Delaware Mortgage Rates Weekly Update for July 7, 2014

Delaware Mortgage Rates weekly update for the Week of July 7, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates moved higher last week as the labor market showed signs of improvement and the stock market continued to rally. If you look at the mortgage bond chart below, you can see the red candles down all week which showed mortgage bonds selling off and interest rates moving higher. We recommend “Locking” your Delaware Mortgage Rate last week in our update so hopefully, you took our advice as mortgage rates did indeed move higher. We are now recommending FLOATING your Delaware Mortgage Rate to start the week as the Jobs Report is behind us and mortgage bonds could find a floor of support. We saw a “Hammer” Technical signal on Friday which could signal bonds are “oversold” and could mean a reversal in the bond is forming.

The Jobs Report for June 2014 was released by the Labor Department on Thursday and it showed 288,000 new jobs were created in June 2014. The report also showed that the Unemployment Rate dropped from 6.3% to 6.1%. The report appeared to be a strong report for the labor market but when you dig into the report, many of the jobs created were part-time and temporary jobs. This is reflected in the Labor Force Participation Rate (LFPR) which remained the same at 62.8%. The LFPR measures the number of people 16 years and older that are able to work that are working full time.

The Weekly Initial Jobless Claims was released on Thursday and it showed 315,000 claims for the week which was up 2,000 claims from the previous week. Initial Jobless claims continue to remain steady in the low 300s.

The Weekly Initial Jobless Claims was released on Thursday and it showed 315,000 claims for the week which was up 2,000 claims from the previous week. Initial Jobless claims continue to remain steady in the low 300s.

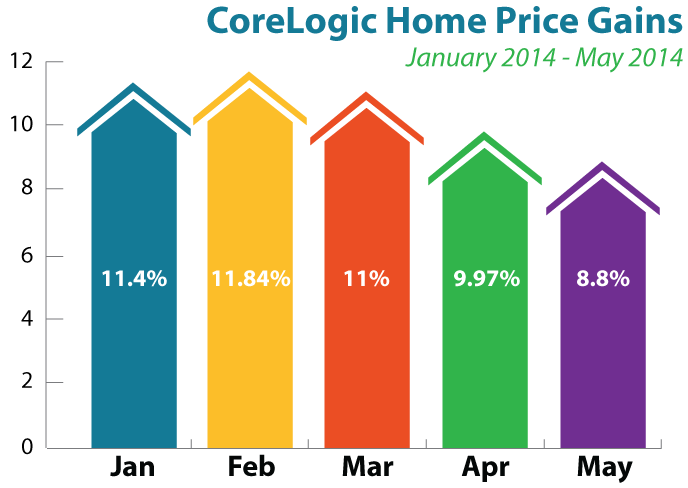

In Housing News, CoreLogic Reported their Home Price Index for May 2014 and it showed home prices increased by 1.4% from April 2014 to May 2014 and were up 8.8% year over year for May 2014. This is down from near 10% for April 2013 to April 2014. This shows the housing market is cooling but to a pace that is much more sustainable.

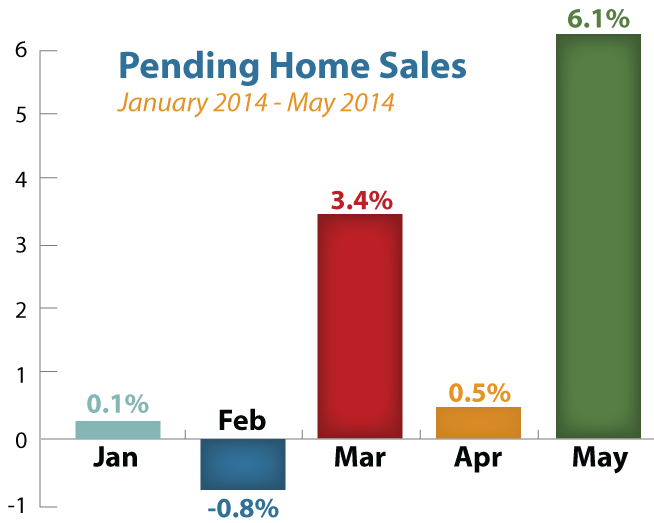

We also saw the release of Pending Home Sales for May 2014 and it surged higher by 6.1% which was above expectations of 1.5%. This Index tracks the number of new contracts signed in the Month of May but not necessarily closed yet. This was the largest one month gain since April 2010 which was when everybody was trying to get under contract before the First Time Home Buyer Tax Credit expired.

We also saw the release of Pending Home Sales for May 2014 and it surged higher by 6.1% which was above expectations of 1.5%. This Index tracks the number of new contracts signed in the Month of May but not necessarily closed yet. This was the largest one month gain since April 2010 which was when everybody was trying to get under contract before the First Time Home Buyer Tax Credit expired.

The next Delaware First Time Home Buyer Seminar is Saturday, July 19, 2014, n Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, July 26, 2014, in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on July 12, 2014, in Frederick, Maryland and Clinton Maryland First Time Home Buyer Seminar on July 19, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713