Doctor Loan Program for Physicians & Dentists

PRMI Doctor Loan Program for Physicians, Dentists & Medical Professionals

Buy your home with up to 100% financing and no PMI—even with student loans.

Program Highlights & Key Benefits

- Purchase of Primary Residence or Rate/Term Refinance

- Minimum Credit Score 680

- 100% Financing up to $1,000,000

- Loan amounts up to $2,500,000 (with reduced LTVs)

- No Mortgage Insurance (PMI)

- Fixed and Adjustable-Rate mortgage options

- Employment Contract accepted for qualifying income

- Maximum DTI 50%

- Gift Funds allowed

- Non-Occupant Co-Borrowers allowed (non-occupant income ? 50% of total qualifying income)

Who Qualifies for the Doctor Mortgage Loan Program?

At least one occupying borrower must hold a valid license in one of the following approved medical fields:

- Doctor of Dental Surgery (DDS)

- Doctor of Dental Medicine (DMD)

- Doctor of Optometry (OD)

- Doctor of Ophthalmology (MD)

- Doctor of Podiatric Medicine (DPM)

- Doctor of Osteopathy (DO)

- Doctor of Veterinary Medicine (DVM)

Not Eligible: Chiropractors.

Additional requirements:

- Borrower must be actively engaged in the eligible profession (e.g., an MD not actively practicing is not eligible).

- Completed residency within the last 10 years or currently a resident, fellow, or intern.

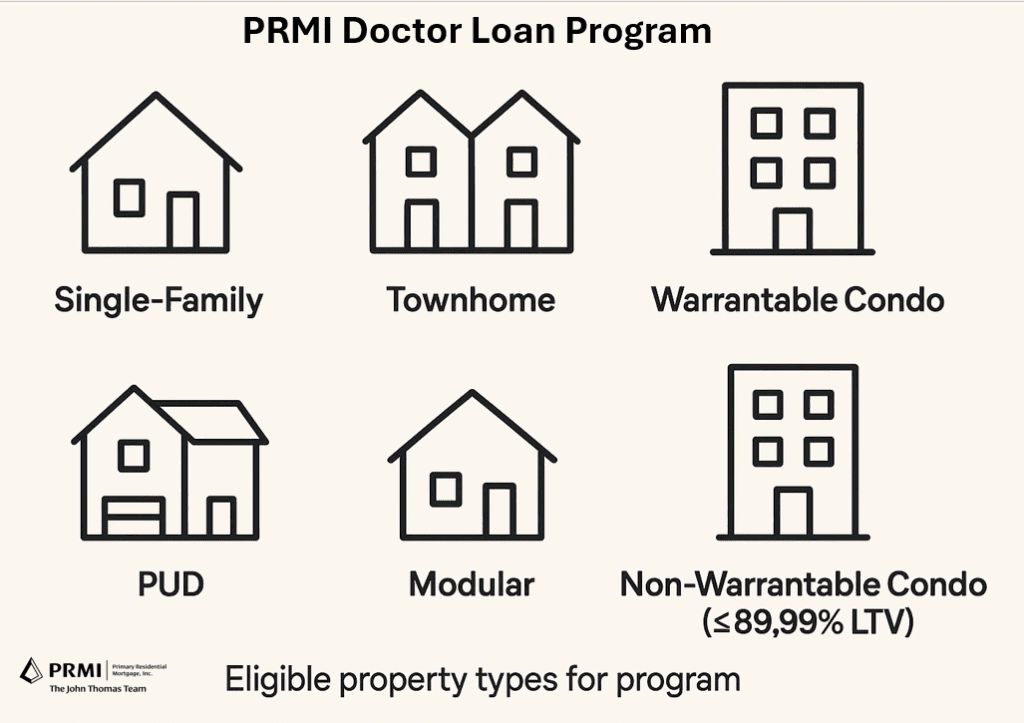

Eligible Property Types

- 1–2 Unit Primary Residence

- Fannie Mae Warrantable Condominiums

- Planned Unit Developments (PUDs)

- Townhomes

- Modular Homes

- Non-Warrantable Condos (restricted to 89.99% LTV)

Ineligible Property Types

- Investment Properties or Second Homes

- Manufactured Homes

- Properties held in Irrevocable Trusts

Doctor Loan Credit Score & Down Payment Guidelines

With a Minimum 720 Credit Score

| Loan Amount | Minimum Down Payment |

|---|---|

| Up to $1,000,000 | 0% Down |

| Up to $1,750,000 | 5% Down |

| Up to $2,500,000 | 10% Down |

With a Minimum 680 Credit Score

| Loan Amount | Minimum Down Payment |

|---|---|

| Up to $750,000 | 5% Down |

| Up to $1,500,000 | 10% Down |

| Up to $2,500,000 | 25% Down |

No PMI is required on the Doctor Loan Program.

