Delaware Mortgage Credit Certificate Program

Delaware Mortgage Credit Certificate Program

Delaware mortgage credit certificate program also known as the MCC for short, was being released by the Delaware State Housing Authority (DSHA) under section 25 of the Internal Revenue Code of 1986 in order to benefit eligible purchasers of single-family dwelling units located within the State of Delaware, by allowing such eligible borrowers to a credit against their individual federal income tax liability. The Mortgage Credit Certificate (MCC) is also called a First Time Home Buyer Tax Credit. The program needs to be applied for through an eligible Delaware Mortgage Lender such as Primary Residential Mortgage in Newark, Delaware. You can apply for the Delaware Mortgage Credit Certificate by calling 302-703-0727 or you can APPLY ONLINE.

Delaware mortgage credit certificate program also known as the MCC for short, was being released by the Delaware State Housing Authority (DSHA) under section 25 of the Internal Revenue Code of 1986 in order to benefit eligible purchasers of single-family dwelling units located within the State of Delaware, by allowing such eligible borrowers to a credit against their individual federal income tax liability. The Mortgage Credit Certificate (MCC) is also called a First Time Home Buyer Tax Credit. The program needs to be applied for through an eligible Delaware Mortgage Lender such as Primary Residential Mortgage in Newark, Delaware. You can apply for the Delaware Mortgage Credit Certificate by calling 302-703-0727 or you can APPLY ONLINE.

What are the Eligibility Requirements for the Mortgage Credit Certificate Program?

Eligible Borrowers must meet the following requirements in order to qualify to receive a certificate under the Program:

Principle Residence Requirement – The borrower must intend to occupy the subject property as a principal residence within 60 days after the first mortgage loan closes. A principal residence is a home occupied primarily for residential purposes.

First Time Home Buyer Requirement – Each borrower must be a Delaware First Time Home Buyer unless the home is in a federally designated targeted area or is a loan to a qualified veteran. A first time home buyer is defined as a person who has not owned a principal residence at any time during the three years prior to closing the related mortgage loan.

Purchase Price Requirement – The maximum purchase price of the related home may not exceed 90% of the average area purchase price for the home being financed. It can be 110% of the average purchase price if the subject property is in a targeted area.

New Mortgage Requirement – The borrower will not be eligible for a Delaware Mortgage Credit Certificate in connection with the acquisition or replacement of an existing mortgage.

Maximum Income Requirement – A borrower’s household income for the MCC may not exceed 115% (100% for families of less than three) of the greater of the applicable median gross income. If the borrower is purchasing in a targeted area than the borrower’s household income for the MCC may not exceed 140% (120% for families of less than three) of the greater of the applicable median gross income.

Under the Mortgage Credit Certificate Program, certificates will be issued to eligible borrowers on a first come, first serve basis. The mortgage credit certificates are only available in connection with fixed rate mortgage loans except loans financed by qualified mortgage bonds.

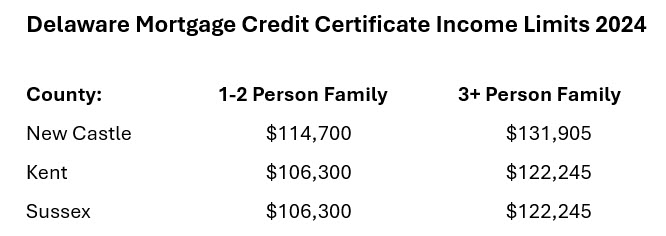

What are the Income Limits for the MCC Program for 2024?

The income limits for the Mortgage Credit Certificate Program for 2024 are based on the county the property is located and the size of the household. The household income limits for 2024 are below:

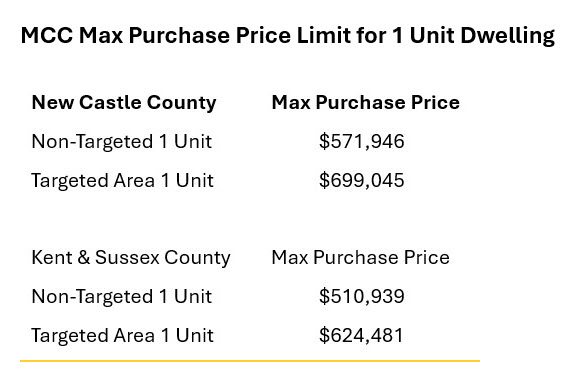

What are the Maximum Purchase Price Allowed for the First Time Home Buyer Tax Credit Program?

All properties must be located in the State of Delaware in order to qualify for the MCC Program and must be under the maximum purchase price as designated per county and based on a targeted area of not. Below is the 2024 maximum purchase price:

Does Everyone Get $2,000 a year every year for the First Time Home Buyer Tax Credit?

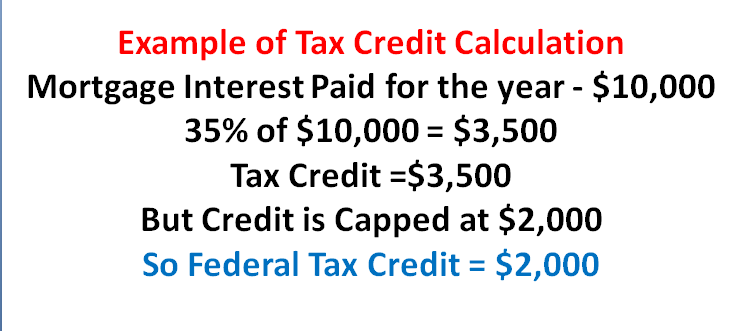

Each person enrolled in the Delaware Tax Credit Program can claim up to 35% of the mortgage interest paid each year on Federal Tax Return capped at a maximum of $2,000. The program is also called the Delaware First Time Home Buyer Tax Credit Program.

A tax credit is a dollar for dollar credit against tax liability on the borrower’s federal income tax return which is much better than a tax deduction which only lowers your taxable income. The tax credit reduces the income tax due by the amount of the credit. The maximum tax credit cannot exceed $2,000 per tax year and can be claimed each year the borrower has the mortgage.

Which Mortgage Programs Can be used with the Delaware MCC Program?

The Delaware Mortgage Credit Certificate can be used with any DSHA first mortgage loan program but can also be used with the following mortgage programs outside of using a DSHA first mortgage:

In order to use a mortgage program that is NOT a DSHA first mortgage, you MUST meet all the eligibility guidelines listed above as well as apply for the first mortgage through an approved DSHA mortgage lender such as Primary Residential Mortgage.

You can also use the Delaware First Time Home Buyer Tax Credit with the DSHA Homes for Grads Program which offers a 0.5% reduction in your mortgage interest rate on DSHA first mortgages using the DSHA Preferred Plus Down Payment Program.

How Do You Apply for the Delaware Mortgage Credit Certificate Program?

For more information on the Delaware Mortgage Credit Certificate Program or to Apply please call 302-703-0727 to speak to a Tax Credit Specialist or get started online with secure online application APPLY NOW!

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713