DSHA Preferred Plus Down Payment Assistance Program

DSHA Preferred Plus Down Payment Assistance Program

DSHA Preferred Plus Down Payment Assistance Program is a new Delaware down payment assistance program to replace the current DSHA SMAL Loan Program and the DSHA Advantage 4 Grant Program effective May 1, 2018. The Preferred Plus program provides Delaware home buyers with down payment assistance loans for 2% to 5% of the first mortgage loan. The down payment assistance can be used toward the required down payment and/or closing costs. Call 302-703-0727 for more information or to apply for the Preferred Plus Program. You can also apply online at DSHA Preferred Plus Program Application

What are the guidelines for the DSHA Preferred Plus Down Payment Assistance Program?

The new DSHA Delaware Down Payment Assistance program will be a soft second mortgage with the following terms:

- Minimum 620 FICO score to be eligible for the program

- Must be under the total household income limit for the county

- Must be purchasing a home for $417,000 or less

- Can receive from 2% up to %5 of the first mortgage loan for down payment assistance

- Must receive an approve/eligible response from the automated underwriting system

- Will sign a Note and Mortgage for Soft Second mortgage at closing

- Must attend 8 hours of HUD approved home buyer counseling if credit score is less than 660

- Must use one of DSHA’s first mortgage programs through an approved DSHA Mortgage Lender such as Primary Residential Mortgage

- Must provide three years of Federal Tax Returns for each working household member to DSHA to prove have not owned a home and are under the income limits for the program.

- *First lien interest rates maybe higher when using a DPA second.

What are the eligible property types for the DSHA Preferred Plus Program?

If you want to apply for the Preferred Plus Program you must be purchasing an owner occupied residential property in New Castle County, Delaware, Kent County, Delaware or Sussex County, Delaware. The following are the eligible property types:

- Single Family Units and Townhomes

- Agency Approved Condominiums for FHA, VA, or USDA

- Planned Unit Developments (PUDs)

- 1-4 Family Unit Properties that meet agency guidelines

- Double wide manufactured homes for FHA Loans Only! (Must have 660 Minimum FICO Score)

Properties that are NOT eligible for the Preferred Plus Program are as follows:

- Rental Homes

- Co-ops

- Investment Properties

- Second Homes

Example of DSHA Preferred Plus Down Payment Program Calculation

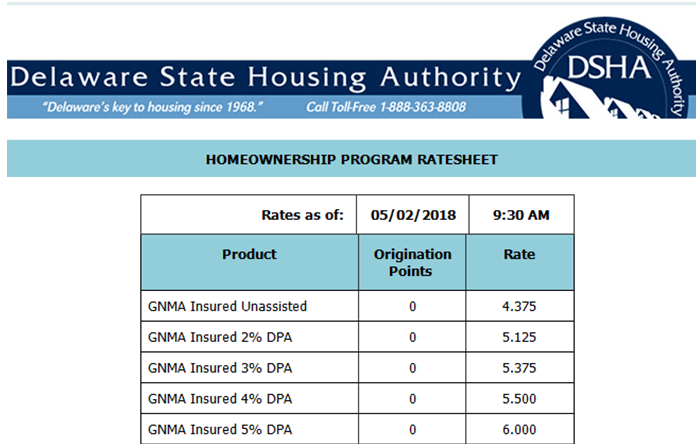

If you are purchasing a home for $200,000 in Delaware and are pre-approved for a DSHA FHA Loan through an approved lender and want to use the Preferred Plus Down Payment Assistance program you have the option of choosing your assistance from 2% to 5%. The higher the percentage of the down payment assistance the higher the mortgage rate on the first mortgage program. For example:

Option 1: Minimum 2% Assistance

Purchase Price – $200,000

Down Payment Required – $7,000 (3.5%)

FHA Loan Amount – $196,377 (includes upfront mortgage insurance premium)

DSHA Preferred Plus Assistance – $3,927 (2% of FHA Loan Amount)

FHA First Mortgage Interest Rate – 5.125%

Option 2: Maximum 5% Assistance

Purchase Price – $200,000

Down Payment Required – $7,000 (3.5%)

FHA Loan Amount – $196,377 (FHA base loan – $193,00 plus upfront mortgage insurance 1.75% – $3,377)

DSHA Preferred Plus Assistance $9,818 (5%)

FHA First Mortgage Interest Rate – 6.0%

Below is a sample Mortgage Interest Rate Sheet for FHA Loans, VA Loans, and USDA Loans using the Preferred Plus Program:

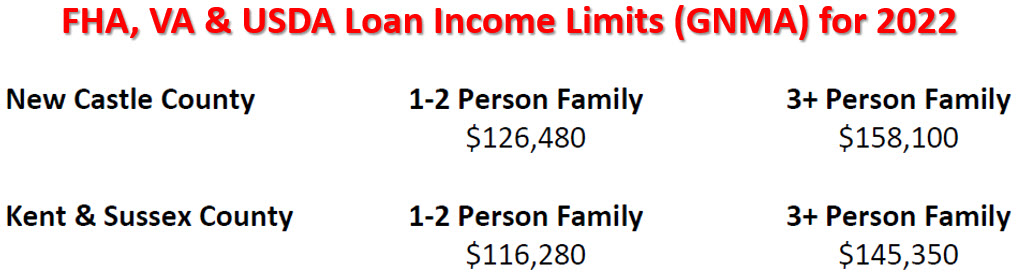

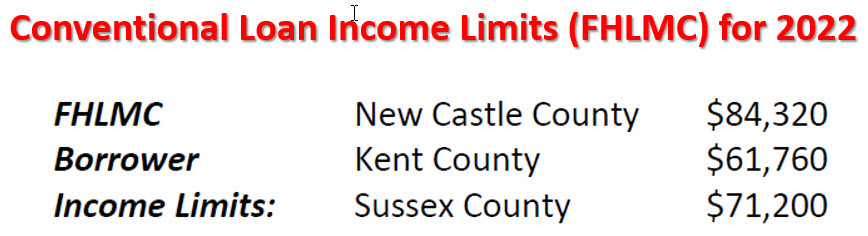

What are the income limits for the DSHA Programs?

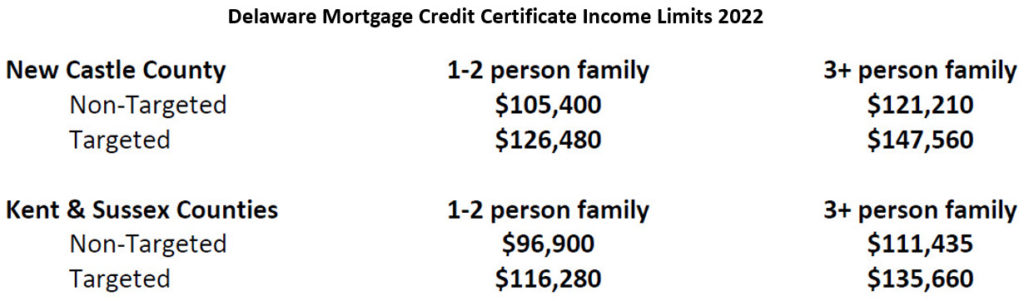

The DSHA Currently has two programs as of May 1, 2018 which are the Preferred Plus Down Payment Assistance Program and the Mortgage Credit Certificate (MCC) Program. The DSHA SMAL Loan Program and the DSHA Advantage 4 Grant Program were eliminated and replaced with the Preferred Plus Program. The income restrictions are different based on if you are just using the Preferred Plus Program or if you are using the Preferred Plus with the MCC Program.

Homeownership Program Income Limits for 2023 are as follows:

Homeownership Program using the MCC Income Limits for 2023 are as follows:

When do you pay the Preferred Plus DPA Program back?

The Preferred Plus DPA Program is a “soft” second mortgage that is recorded as a lien against the property your are buying. There are no required payments on the loan and the interest rate is 0% fixed for the whole time you have the loan. You are required to pay the loan back in full when one of the following three events occur:

- Must Pay back in full when you sell the home.

- Must Pay back in full when you refinance the first mortgage loan.

- Must Pay back in full if you move out and no longer occupy the property as your primary residence.

How do you Apply for the DSHA Preferred Plus Program?

If you would like to apply for the DSHA Preferred Plus Down Payment Assistance program you can call 302-703-0727 or you can get started online at DSHA Program Online Application You can get started with a DSHA approved Delaware mortgage lender and can apply for the Preferred Plus as well as the MCC tax Credit Program.

#DelawareFirstTimeHomeBuyer

#DelawareDownPaymentAssistance