Mortgage Interest Rates Updates May 16, 2016

Mortgage Interest Rates Weekly Update May 16 2016

Mortgage Interest Rates weekly update for the Week of May 16, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Interest Rates remain at 3 year record lows! Now is the best time to refinance or purchase a home in a very long time. If you look at the mortgage bond chart below you can see bond prices have been capped by the blue line since February. Every time the bond has hit the blue line it has been turned lower which means rates would move higher so we are recommending LOCKING your mortgage interest rate at these record lows unless the bond can close above that blue line.

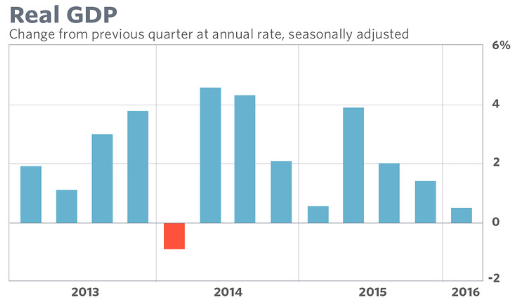

In Economic News, the Federal Open Market Committee (FOMC) had their meeting in April 2016 and as expected decided not to increase the Fed Funds Rate which is the rate banks use to lend money overnight to each other. The big reason for leaving interest rates steady is their concern over economic activity appears to have slowed when measured by the GDP which is a broad measure of economic activity in the U.S. The GDP first quarter reading was only 0.5% which is a big drop as seen in the chart below:

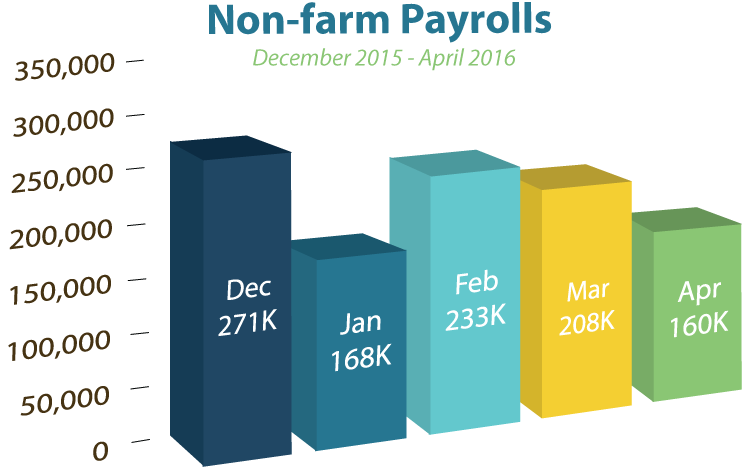

The April 2016 Jobs Report was released on May 6th and it showed 160,000 jobs created in April which was well below the 207,000 expected. This was the lowest number in jobs created since September 2015. The trend for lower job creation is not showing a strong labor market in the U.S.

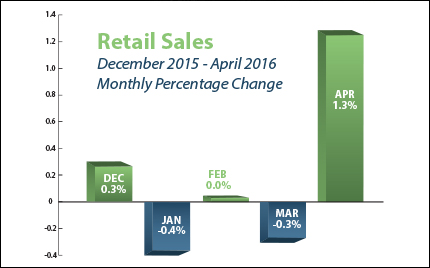

Retail Sales for April 2016 rebounded higher to 1.3% from -0.3% for March as consumers opened their wallets in April. The Commerce Department released the report on Friday and it was the biggest jump in retail sales in a year. The Retail Sales Report is a measure of the total retail store receipts from all businesses throughout the nation.

Consumer Sentiment for April 2016 rose 6.8 points from March to 95.8 which is the highest reading since June 2015. Consumer Sentiment increased across all income and age groups. The optimism in the report was attributed to income gains and better outlook on economy from lower interest rates and lower inflation.

Producer Price Index (PPI) for April was released and showed inflation at the wholesale level remains tame at a rise of only 0.2%. The year over year remains flat. Low inflation is good for low mortgage rates.

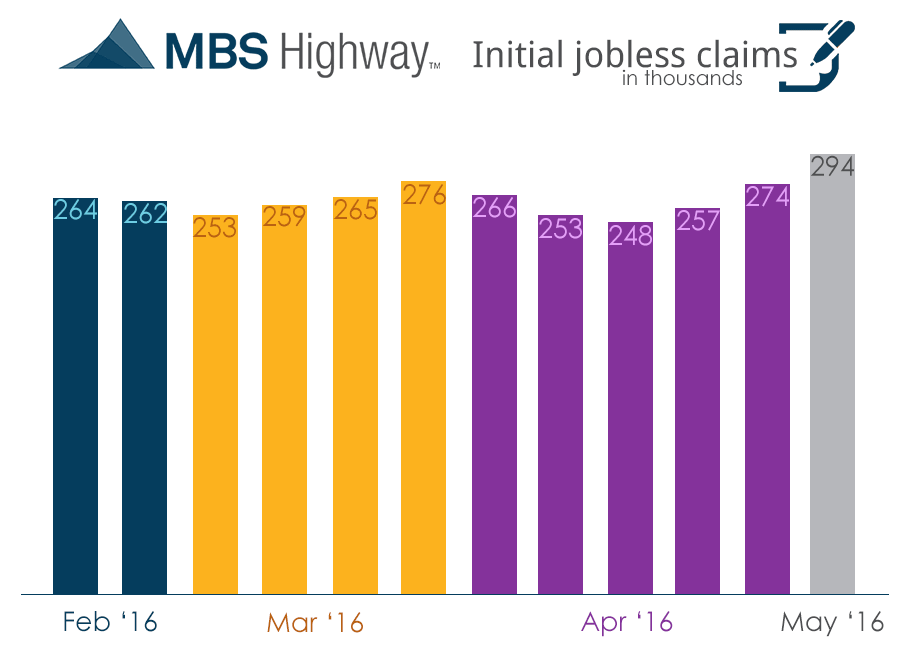

Weekly Initial Jobless Claims were released on Thursday and moved up 20,000 to 294,000 claims for the week. Are we seeing a change in the labor market? The jobs report has been showing less jobs created since the beginning of the year and jobless claims have risen 46,000 claims since early March. This is not quite enough data to make a conclusive conclusion but if trend continues then that would be a clear signal the labor market has taken a turn for the worse.

In Housing News, The National Association of Realtors (NAR) reported Existing Home Sales for March 2016 jumped 5.1% from February ending up 1.5% higher from one year ago. The inventory of existing homes for sale is still very limited as NAR reported it at 4.5 months of existing inventory for March 2016. A six month supply of existing homes for sale is considered normal so when inventories are low, “bidding wars” on homes listed for sale often increases.

CoreLogic released their National Foreclosure Report for March 2016 which showed the number of homes in some form of foreclosure dropped 23% from 556,000 down to 427,000 homes. The foreclosure inventory also dropped from 1.4% of all homes for sale in 2015 to only 1.1% in March 2016.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday May 21, 2016 in Newark, Delaware.

The next Dover Delaware Home Buyer Seminar is Saturday June 4, 2016 in Dover, Delaware

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com