Delaware Mortgage Rates Weekly Update for February 10, 2014

Delaware Mortgage Rates weekly rate update for the Week of February 10, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware mortgage rates ended the week almost where they started after a roller coaster week. If you look at the mortgage bond chart below you can see mortgage bonds sold off after reaching a high not seen since November but then sold off on Tuesday and Wednesday. The market was expecting a Jobs Report that would be strong so bonds sold off. When the Jobs Report disappointed again mortgage bonds rallied on Friday but closed right at a tough ceiling of resistance. If you didn’t LOCK your interest rate on Friday then we recommend starting the week FLOATING your Delaware mortgage rate but if bonds can’t break above the ceiling of resistance then quickly switch to a LOCKING stance.

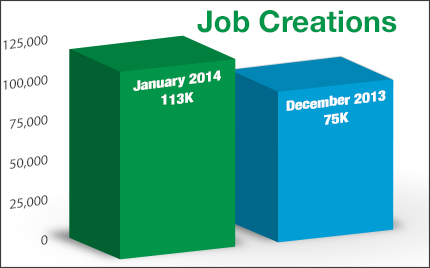

The January 2014 Jobs Report was released on Friday morning by the U.S. Labor Department and was very disappointing with employers only adding 113,000 New Jobs well below expectations of 175,000 new jobs. December Jobs Report was only revised upward by 1,000 jobs to 75,000 new jobs.

Unemployment dropped from 6.7% to 6.6% but this number is not a very good indicator of the Labor Market as the number is going down not because people are returning to work but because the number of people looking for work that are unemployed is going down. This is clearly seen in the Labor Force Participation Rate (LFPR) which still remains at 63% which is a 35 year low! If we are truly putting more people back to work then the LFPR would be moving up showing more people that are eligible to work are actually working.

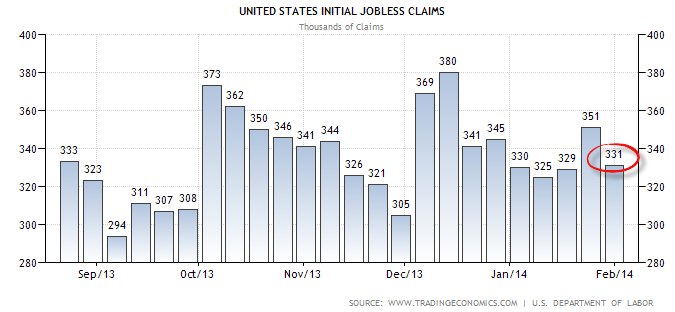

The Weekly Initial Jobless Claims were reported on Thursday and came in at 331,000 claims down from 351,000 claims the previous week. Jobless claims continue to be stubbornly high in the 330ks range.

The Federal Reserve announced it would taper the asset purchase program QE3 by another $10 Billion in February to purchase only $65 Billion in Mortgage Bonds and U.S. Treasuries. This is down from $85 Billion in December and $75 Billion in January. The Feds goal is to continue to taper at every meeting by $10 Billion until down to $0 by the end of the year. The Fed’s tapering of asset purchases triggered a domino effect in emerging market currency markets that ended up negatively impacting stock markets around the globe.

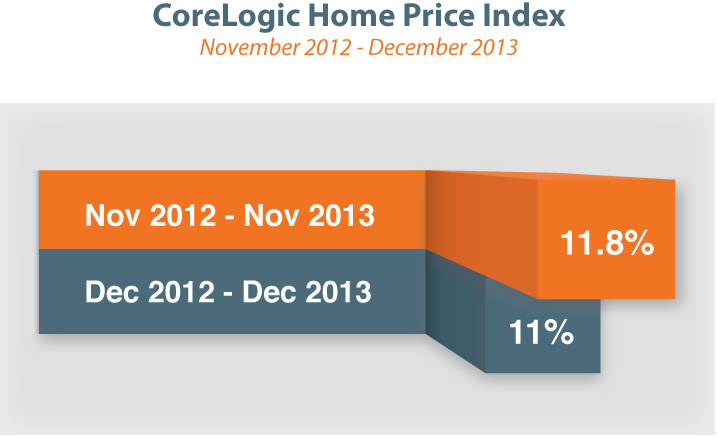

In Housing News, CoreLogic reported its Home Price Index for December 2013 which showed an 11% increase in home prices from December 2012 till December 2013. December marked the 22nd consecutive year-over-year gain in home prices nationally. However, from November 2013 to December 2013, home prices fell by 0.1%.

FHA Update – FHA Announced it would finally accept electronic signatures on documents. The two big hold-ups on allowing lenders to accept electronic signatures on loan documents in the past have been the IRS wouldn’t accept them on the 4506 form for request of tax transcripts and FHA would not accept them. The IRS agreed to accept electronic signatures at the end of 2013 and now FHA has agreed. Primary Residential Mortgage, Inc. is one of the first mortgage lenders that has implemented electronic signatures.

USDA Update – The U.S. Senate and House passed a farm bill legislation that includes language to maintain the current USDA eligible financing areas until 2020 rather than switching to the 2010 Census Data on October 1, 2014, which would render over 900 communities nationwide ineligible for USDA financing that currently are eligible. The legislation is headed to President Obama for his signature.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, February 15, 2014, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar Saturday, February 8, 2014, in Rockville, Maryland or Maryland First Time Home Buyer Seminar is Saturday, February 22, 2014, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713