Mortgage Rates Weekly Update for April 13, 2015

Mortgage Rates weekly market update for the Week of April 13, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates bounced around last week near record lows as mortgage bonds traded in a tight trading channel. If you look at the mortgage bond chart below you can see the two below lines on the chart created a ceiling of resistance at the top and a floor of support on the bottom. Mortgage bonds are looking to break out of this channel and with the green candle on Friday, we are recommending FLOATING your Mortgage Rate to see if bonds can get enough momentum to break through the ceiling of resistance.

The long term trend for mortgage bonds is still for bonds to move higher when looking at the two-year trading pattern which can be seen in the mortgage bond chart below with the blue line. This means we could see rates move even lower this year if the trend holds.

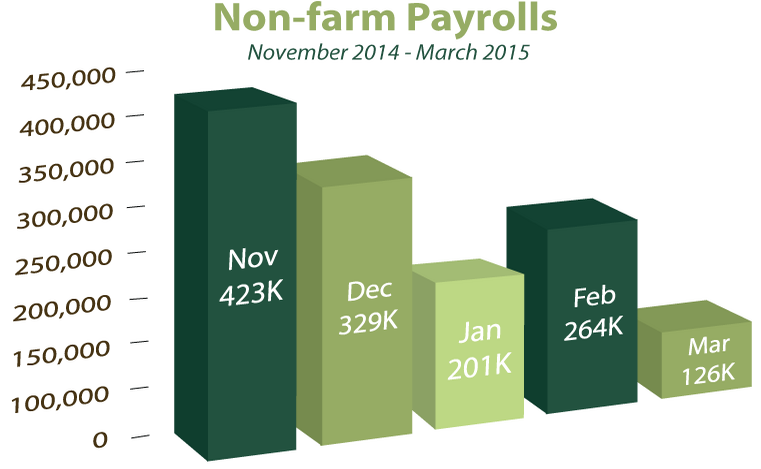

In Economic News, the March 2015 Jobs Report came out on Friday, April 3rd and it was a BIG disappointment with only 126,000 jobs created for March. This was well below expectations of 250,000 jobs created and to top it off January and February jobs were lowered by 69,000 jobs. The Unemployment Rate remained the same at 5.5% but the Labor Force Participation Rate (LFPR) dropped from 62.8% to 62.7%.

The Federal Reserve released the minutes from their March Meeting on Wednesday and stated that they were going to make a decision on hiking the Feds Fund Rate based on the data that comes out on the Economy. The minutes that were released make it very unlikely the Feds will raise rates in June as previously thought. Now it looks like September at the earliest if not the end of the year.

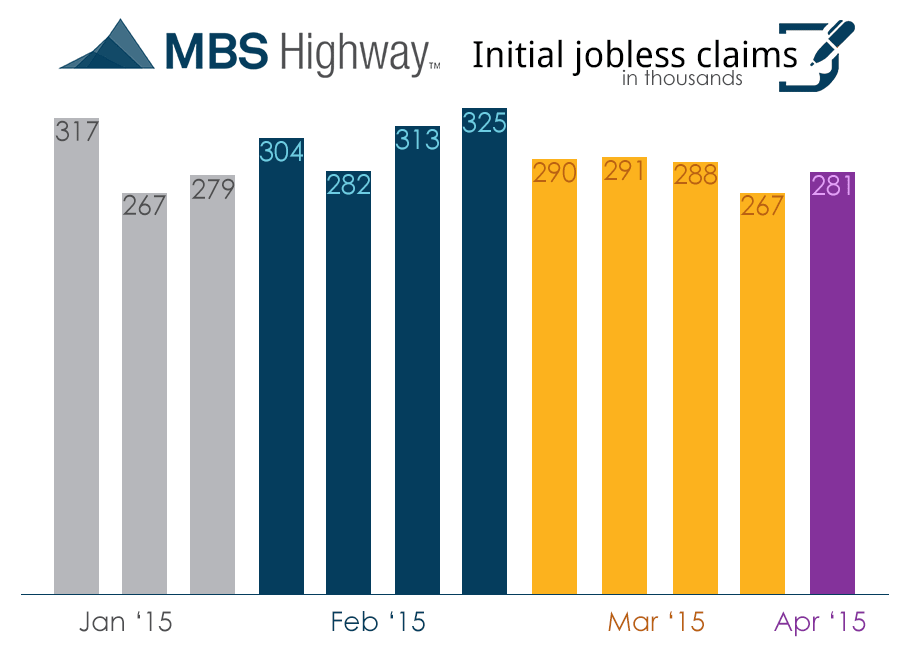

Thursday we saw the release of the Weekly Initial Jobless Claims which move up to 281,000 from the extremely figure last week of 267,000. Even though we saw an uptick in jobless claims, 281k was still a good number as well below the 300,000 marks.

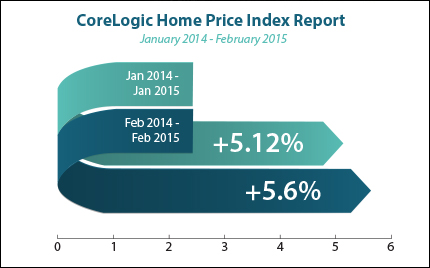

In Housing News, CoreLogic Released its Home Price Index for February 2015 and home prices were up 1.1% from January 2015 and were up 5.6% year over year. Home Prices are continuing to rise as there is a shortage of inventory of homes for sale nationwide.

In Other Housing News, Sales of Vacation Homes is Skyrocketing as a record 1.13 million vacation homes were sold last year which represented 21% of the market which is up 57% from 2013. Owner-occupied homes made up 60% of the market at 3.23 Million Homes sold.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 4/10/2015 they are working on reviewing files that have been submitted on 3/17/2015 so they are taking about 10 Business days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, April 18, 2015, n Newark, Delaware.

The next Dover Delaware Home Buyer Seminar is Saturday, April 25, 2015, in Dover, Delaware

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713