Delaware Mortgage Rates Weekly Market Update for April 21, 2014

Delaware Mortgage Rates weekly rate update for the Week of April 21, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

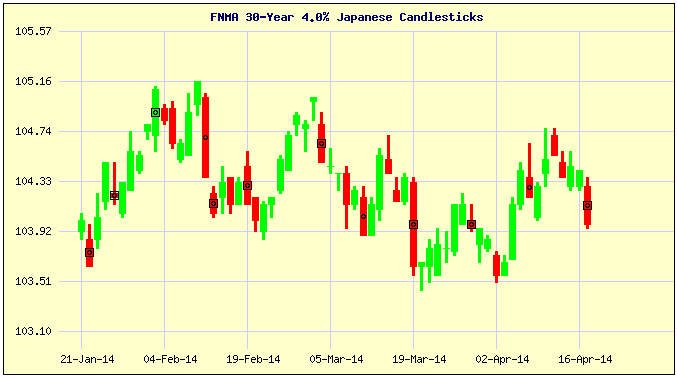

Delaware Mortgage Rates jumped higher on Thursday as mortgage bonds sold off and broke below the line of support. If you look at the mortgage bond chart below you can see the big red candle on Thursday showing the bond market selling off. Last week bonds drifted lower on Monday and Tuesday and tried to stabilize on Wednesday and Thursday but then sold off on Friday. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if mortgage bonds can rally after the sell-off.

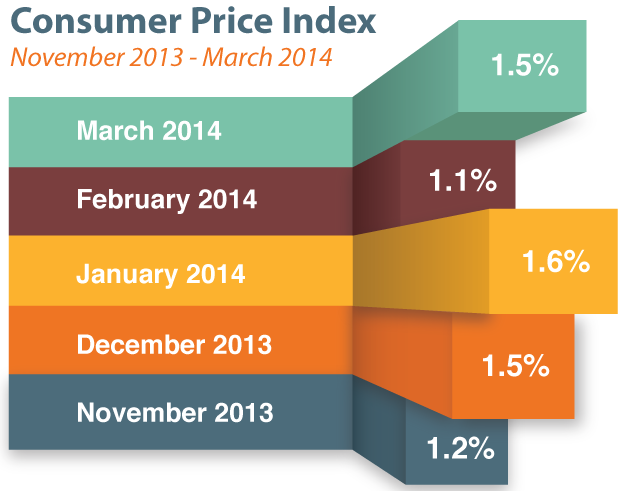

In Economic News, the Labor Department reported that the March Consumer Price Index (CPI) rose by 0.2% versus the 0.1% that was expected. The CPI measures inflation at the consumer level and it jumped 1.5% year over year which is hotter than expected and comes on the heels of the Producer Price Index last week which showed inflation hotter at the wholesale level. The Feds will be watching to see if inflation continues to spike higher.

Weekly Initial Jobless Claims were released on Thursday and moved up 2k claims to 304,000 claims for the week. This was below expectations of 312k claims. Fed Chairwoman Janet Yellen stated after the release of the weekly claims that a healthy and robust job market is more than 2 years away.

In Housing News, the Commerce Department released Housing Starts for March 2014 which came in at 946k which is up 3% but still below expectations of 955k starts. Housing Starts to measure the number of new homes that builders have started construction on for that month. This report shows some underlying weakness in the new home construction market. Building Permits for March 2014 were also released last week and they declined by 2.4% to 990k which also shows weakness in the new home market. Building Permits measures how many new permits to build houses have been applied for by new home builders.

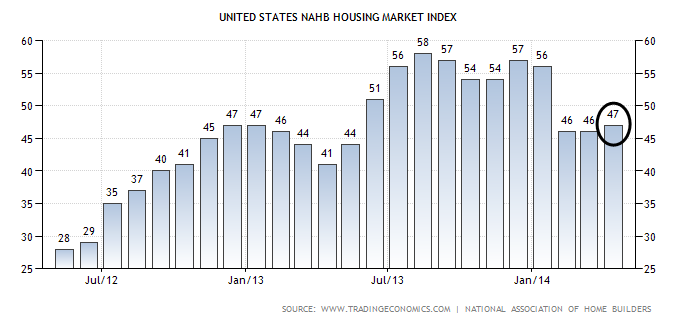

The National Association of Home Builders (NAHB) released their Housing Market Index for April 2014 and it came in worse than expected at 47 and the March Index was revised lower from 47 to 46. This shows that the index is down from the high of 58 in August 2013 but we are still way higher than the 15 reading seen back in 2009.

The next Delaware First Time Home Buyer Seminar is Saturday, May 17, 2014, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, April 26, 2014, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713