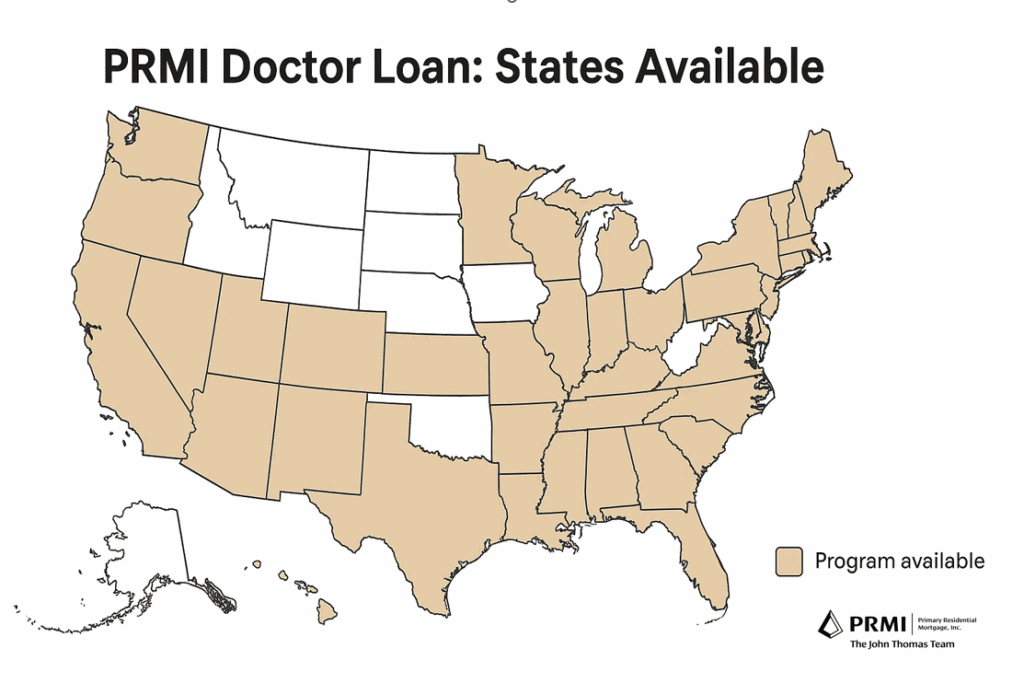

States Where the PRMI Doctor Loan Is Available

AL, AR, AZ, CO, CT, DE, GA, IA, ID, IL, IN, KS, KY, LA, MA, MD, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY.

Gift Funds & Seller Contributions

- Gift funds are allowed for down payment and/or closing costs.

- Seller-paid closing costs are allowed and must follow Fannie Mae Interested Party Contribution guidelines.

Residency Status Eligibility

As of 2025, only U.S. Citizens and Permanent Residents are eligible for the PRMI Doctor Loan Program. Non-permanent residents must follow FHA guidelines and are not eligible for this program.

How to Apply for the PRMI Doctor Loan Program

- Call the John Thomas Team at 302-703-0727 to review your eligibility and next steps, or

- Start your secure application online: Apply Online.

If you don’t meet the Doctor Loan guidelines, consider these alternatives:

Frequently Asked Questions – PRMI Doctor Loan Program

1) What is the PRMI Doctor Loan Program?

The PRMI Doctor Loan Program (Physician Mortgage) is a specialized mortgage for licensed medical professionals to purchase or rate/term refinance a primary residence with up to 100% financing, no mortgage insurance, flexible DTI (to 50%), and both fixed- and adjustable-rate options.

2) Who is eligible for the program?

At least one occupying borrower must hold a valid license in one of these fields: Doctor of Dental Surgery (DDS), Doctor of Dental Medicine (DMD), Doctor of Optometry (OD), Doctor of Ophthalmology (MD), Doctor of Podiatric Medicine (DPM), Doctor of Osteopathy (DO), or Doctor of Veterinary Medicine (DVM). Chiropractors are not eligible. Borrower must be actively practicing and either currently a resident/fellow/intern or have completed residency within the last 10 years.

3) What are the credit score and down payment options?

Minimum credit score: 680.

720+ credit score:

- 0% down to $1,000,000

- 5% down to $1,750,000

- 10% down to $2,500,000

680–719 credit score:

- 5% down to $750,000

- 10% down to $1,500,000

- 25% down to $2,500,000

4) Are there loan amount limits and is PMI required?

Loan amounts available up to $2,500,000 (with reduced LTVs above $1,000,000). There is no mortgage insurance (PMI) requirement.

5) What property types are eligible?

Eligible: 1–2 unit primary residences, townhomes, Fannie Mae warrantable condos, PUDs, modular homes, and non-warrantable condos (restricted to 89.99% LTV).

Ineligible: investment properties, second homes, manufactured homes, and properties held in irrevocable trusts.

6) Is this purchase only, or can I refinance?

Purchase of a primary residence or a rate/term refinance of a primary residence are both allowed.

7) What’s the maximum DTI and can I use an employment contract?

Maximum DTI is 50%. Yes—an employment contract/offer letter is acceptable for qualification.

8) Can I use gift funds or a non-occupant co-borrower?

Gift funds are allowed. Non-occupant co-borrowers are allowed, but the non-occupant’s income must be ? 50% of the total qualifying income.

9) Are seller credits allowed?

Yes. Seller-paid closing costs must follow Fannie Mae Interested Party Contribution (IPC) guidelines.

10) Which borrowers are eligible based on residency status?

As of 2025, only U.S. citizens and permanent residents are eligible for the PRMI Doctor Loan Program. Non-permanent residents must follow FHA guidelines and are not eligible for this program.

11) Where is the program available?

Available in: AL, AR, CO, CT, DE, FL, GA, IA, ID, IL, IN, KS, KY, LA, MA, MD, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY.

12) How do I apply?

Call the John Thomas Team at 302-703-0727 or click Apply Online to get started.

If you don’t meet the Doctor Loan guidelines, ask us about our Home Town Heroes Grant Program or our Nurses Mortgage Loan Program.