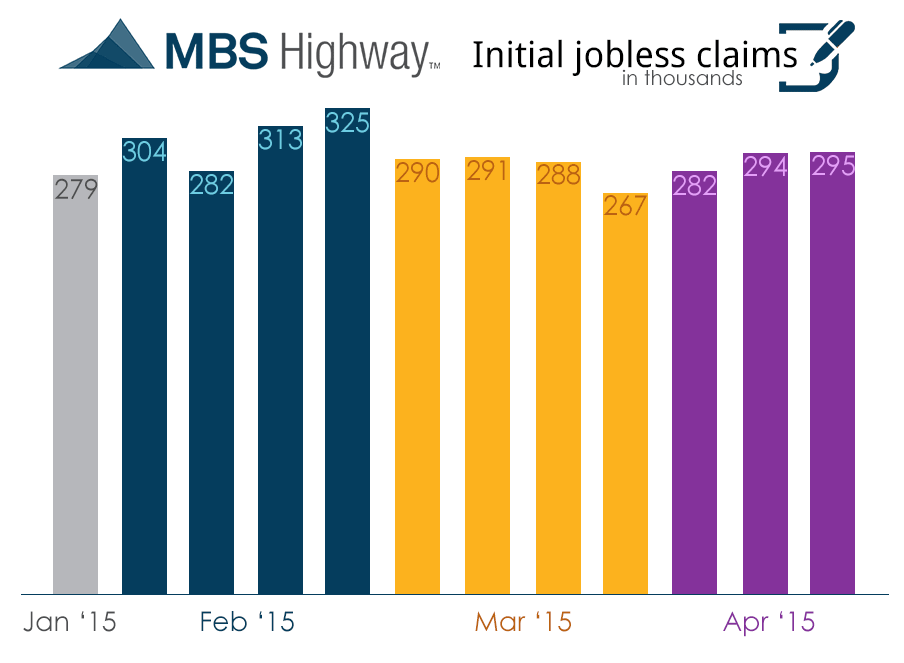

In US Economic News, Weekly Initial Jobless Claims came in at 295,000 which was above expectations of only 286,000 claims and up 1,000 claims from the previous week. This report will be the one used for the April 2015 Jobs Report which will be released on May 8th.

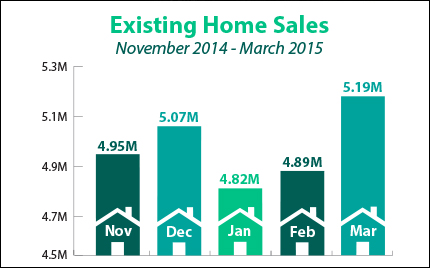

In Housing News, Existing Home Sales for March 2015 surged higher by 6.1% from February as reported by the National Association of Realtors (NAR). This brought home sales to 5.19 Million units on an annualized basis. This was the largest monthly increase in existing home sales since December 2010. This is the six consecutive months of increased year over year existing home sales and is now up 10.4% from a year ago.

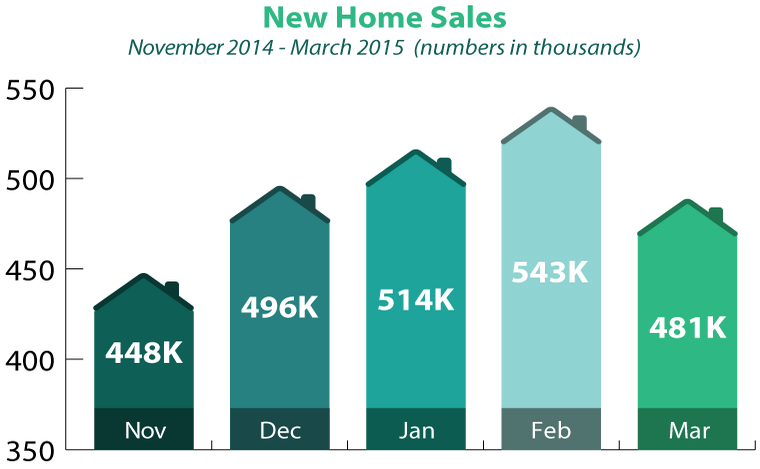

New Home Sales for March 2015 was reported on Friday and sales fell by 11.4% in March from February to an annual rate of 481,000. This was a drop from February which was revised higher to 543,000. The harsh winter weather of January and February could be to blame fro the drop in March so we will have to see how New Home Sales do in April.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 4/24/2015 they are working on reviewing files that have been submitted on 4/16/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, May 30, 2015, n Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713