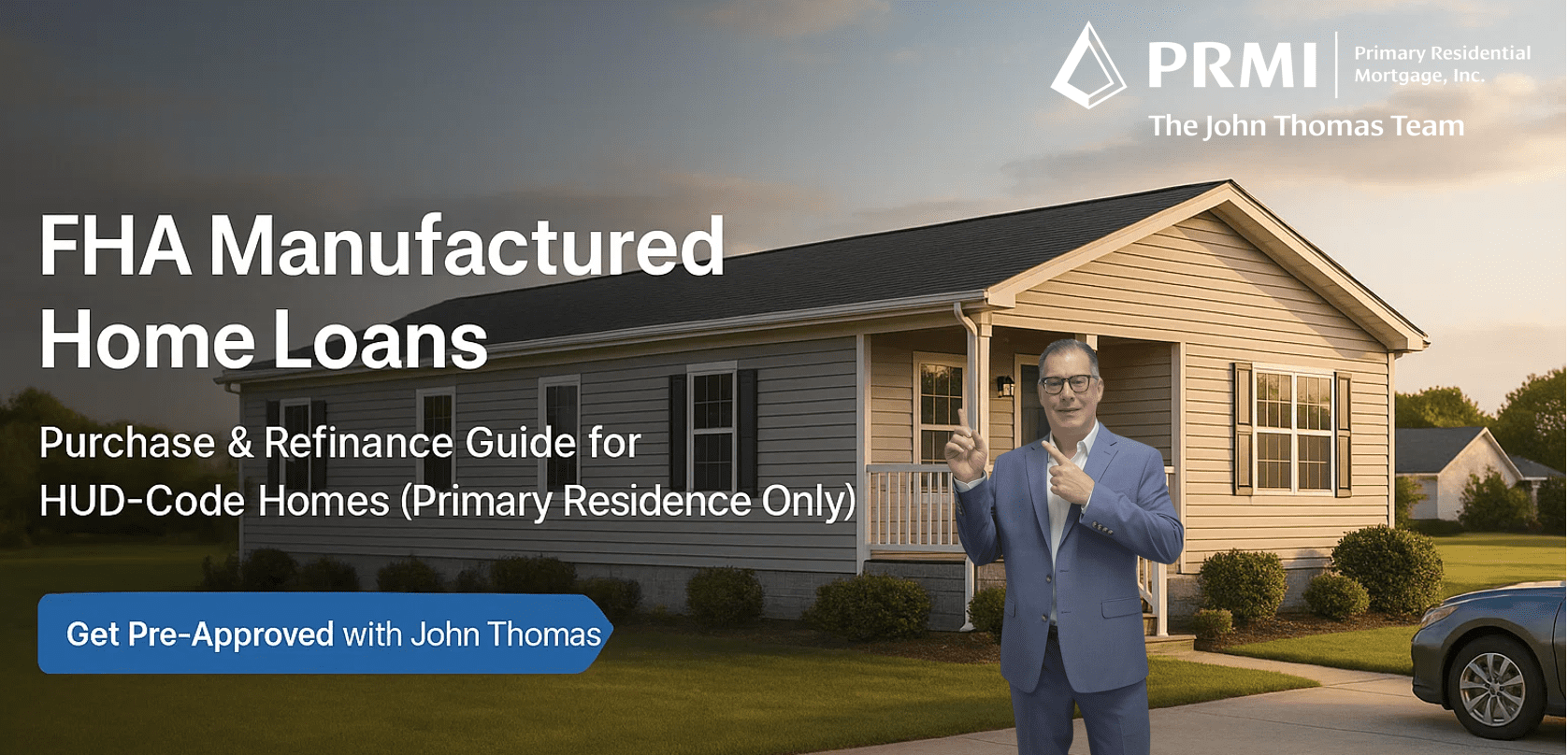

FHA Manufactured Home Loans: What You Need to Know

FHA Manufactured Home Loans: Purchase & Refinance Guide

Learn how FHA manufactured home loans work for purchasing and refinancing HUD-code manufactured homes. FHA loans are for primary residences only.

Manufactured homes can be an affordable path to homeownership, and the FHA manufactured home loan can make financing more attainable. In this guide, we cover eligibility, property requirements, how to use an FHA manufactured home purchase loan, and your options to refinance a manufactured home with FHA. Important note: FHA loans are for primary residences only—not second homes or investment properties. If you would like to apply for a FHA Manufactured Home Loan to purchase or refinance a property, give John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE.