Mortgage Rates Update Sept 19 2016

Mortgage Rates Weekly Update September 19, 2016

Mortgage Rates weekly update for the Week of September 19, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

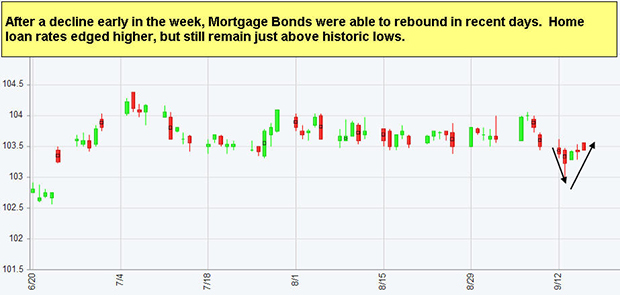

Mortgage Rates were able to rebound last week and move lower to end the week after moving higher the previous week. If you look at the mortgage bond chart below for Fannie Mae 3.5% bond you will see that mortgage bonds had been selling off but were able to hit a floor of support Tuesday and then Rally off that support on Wednesday which moved mortgage interest rates lower. We are recommending FLOATING your Mortgage Rates to start the week.

In Economic News, the Consumer Price Index for August 2016 came out hotter than expected at a 0.3% gain for the Core reading and the Core CPI was up 2.3% year over year. This is the 10th month the Core CPI was over 2% and matches the highest level in 8 years. Consumer Price Index is a measure of inflation at the consumer level and inflation is the enemy of mortgage bonds.

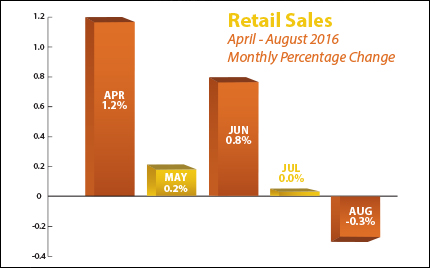

Retail Sales for August 2016 were released last week with a weak reading of -0.3% which was below expectations of coming in flat. This is the second month in a row Retails Sales have declined which is bad news for the economy. The major driver of the US economy is consumer spending. This will probably prevent the Federal Reserve from raising their short terms rates at September meeting.

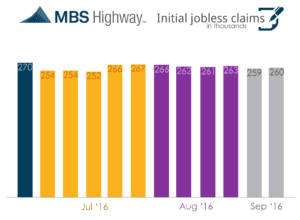

Weekly Initial Jobless Claims came out on Thursday at 260,000 claims for the week which was the 2nd best number for jobless claims 2 months. Jobless claims have remained below 300,000 claims for 80 consecutive months. Employers are still holding on to good employees and firing less. The labor market remains very stable in terms of continued employment but we will need to see if this translates into more jobs or not when get September Jobs Report.

In Housing News, CorLeogic Released its National Foreclosure Report for July 2016 which showed that the foreclosure picture continues to improve. The report showed that there are 355,000 homes in some form of foreclosure which is down from 501,000 homes from last year which is a drop of almost 30%! If you are looking to purchase a home that is a foreclosure or a short sale that needs work, then your best option would be a renovation loan such as a FHA 203k Rehab Loan which allows you to purchase the property and fix it up all in one.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Mortgage Interest Rates remain near all time record low rates, so it is the perfect time to purchase or refinance a home before rates move higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you.

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate