Delaware Mortgage Rates Weekly Update for December 16, 2013

Delaware Mortgage Rates weekly mortgage market update for the Week of December 16, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

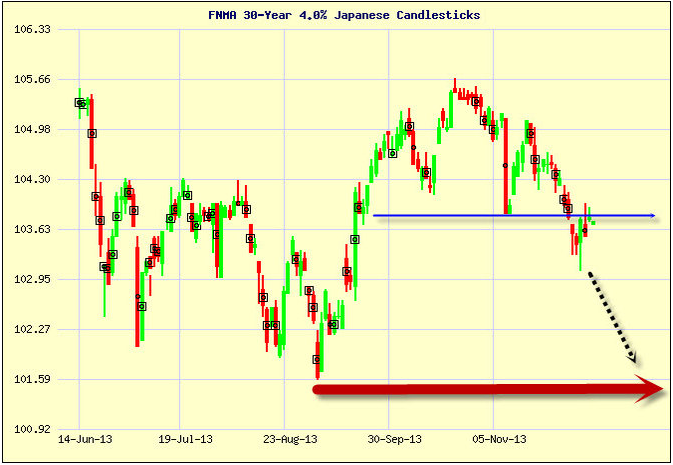

Delaware mortgage rates moved higher last week from fears that the Federal Reserve may start tapering at their December meeting versus waiting till 2014. If you look at the mortgage bond chart below you can see that mortgage bonds have been on a roller coaster ride but the long term trend is still for mortgage bonds to move lower which will cause home loan interest rates to move higher in the long term. We did see a green candle on Friday which means mortgage bonds could be trying to rally in the short term so we are going to recommend cautiously FLOATING your Delaware mortgage rate to start the week.

The big picture for mortgage rates shows mortgage bonds up against a tough ceiling of resistance in the blue line on the mortgage bond chart below. The long term trend which is seen with the dotted line is for mortgage bonds to move lower especially with the stock market rallying and the fears of the Federal Reserve tapering the asset purchase program. Short term we can cautiously float our rate but if the bond starts selling off and moving lower there is a long way for it to go to hit a floor of support which is the big red line horizontal on the chart. This floor is where rates will be in the 5% range and is where rates are predicted to move for 2014.

In Economic News, the U.S. Congress hammered out a deal on the U.S. Budget for the next two years which will avoid another government shut down in January 2014. The budget deal reduces the deficit by $23 Billion and it does not raise taxes. The budget sets government spending at $1.012 trillion for the current fiscal year through September. $23 Billion savings on $16 Trillion in National Debt doesn’t really do much. The budget plan includes higher fees for airline passengers and changes to government pensions and increased annual discretionary spending. It did not include another extension of jobless benefits.

Retail Sales for November 2013 came in better than expected at 0.7% above the 0.6% expected. This is not bond friendly news because as the economy improves, it gives the Federal Reserve more reasons to taper the asset purchase program and to increase the rate at which it tapers. We did some bond friendly news on Friday as the Producer Price Index came out very low at 0.1% which is a measure of inflation at the wholesale level. Year over a year the PPI is only at 1.3% so inflation still remains very low.

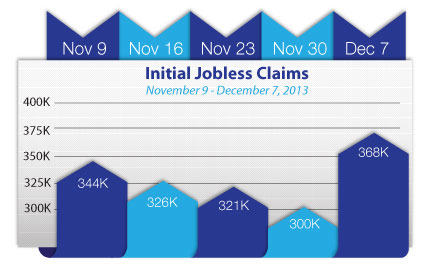

We saw the Weekly Initial Jobless Claims came out last Thursday and it surged higher by 68k claims to 368,000 claims for the week. Last week claims had dropped to 300,000 but that was mostly due to the Thanksgiving Holidays.

In Housing News, FHA lowered the loan limits for 2014. The loan limits will be calculated based on the median home price per region using 115% of the median home price but the lowest maximum limit is $271,050. Delaware FHA Loan limits for 2014 will be $271,050 for Kent County, $379,500 for New Castle County, and $316,250 for Sussex County. You can read the full story at Delaware FHA Loan Limits for 2014

CoreLogic reported that Foreclosures for October 2013 were 48,000 which is down 30% from October 2012 which was 68,000. The foreclosure inventory declined by 28% this year and the rate of serious delinquency is at its lowest level since November 2008. This is good news but we still have a ways to go as there are still almost 900,000 properties across the nation still in foreclosure which is four times the normal.

The FHFA announced it will increase the “G-Fee” for all conventional loans that are delivered to either Fannie Mae or Freddie Mac. The “G-Fee” is basically a hidden tax on conventional loans. Congress figured out they can fund things such as the health care bill through this hidden “tax” but telling the American people they didn’t raise taxes. The fee raises the cost of mortgages for people who getting conventional loans to pay for things totally unrelated to mortgages or the cost of mortgages. This increase in the “G-Fee” will mean mortgage rates are going up in March or April when they implement the increase.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, January 18, 2013, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

The next Dover Delaware Home Buyer Seminar is Saturday, January 11, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, January 25, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713