Delaware Mortgage Rates Weekly Mortgage Market Update for September 16, 2013

Delaware Mortgage Rates weekly market update for the week of September 16, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

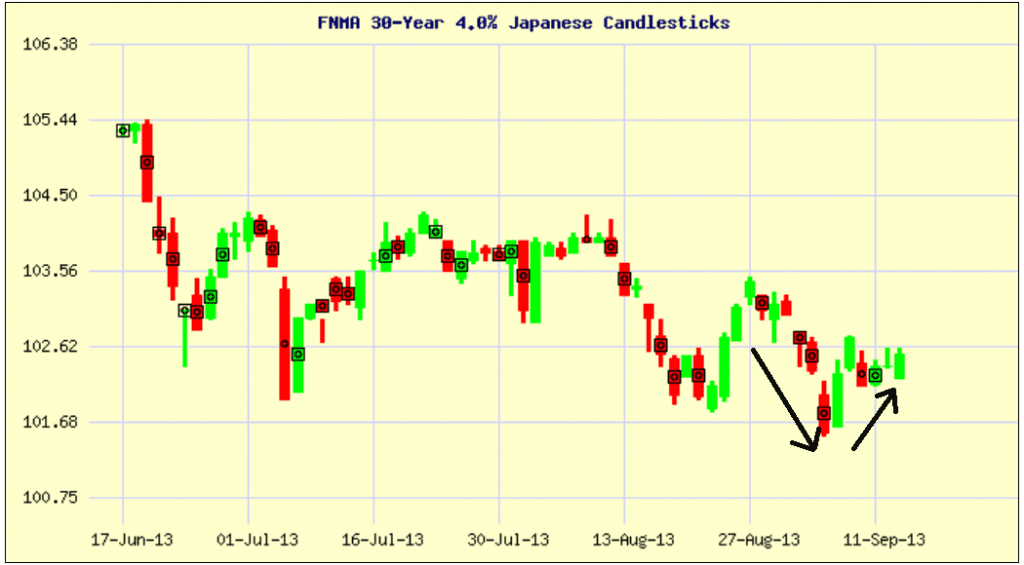

Delaware Mortgage Rates moved lower from the previous week as mortgage bonds built on the momentum from a poor jobs report for August. If look at the mortgage bond chart below you can see mortgage bonds jumped higher on Monday and then traded in a tight range for the rest of the week ending the week almost on Monday’s high. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if bonds can continue to rally on the poor economic reports that came out on Friday but the big event this week to watch is the Federal Open Market Committee meeting on September 18th.

In Economic News, Retail Sales in August 2013 rose 0.2% below the expectations of 0.4% and the lowest reading since April 2013. Consumer Spending is one of the main drivers of economic growth so bad Retail Sales is not good economic news. Wholesale inflation as measured by the Producer Price Index (PPI) came in at 0.3% for August versus the 0.2% expected but the Consumer Price Index (CPI) came in at 0.1%. Consumer Sentiment (76.8) declined in early September 2013 from August 2013 (82.0) as Americans are nervous over higher mortgage interest rates that could put a damper on the housing recovery and economic growth. Within the report, it showed that consumer expectations fell to an eight-month low

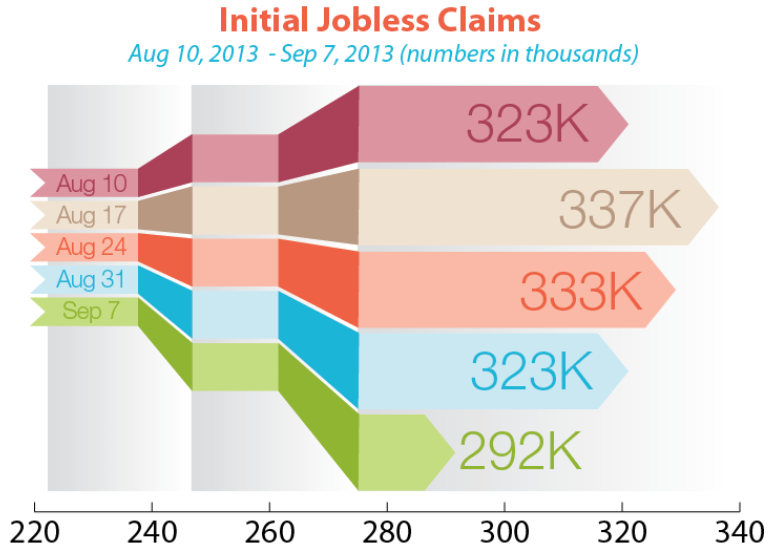

Thursday we saw the release of the Weekly Initial Jobless Claims which came in at a very low 292,000 claims but the data was not accurate as two states did not report all of their data because of computer system upgrades.

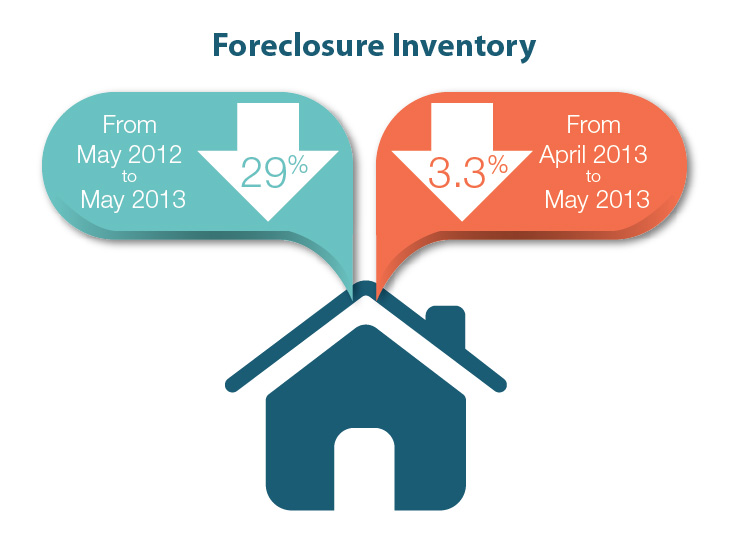

In Housing News, RealtyTrac reported yesterday that foreclosure filings plunged by 34% year-over-year in the month ended in August 2013. The decline was due in part to a rise in home prices, a pickup in job growth and less troubled loans and are at levels not seen in eight years. A RealtyTrac spokesperson said the “foreclosure flood waters have receded” in most parts of the country, but towns continue to clean up the damage that was left behind. This report continues the trend as foreclosure filings in the May 2013 year over year were down 34% and were down 3.3% from April 2013 to May 2013

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, October 12, 2013, in Newark, Delaware and Free First Time Home Buyer Seminar on Saturday, September 28, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Maryland First Time Home Buyer Seminar is Saturday, October 19, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713