How CAIVRS Report Can Prevent You From Getting A Loan

If you’re applying for a mortgage backed by the government like an FHA loan or VA loan, your lender will run a CAIVRS check before approving your loan.

This little-known government database, called U.S. Department of Housing and Urban Development Credit Alert System (CAIVRS), checks for specific types of credit defaults that could affect your mortgage loan approval. If you want to get pre-approved for a Mortgage Loan program to purchase or refinance a home please call the John Thomas Team at 302-703-0727 or APPLY ONLINE..

What Is CAIVRS Report on Mortgage Lending?

If you apply for a government-backed loan, like an FHA mortgage loan, the lender will run a CAIVRS (pronounced “kay-vers”) check before approving your application

CAIVRS is a database that tracks liens, defaults, and any outstanding debt owed to federal agencies.

If the CAIVRS search shows you’re delinquent on government debt, you won’t be able to get a new loan until you’re no longer delinquent on the federal debt or, in some cases, until a certain amount of time passes.

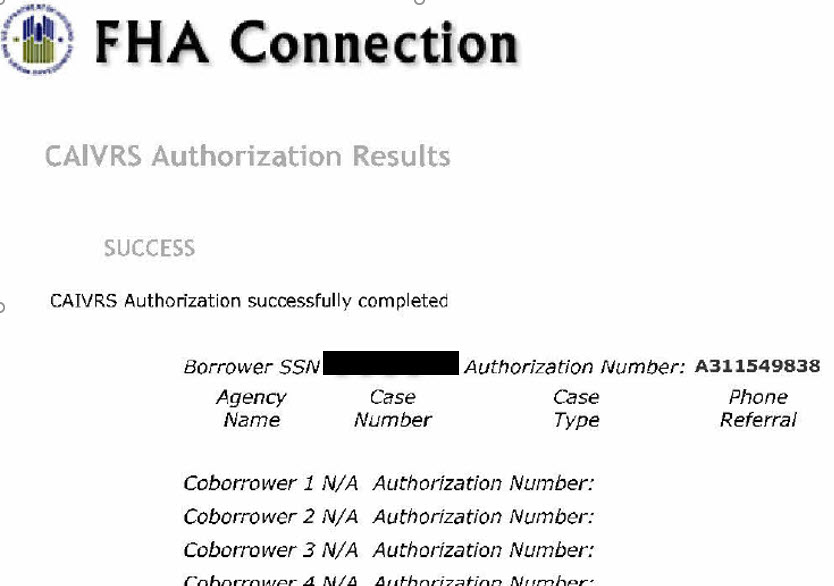

Below is Picture of a Clear CAIVRS from FHA Connection Website – The Authorization Number Starts with Letter A which means CAIVRS is clear and person is eligible for new Federally insured loan.

HUD founded CAIVRS in 1987 as a way to keep tabs on consumers who have defaulted on federal debt or had a claim paid on a federally insured loan within the last three years.

Today, the participating agencies and approved lenders who access CAIVRS are granted the ability to:

- Verify people applying for federal loan programs do not have outstanding debt or delinquency on other federal loans.

- Help private lenders issuing government-backed loans to avoid extending credit to people considered credit risks.

- Show the public that the federal government is taking steps to collect on unpaid debt.

Which do Agencies report to CAIVRS?

CAIVRS is exclusively for government agencies to report delinquencies on federal loans.

A few of the agencies that report to the CAIVRS system are:

- Department of Housing and Urban Development(HUD)

- Department of Veterans Affairs (VA)

- Department of Education(DOE)

- Department of Agriculture(USDA)

- Small Business Administration (SBA)

- Department of Justice (DOJ)

What Information Shows Up on a CAIVRS Report?

There are six types of defaulted federal debt that may show up on a CAIVRS report. This includes:

- FHA loans. HUD reports any current FHA loan delinquencies, as well as insurance claims paid by HUD for homes foreclosed in the last three years.

- VA loans. Military homeowners that default on their VA loans are reported to CAIVRS. The VA also reports information on Native American Direct Loans (NADL) and VA interest rate reduction refinance loans (VA IRRRL Refinance Loan).

- USDA loans. Rural homeowners with delinquencies, defaults or insurance claims on federally guaranteed USDA loans are reported to CAIVRS.

- Federal student loans. The Department of Education reports delinquent or defaulted student loans, as well as claims paid for federally backed education loans.

- Small business loans. A Small Business Administration (SBA) loan might escape reporting on your personal mortgage credit report if it was taken out using your business tax identification number (TIN) instead of your Social Security number. However, borrowers that default on SBA loans are reported to CAIVRS.

- Department of Justice judgments or settlements. CAIVRS collects data on DOJ debtors or those who have unsatisfied judgments (which are court orders to pay debts).

How To Check If You’re On the CAIVRS Report?

Unfortunately, unlike with credit reports, there’s no way to check if you are listed on the CAIVRS database until you apply for a federal loan.

If the lender has determined you are in default on a federal loan or have had a claim paid on a previous FHA loan, that information will be shared with you, including with which federal agency you’re delinquent. This also means you become ineligible for an FHA loan.

You might be able to clear up the matter even if the CAIVRS entry isn’t a mistake, though you probably won’t be able to get a new government loan in the meantime.

Once you have paid off your debt to the federal government or three years have passed since you defaulted on a federal loan, your name will be dropped from the list.

How Long Do Delinquencies Stay on Your CAIVRS Report?

CAIVRS reports delinquent federal debt for 36 months after a claim is paid. However, the time it takes for a federal agency to report bad debt to CAIVRS may vary, making it even more important to have a CAIVRS report run early in the lending application process if you have delinquent federal debt in your past.

For example, the VA allows you to apply for a new mortgage two years after a VA foreclosure, but CAIVRS might still report the debt for three years. Knowing this early in the loan process could help you avoid unexpected stress and delays right before a loan closing.

How To Fix A Mistake in CAIVRS Report?

Incorrect reporting sometimes occurs after someone is the victim of identity theft when the thief takes out a new federal loan and then stops making payments.

If CAIVRS shows you’re delinquent on a federal debt, HUD (which manages the database) will provide:

- the name of the agency that reported the delinquency

- the type of delinquency (such as a student loan, a federal lien, judgment, or a government-backed loan that went into default and was foreclosed upon), and

- a telephone number you can call for more information or assistance.

How to Clear a CAIVRS Default

You won’t be able to take out a new federal loan if your CAIVRS report reveals a delinquent federal debt, but you can take these steps to clear it:

- PAY THE PAST DUE BALANCE IN FULL – Pay the balance off (if you can) and provide proof of the paid debt to clear your CAIVRS report.

- SETUP A PAYMENT SCHEDULE ON THE PAST DUE BALANCE – You may be able to negotiate a payment plan for defaulted federal debt that is in a collection or judgment status. Once you’ve made timely payments, you may apply for a new federally backed loan. But must wait for the agency to report to clear your CAIVRS. It can sometimes take 9-12 months of on time payments before your CAIVRS will clear.

- PROVE YOUR ELIGIBLE FOR A FHA CAIVRS EXCEPTION – If you meet and can document circumstances for the special exceptions mentioned earlier, you might be able to overcome negative CAIVRS feedback.

You’ll need to contact the appropriate FHA Homeownership Center in your area if you believe you are listed on the CAIVRS in error.

If you’re worried about how the CAIVRS report can affect your home purchase and are looking to work with an FHA-approved lender in Delaware, Maryland, New Jersey, Pennsylvania, or Virginia then you can call John Thomas at 302-703-0727 or APPLY ONLINE.