Delaware Mortgage Rates 9-26-2016

Delaware Mortgage Rates Weekly Update September 26, 2016

Delaware Mortgage Rates weekly update for the Week of September 26, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

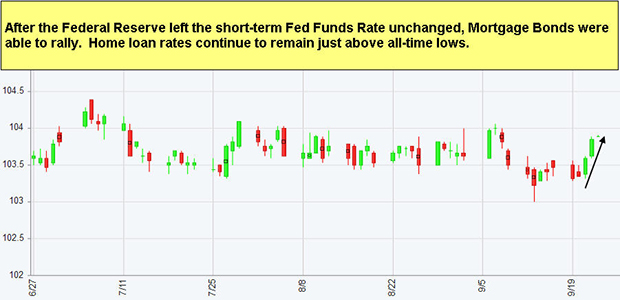

Delaware Mortgage Rates moved lower last week as mortgage bonds were able to rally higher on Wednesday after Federal Reserve left Fed Funds Rate the same. If you look at the mortgage bond chart below you can see mortgage bonds were trading at tough ceiling of resistance but were able to break higher on Wednesday through Friday. The short term trend is for mortgage bonds to move higher which would move mortgage interest rates lower. We recommend FLOATING your Delaware Mortgage Rates to start the week.

In Economic News, the Federal Open Market Committee (FOMC) met on Wednesday to review data on US Economy such as jobs data, economic growth, inflation, and consumer spending to determine if appropriate to raise the Federal Reserves short term interest rate called the Fed Funds Rate. They voted to leave the rate unchanged at 0.50% versus raising it 0.25%. The Fed Funds Rate is not mortgage rates, it is the rate at which banks lend money to other banks overnight.

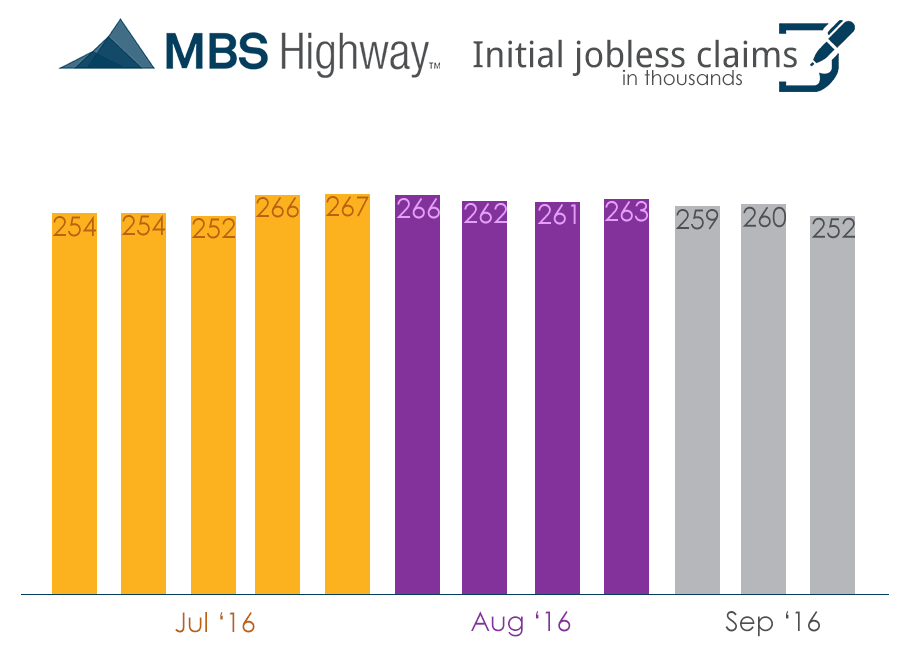

Weekly Initial Jobless Claims were released last Thursday which showed a drop of 8,000 claims to 252,000 jobless claims. This was below expectations of 261,000 claims and was lowest reading since July 2016. This is the 81st week jobless claims have remained below 300,000 claims. This week was also the sample week for the September Jobs Report which points to another very strong jobs report.

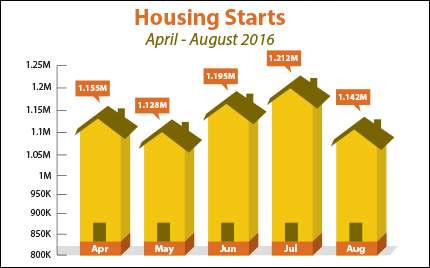

In Housing News, Housing Starts on new home construction for August 2016 dropped 5.8% from July 2016 to 1.143 million units on annualized basis which was below expectations of 1.186 Million units. Building Permits for August 2016 declined by 0.4% from July 2016 which was also below expectations.

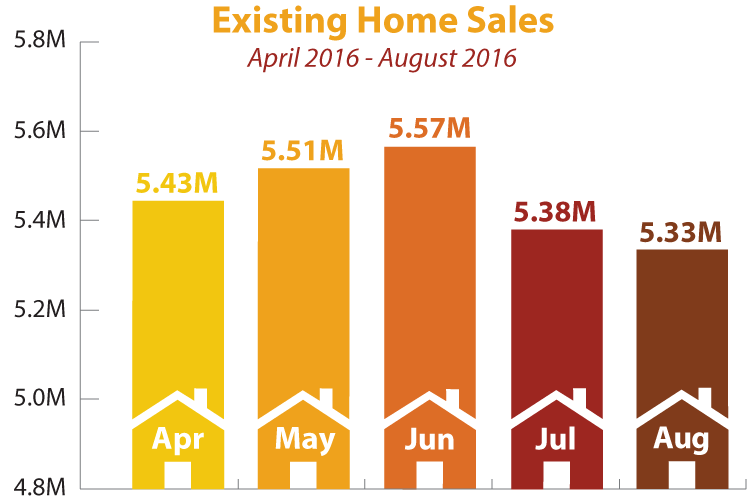

Existing Home Sales for August 2016 were down 0.9% from July 2016 to 5.33 Million units on annualized basis. Existing home sales were up 0.8% from August 2015. The National Association of Realtors cited high prices and low inventory kept some buyers on the sideline contributing to the drop in existing home sales.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Next Dover Delaware First Time Home Buyer Seminar is Saturday October 15, 2016 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Mortgage Interest Rates remain near all time record low rates, so it is the perfect time to purchase or refinance a home before rates move higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you.

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate