Delaware Mortgage Rates Weekly Update for December 8, 2014

Mortgage Rate Update – December 8

Mortgage Rates weekly mortgage market update for the Week of December 8, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates moved higher last week after the November Jobs Report was released by the Labor Department. If you look at the mortgage bond chart below you can see that the trend had been for mortgage bonds to move higher until last week. Mortgage bonds sold off most the week then dropped even more after the jobs report.

Bonds were able to bounce off resistance on Friday and recover some of the losses so we are recommending FLOATING your Delaware Mortgage Rate to start the week to see if bonds can hold above resistance.

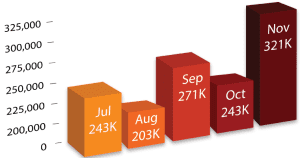

In Economic News, the U.S. Labor Department released the November 2014 Jobs Report on Friday and it showed 321,000 jobs were created which was well above the 230,000 expected. November marked the 10th straight month of 200,000 plus jobs being created each month.

This is the longest streak since 1994. We also saw September and October Jobs increased by a total of 44,000 jobs. The report showed a very robust labor market and is a very good sign for the economy.

We also saw the Unemployment Rate remain the same at 5.8%. The Labor Force Participation Rate (LFPR) also remained steady at 62.8%. The U6, which measures total unemployment dropped from 11.5% to 11.4% which is much better than last year when the U6 was 13.2%.

Thursday saw the release of the Weekly Initial Jobless Claims which came in at 297,000 claims, a drop of 17,000 claims from the previous week. This was a good report as it brought weekly claims back below 300,000 claims.

In Housing News, CoreLogic Released their National Foreclosure Report for October 2014 which showed that the foreclosure pictured continued to improve. Foreclosures were down from 924,000 in 2013 to only 605,000 for October 2014. This is an improvement of almost 35% year over year. The foreclosure inventory also dropped from 2.3% last year to only 1.6% of all homes with mortgages for 2014.

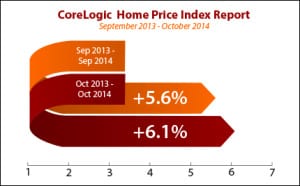

CoreLogic also reported their Home Price Index for October 2014 showed home prices increased by 6.1% year over year for October 2014 which is up from only 5.6% for September 2014. This report shows that the seven-month housing slow down has stopped.

In Other Housing News, FHA released their Delaware FHA Loan Limits for 2015 that go into effect for FHA Case numbers assigned on or after January 1, 2015. The income limits are by county so the 2015 loan limits are as follows:

New Castle County – $379,500

Kent County – $271,050

Sussex County – $316,750

The next Delaware First Time Home Buyer Seminar is Saturday, December 13, 2014, in Newark, Delaware. There is a First Time Home Buyer Seminar Saturday, December 6, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, December 20, 2014, in Towson, Maryland Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713