Mortgage Rates Weekly Update 12-5-2016

Mortgage Rates Update for December 5, 2016

Mortgage Rates update for the Week of December 5, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week slightly higher than they started as mortgage bonds continued to their downward move. If you look at the mortgage bond chart below you can see the trend line has been for mortgage bonds to sell off and move mortgage interest rates higher. Mortgage Bonds did find a floor of support and bounced higher off 2016 lows so we are recommending FLOATING Your mortgage rate to see if mortgage bonds can move higher and move mortgage rates lower.

In Economic News

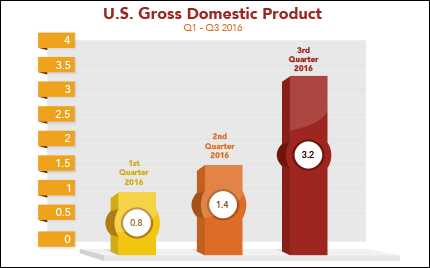

Gross Domestic Product (GDP) for 3rd Quarter of 2016 was released last week and came out surprisingly higher than expected at 3.2%. This is a big jump from GDP in the first quarter (0.8%) and second quarter (1.4%). This is the fastest pace of GDP growth in 2 years. GDP is a measure of the monetary value of all the finished goods and services produced in a specified period of time and is considered by some the broadest measure of economic activity. Consumer Spending for October 2016 rose by 2.8 percent.

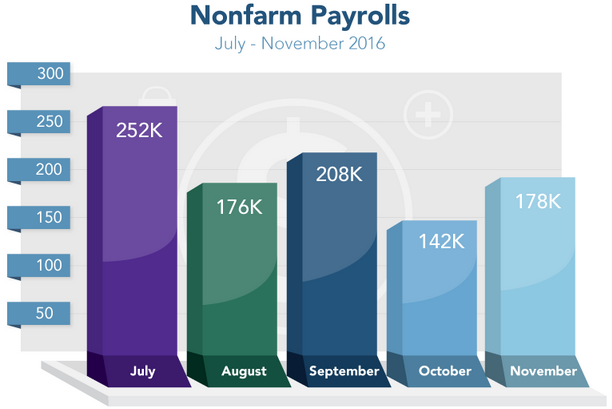

Jobs Report for November 2016 was released on Friday and showed 178,000 jobs were created for the month which brings the monthly average for 2016 to 181,000. The Unemployment Rate fell to 4.6% which is the lowest since 2007. The big drop in unemployment was from 226,000 people dropping out of the work force not for that many more people returning to work. Average Hourly Earnings fell a disappointingly by 0.1% versus expectations of a 0.2% increase. This decrease in wage pressure is bond friendly as it eases inflation.

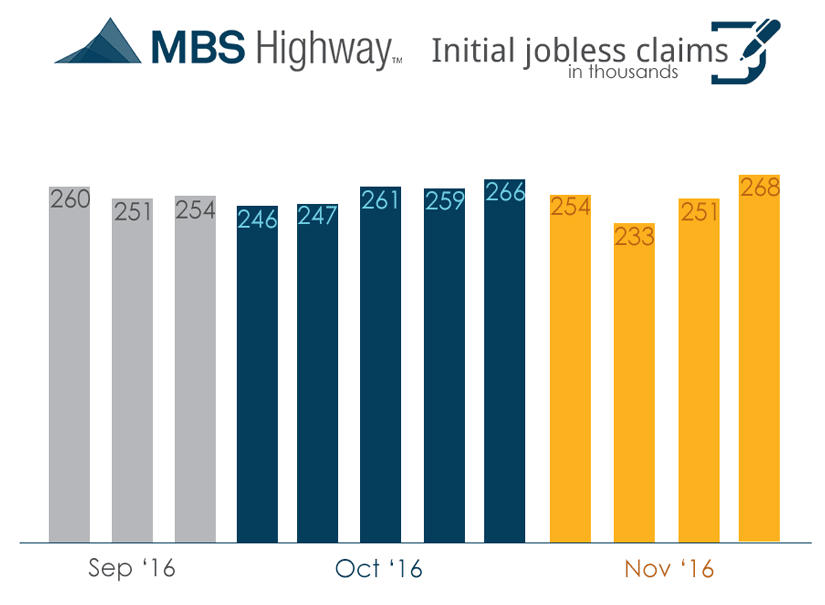

Weekly Initial Jobless Claims were released on Thursday and showed claims jumped higher by 17,000 claims to 268,000 claims. This was the second week in a rough that initial claims have moved higher. Claims are still very good and remain below 300,000 claims.

In Housing News

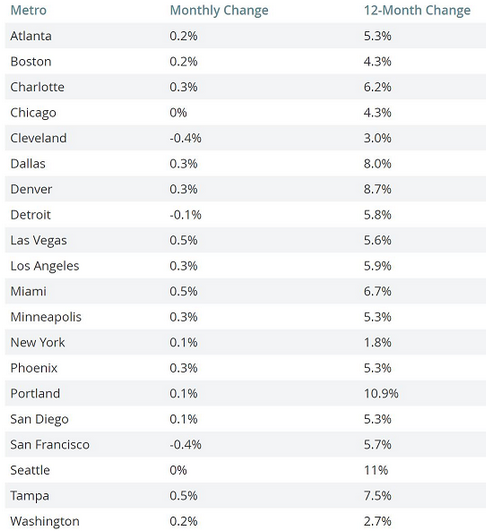

Case-Shiller 20 City Home Price Index for September 2016 showed that home prices rose by 5.2% on an annualized basis which was inline with estimates. The report shows that the housing market continues to show strength. Below is a chart of the 10 biggest cities in the report and the change in home prices monthly and year over year.

FHA Loan Limits for 2017 Released

HUD released the FHA Loan Limits for 2017 effective for FHA case numbers assigned on or after January 1, 2017. The following are the FHA Loan limits for each county of Delaware:

New Castle County Castle FHA Loan Limit – $379,500

Kent County Delaware FHA Loan Limit – $275,650

Sussex County Delaware FHA Loan Limit – $316,750

Conventional Loan Limits for 2017 Released

Conventional Loan Limits for 2017 have increased in all three counties of Delaware above the old $417,000 limit. Effective January 1, 2017 the following will be the new conventional conforming loan limits for use with mortgage loans that are delivered to Fannie Mae and Freddie Mac as announced by the Federal Housing Finance Agency (FHFA):

New Castle County Castle Conforming Loan Limit – $424,100

Kent County Delaware Conforming Loan Limit – $424,100

Sussex County Delaware Conforming Loan Limit – $424,100

This is the first increase to the conforming loan limits since 2006.

VA Loan Limits for 2017 Released

The Department of Veterans Affairs released the VA Loan limits for 2017 and the maximum VA loan limit for 100% financing increased from 417,000 to 424,100 effective for Veteran loans closed on or after January 1, 2017.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday December 17, 2016 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday January 21 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate